China’s leading law firms saw revenue slow in 2020, but at a better rate than many predicted as the countercyclical sector swung back with resilience during the pandemic and subsequent global economic shutdown. China Business Law Journal’s annual survey tapped 109 law firms for their views on last year’s rollercoaster of market trends. Avery Chen reports

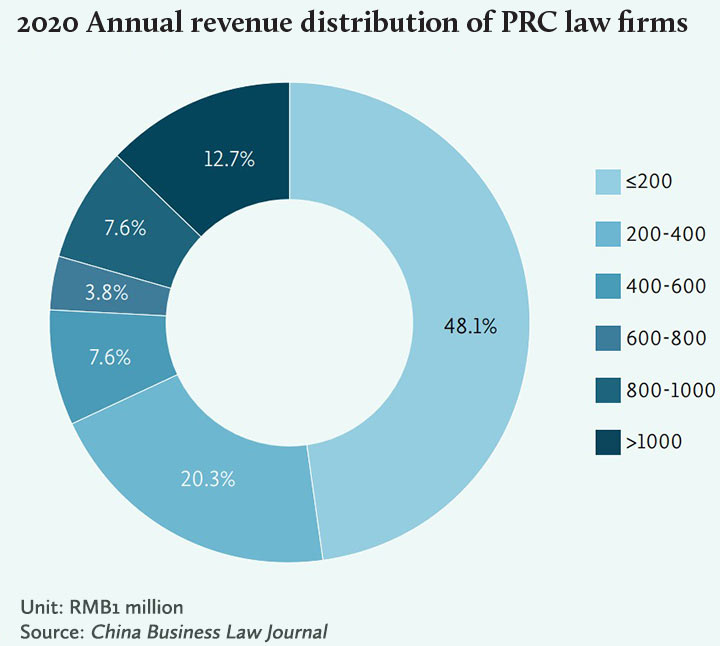

According to China Business Law Journal’s annual legal market survey, a total of 72 law firms recorded a median revenue of RMB205.5 million (USD31.9 million) last year. However, the average growth rate nearly halved to 12.6% in 2020 from 24% in 2019.

“Achieving revenue growth is already better than expected,” says Yu Yongqiang, a Beijing-based partner at JunHe. “Many law firms were worried about decline in revenue at the beginning of last year, when employees worked from home due to the covid-19 pandemic.”

Last year was anything but normal. In the first few months, law firms were asking staff to work remotely when the central government imposed lockdowns on the majority of cities. Even after the pandemic was under control, firms faced fierce competition due to falling demand from clients, which put their investment plans on hold and slashed their budgets for legal services.

“With a double-digit increase, the legal services industry has outperformed many other sectors,” says David Lin, managing partner of Dare & Sure Law Firm in Beijing. “The industry is largely dependent on the real economy, so it’s normal to see a slowing growth last year.” Despite China becoming the first major economy to recover from covid-19, the country’s GDP rose by 2.3% last year, the lowest rate since 1976.

“The pandemic dealt a blow to economic activity, and there is more friction in international trade,” says Lin. “That’s why law firms’ business has been rising but the revenue growth has slowed, and billing rates per case were going down.”

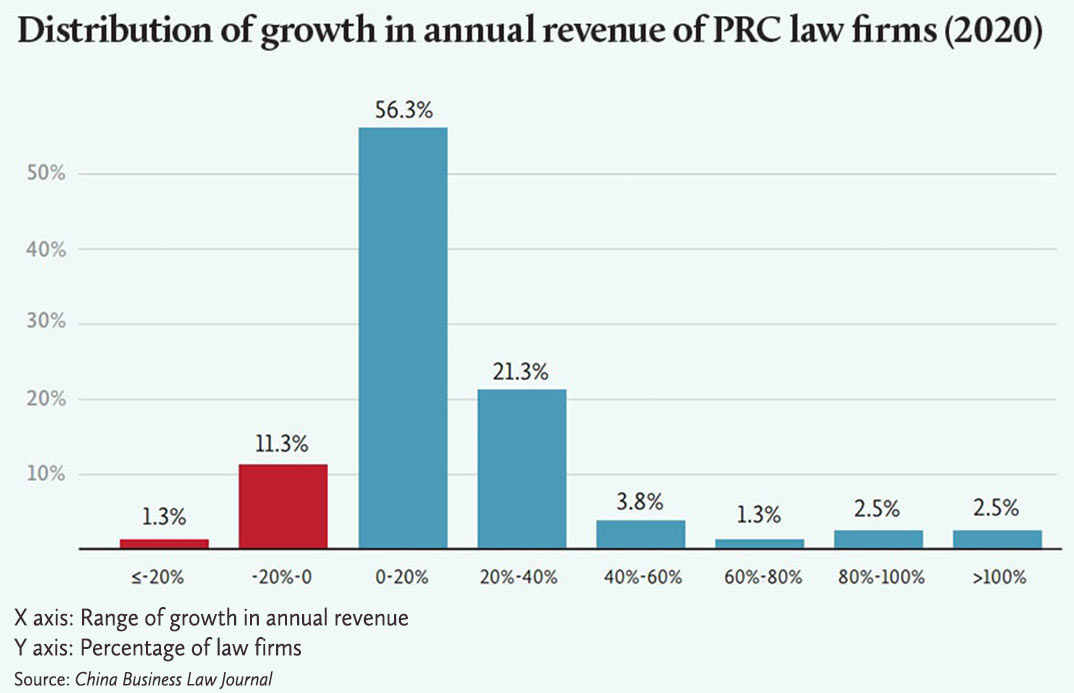

In 2020, more than half of our survey’s participants saw revenue rise by between 0% and 20%, while 12.6% of law firms saw a contraction in earnings.

