China’s legal services market is navigating a tumultuous period of change. Our annual survey looks at how firms are performing, and what strategies they have in place to see them through the storm, while Frankie Wang asks industry leaders for their predictions for the future of the economy and the legal market

In the past year, leading law firms have continued scale-up by setting up branches, or through mergers and alliances, while boutiques established by partners who left the big names are beginning to take root.

No matter which development model a law firm chooses in these troubled times, revenue growth is of overriding importance. According to the annual legal market survey of first-tier law firms conducted by China Business Law Journal, in 2019, the total annual revenue of Chinese law firms registered overall growth year-on-year, with a median revenue of RMB250 million (US$36.8 million), which was up by 15.7% compared with 2018 (please refer to “Crunching the numbers” for details of the survey).

The outbreak of covid-19 has become a watershed moment in the development of the legal industry, and while overall growth figures are encouraging, the difficulty the industry is facing is evident from the smaller and medium-sized law firms. In April, the Beijing Chaoyang Lawyers Association conducted a survey of 466 law firms, each with under 50 employees, in Beijing, Baoding and Hangzhou, and produced its Investigation Report on the Survival Status and Development Suggestions of Small and Medium-Sized Law Firms under the Pandemic. According to the report, in the first quarter, 77% of the law firms surveyed recorded a year-on-year decrease in contract value, and 75.9% recorded a year-on-year decrease in business revenue.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

—

Crunching the numbers

Revenue figures reflect a law firm’s growth, and revenue per lawyer or equity partner can show a firm’s actual strength behind the growth, and beyond the scale. In order to learn how much PRC law firms earned in 2018-2019, China Business Law Journal conducted an annual legal market survey for top-tier firms active in the market, in which nearly 80 firms participated:

In 2019, the annual revenue generally showed growth among Chinese law firms. The median revenue of law firms, at RMB250 million, was a 15.7% increase compared with RMB216 million in 2018.

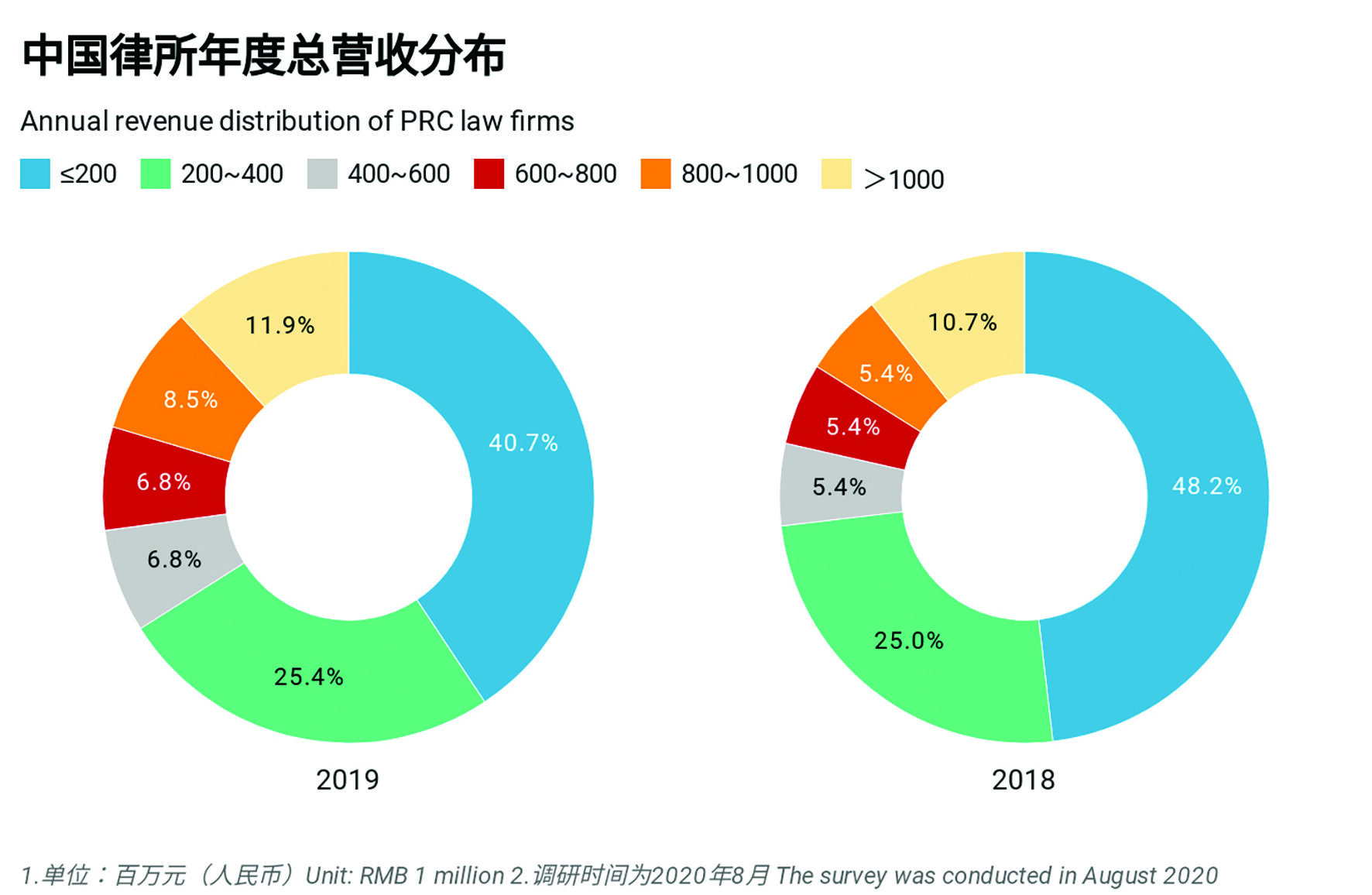

The survey shows that law firms with annual revenue of less than RMB200 million and RMB200-400 million are the two largest groups, accounting for more than 40% and 25% of the surveyed firms, respectively.

In particular, the number of law firms with revenue less than RMB200 million fell by about 7.5% year-on-year in 2019, to account for 40.7% of the firms surveyed. Considering the growth in medians, this decrease may indicate that the revenue of some law firms increased to more than RMB200 million.

Source: China Business Law Journal

Meanwhile, law firms with between RMB800 million to RMB1 billion in annual revenue account for 8.5%, recording a year-on-year increase of 3.1%. With the increasing scale of national firms and the continuing trend of mergers among law firms, this increase may point to a rise of mega law firms. There are four firms each with annual revenue of RMB400-600 million and RMB600-800 million, each accounting for 6.8% of the firms surveyed.

Law firms with annual revenue more than RMB1 billion account for 11.9%, all of which are nationwide firms with comprehensive serving capabilities. Although RMB1 billion is a value hard for a boutique firm to achieve, it is not an impossible goal for strong ones. In the survey, the 2019 revenue of one boutique firm was close to RMB1 billion.

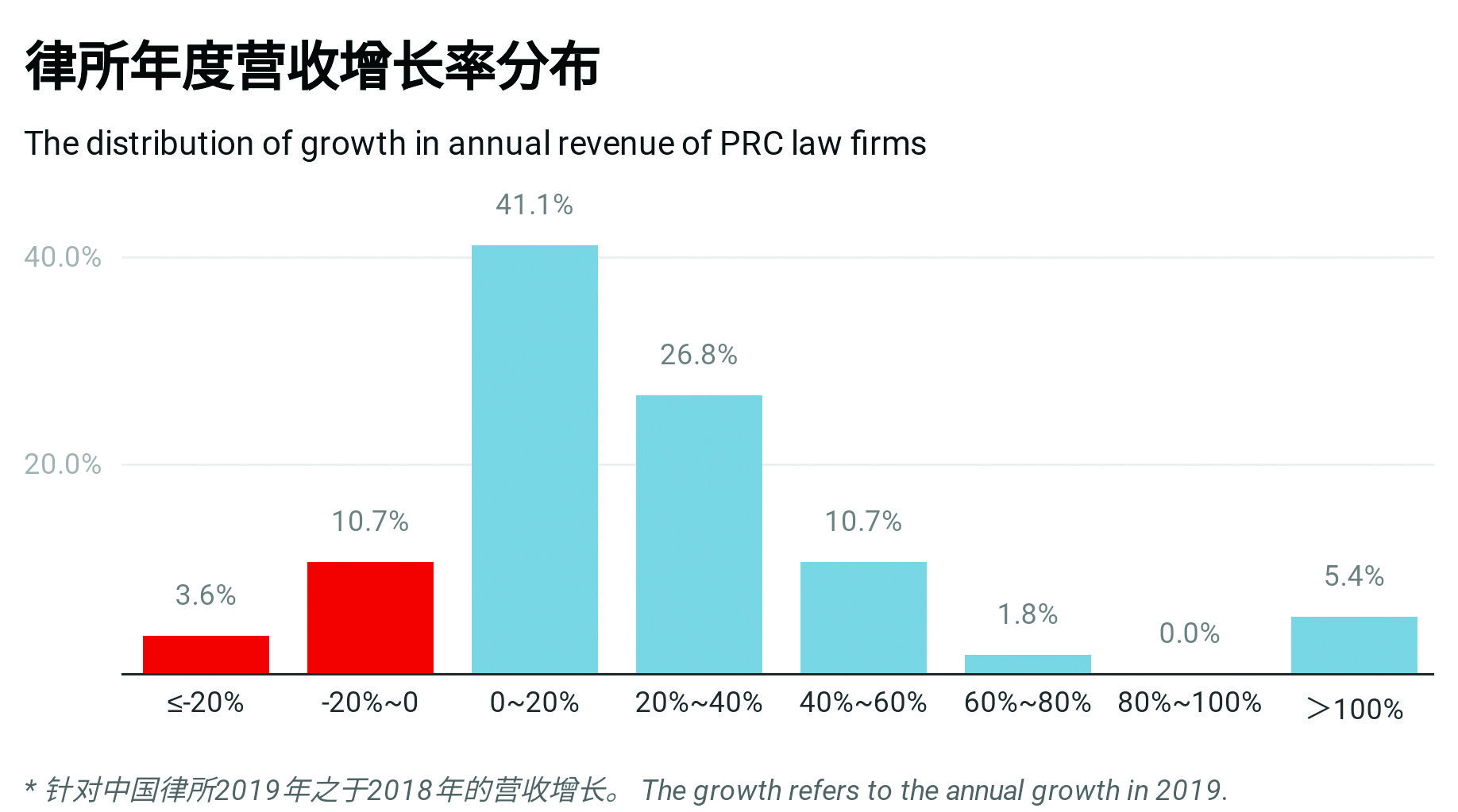

In terms of the growth in annual revenue, the survey shows that 2019 was a year of strong growth for most firms. While 41.1% of the firms grew at a rate of 0-20%, a robust 26.8% of the firms saw a growth of 20%-40% and 10.7% saw growth at 40%-60% in 2019.

One firm reported growth of 79.7%. Three firms achieved a growth rate of more than 100%, accounting for 5.4%, among which two of them are firms established in the past two to three years, and the remaining one is a national firm that has expanded its presence considerably recently.

Although 14.2% of the responding firms reported negative growth, it doesn’t necessarily mean those firms are on the slide. A partner of a Chinese firm told China Business Law Journal that in some scenarios the closure of a high-value case may pull up the revenue figures, followed by a slight decline in the next year.

“To evaluate whether a project is profitable or not, we may consider the total time we invested in the project and its different subsectors,” he says. “If the number of working hours is high, but the final result is not very satisfying, or the revenue is relatively low, this kind of business is something we need to reflect on and adjust in our daily work.”

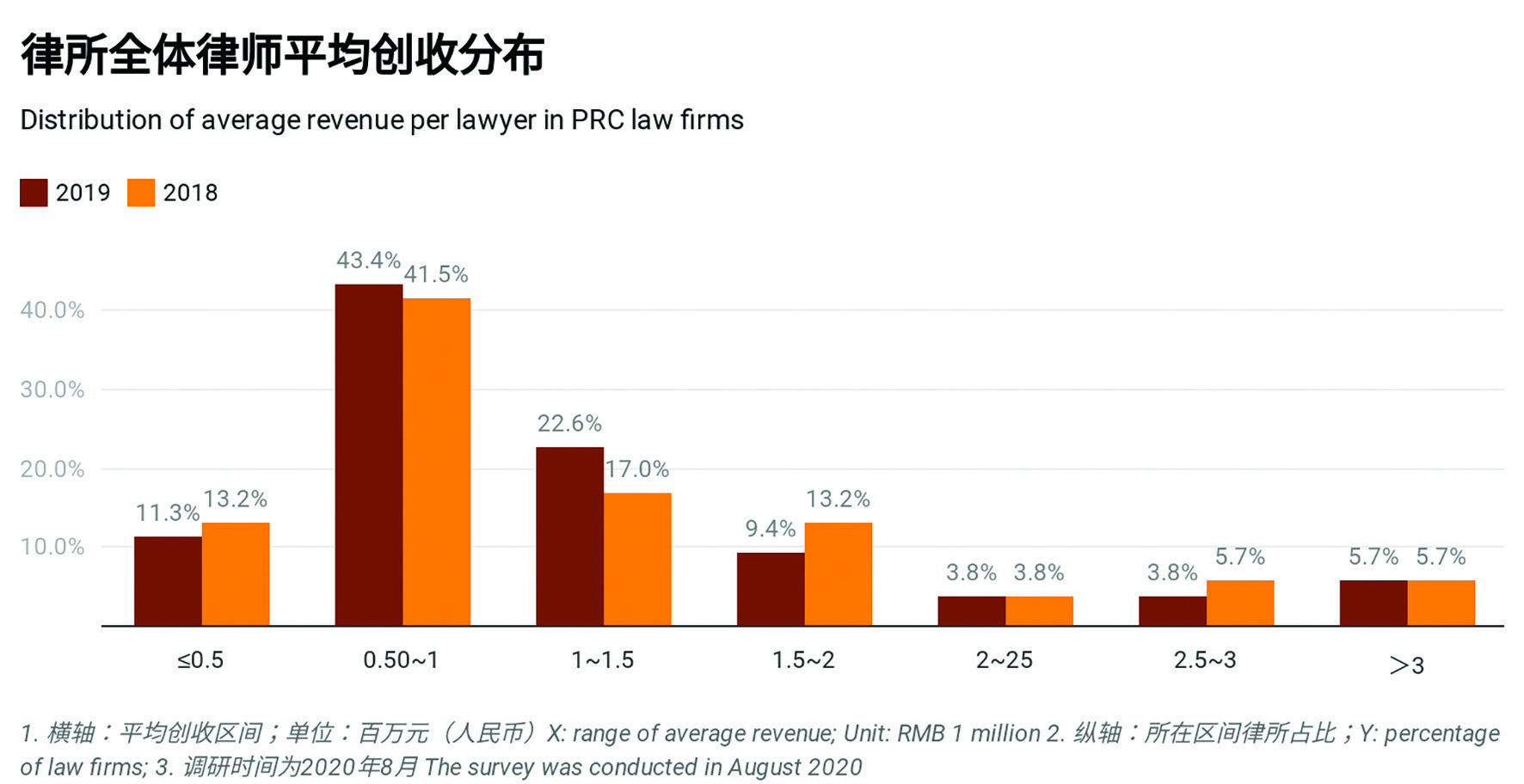

In addition, he mentions that the clients’ willingness and enthusiasm to pay will also affect the law firm’s returns. While total revenue may reflect the growth of a firm, average revenue per lawyer or equity partner may reveal their actual strength, especially with the boutique firms. According to the survey, the median of average revenue per lawyer among Chinese law firms increased slightly to RMB928,600 in 2019 from RMB916,700 in 2018.

In terms of distribution, the majority of law firms’ average revenue in 2019 shows a fall of RMB0.5 million to RMB1 million, and RMB1-1.5 million, accounting for 43.4% and 22.6% of the firms surveyed, respectively. It is worth noting that the percentage of law firms in the RMB1-1.5 million group increases by 5.6%, while the RMB1.5-2 million group accounts for 9.4%, recording a year-on-year decrease of 3.8%.

Firms with less than RMB500,000 in average revenue per lawyer account for 11.3%, while 3.8% of the surveyed firms are in the RMB2-2.5 million group, and 5.7% have an average revenue per lawyer of more than RMB3 million. The number of law firms with RMB2.5-3 million reduced from 5.7% in 2018 to 3.8% in 2019.

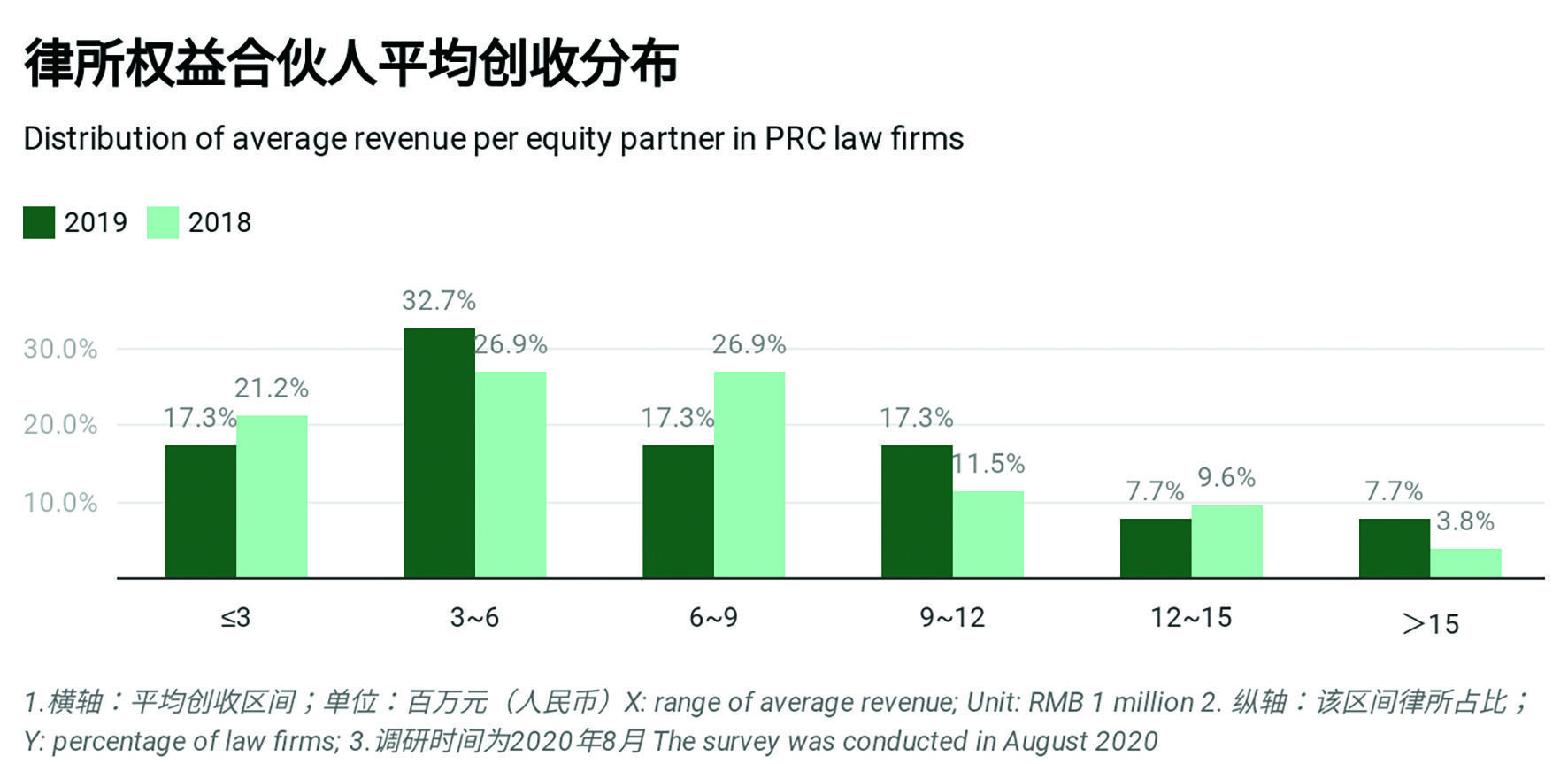

Compared with a slight increase in median average revenue per lawyer, the median per equity partner fell from RMB6.15 million to RMB6.05 million in the past two years. In terms of distribution, most of the firms recorded average revenue per equity partner at RMB3-6 million, accounting for 32.7%, a year-on-year increase of 5.8%.

Law firms in the RMB9-12 million group account for 17.3%, a year-on-year increase of 5.8%. Law firms with average revenue per equity partner larger than RMB15 million account for 7.7%, a year-on-year increase of 3.9%. These two increases may indicate a rise of a growing club of mega law firms.

Law firms with less than RMB3 million in average revenue per equity partner account for 17.3%, recording a year-on-year decrease of 3.9%; the RMB6-9 million group also accounts for 17.3%, a year-on-year decrease of 9.6%. The RMB12-15 million group accounts for 7.7%, a fall of 1.9%.

Longan Law Firm saw a modest increase in average revenue per lawyer, but a decline in average revenue per equity partner. “Longan promoted quite a few lawyers to partnership last year, with additions from outside, that is to say, we have more partners,” says Wang Dan, Beijing-based director of Longan. “Our average revenue per equity partner slightly reduced by 0.5%, which is insignificant.”

Wang Dan adds that the growth of the firm’s average revenue per lawyer is below 20% compared with the annual revenue growth of 28%, which is due to a significant increase in the number of lawyers as well. “The quality of a law firm’s growth depends on the average revenue per lawyer,” he says. “If [you] only look at the total revenue figure, and rely on recruiting more staff too much without considering the average, the number is just … made up.”

Due to the difference of partner level, promotions, equity standards and external publicity, average revenue per lawyer may represent a firm’s strength better than revenue per equity partner.

Y axis: Percentage of law firms

Source: China Business Law Journal

Y: Percentage of law firms

Source: China Business Law Journal

Y: Percentage of law firms

Source: China Business Law Journal

The following firms participated in the survey (in alphabetical order): AllBright Law Offices, An Tian Zhang & Partners, AnJie Law Firm, Anli Partners, Baohua Law Firm, Boss & Young Attorneys-At-Law, Broad & Bright, CCPIT Patent & Trademark Law Office, Chance Bridge Partners, Chang Tsi & Partners, Chen & Co Law Firm, China Commercial Law Firm, China Patent Agent (HK), City Development Law Firm, CM Law Firm, Co-effort Law Firm, Commerce & Finance Law Offices, Corner Stone & Partners, Dare & Sure Law Firm, DeHeng Law Offices, Dentons, DHH Law Firm, DOCVIT Law Firm, Duan & Duan Law Firm, East & Concord Partners, ETR Law Firm, Fangda Partners, Gaowo IP Law Firm, Global Law Office, GoldenGate Lawyers, Grandall Law Firm, Grandway Law Offices, Guantao Law Firm, Haiwen & Partners, Han Kun Law Offices, Hansheng Law Offices, Hengdu Law Firm, HHP Attorneys-at-Law, Hightac PRC Lawyers, Huang & Huang Co Law Firm, Hui Ye Law Firm, Hylands Law Firm, Jia Yuan Law Offices, Jiaxuan Law Firm, Jin Mao Law Firm, Jincheng Tongda & Neal, Jingtian & Gongcheng, JunHe, JunZeJun Law Offices, King & Wood Mallesons, Lanbai Law Firm, Landing Law Offices, Lantai Partners, Llinks Law Offices, Longan Law Firm, Merits & Tree Law Offices, PacGate Law Group, PW & Partners, Saelink Law, Sanyou Intellectual Property Agency, Shihui Partners, Silkroad Law Firm, Tian Yuan Law Firm, Tiantai Law Firm, TianTong Law Firm, TransAsia Lawyers, TTL Law Firm, V&T Law Firm, Wang Jing & Co, Wang Jing & GH Law Firm, Wanhuida Intellectual Property, Watson & Band, Yingke Law Firm, Young-Ben Law Firm, Zhenghan Law Firm, Zhong Lun Law Firm, Zhonghao Law Firm.