“The economic cycle has had a small impact on full-service firms, while companies that rely on a single [sector] were more affected,” says Yu.

Among the 72 law firms that disclosed financial data, 10 passed the milestone of RMB1 billion in revenue. The 10 firms posted average revenue growth of 19.8%, 7.2% higher than the average across the industry.

The pandemic brought more opportunities for elite law firms. Downward pressure on the economy gave a boost to countercyclical sectors such as restructuring and insolvency, labour law matters, compliance and M&A, etc.

“The external challenges did take a toll on our financial performance,” says Lin. “We failed to sustain a similar growth rate for business this year, but we saw a significant increase in competition law and due diligence business.”

Yu also notes the pickup in new demand when the economic situation worsens in areas including labour law, compliance and litigation. The central government’s push on the domestic supply chain was also a major boon to the legal marketplace.

“Legal services have been in high demand given such a big economy,” says Yu. “The latest ‘dual circulation’ strategy is also giving a boost to the industry.”

This new strategy was put forward by President Xi Jinping in May 2020, under which domestic production, distribution and consumption would be the key drivers for the economy, supplemented by international trade.

Market data also reflect the trend. China’s M&A value rose 30% to USD733.8 billion in 2020, hitting a five-year high, driven by strong state-owned enterprise (SOE) participation, which offset a steep decline in cross-border deals, according to a report from accounting firm PwC.

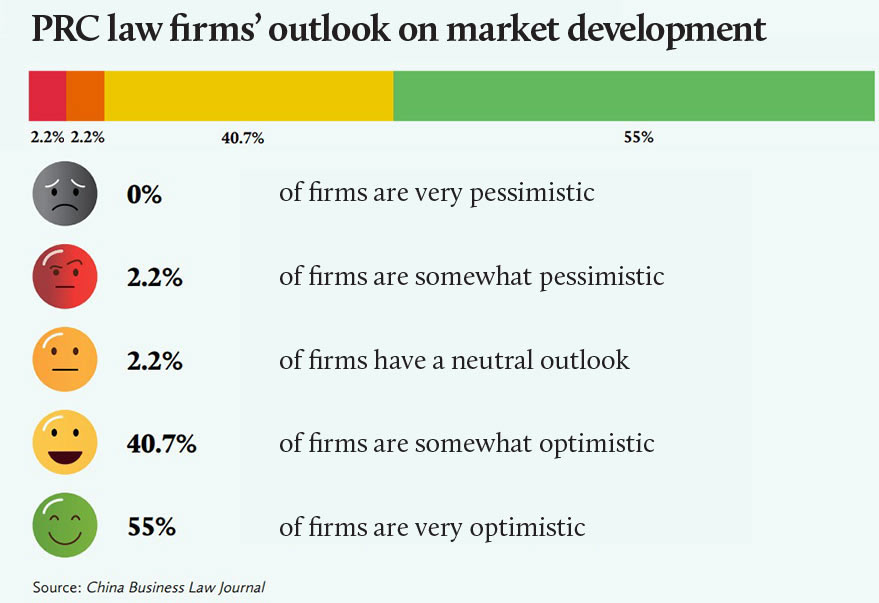

Our survey respondents are seeing positive long-term growth. About 55% of participants say they are “very optimistic” about the development of the Chinese legal industry, followed by “somewhat optimistic” (40.7%), “neutral” (2.2%) and “somewhat pessimistic” (2.2%).

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

The following firms participated in the survey (in alphabetical order): AllBright Law Offices, An Tian Zhang & Partners, AnJie Law Firm, Anli Partners, Baohua Law Firm, Beshining Law Office, Boss & Young Attorneys at Law, Bridgeon Law Firm, CCPIT Patent and Trademark Law Office, Chance Bridge Partners, Chang Tsi & Partners, Chen & Co Law Firm, China Commercial Law Firm, CM Law Firm, Co-effort Law Firm, Commerce & Finance Law Offices, Corner Stone & Partners, Dare & Sure Law Firm, DeHeng Law Offices, Dentons, DHH Law Firm, DOCVIT Law Firm, East & Concord Partners, ETR Law Firm, Exceedon & Partners, Fangda Partners, Gaopeng & Partners, Gaowo Law Firm, Global Law Office, GoldenGate Lawyers, Gong Cheng Law Firm, Grandall Law Firm, Grandway Law Offices, Guantao Law Firm, Hai Run Law Firm, Haiwen & Partners, Han Kun Law Offices, Hansheng Law Offices, Hengdu Law Offices, HHP Attorneys-At-Law, Hightac PRC Lawyers, Hiways Law Firm, HongFangLaw, Huang & Huang Co Law Firm, Hui Ye Law Firm, Hui Zhong Law Firm, Hylands Law Firm, Jia Yuan Law Offices, JianLingChengDa Law Firm, Jiaxuan Law Firm, Jin Mao Law Firm, Jincheng Tongda & Neal, Jingtian & Gongcheng, Joint-Win Partners, JOIUS Law Firm, Jundu Law Firm, JunHe, JunZeJun Law Offices, K&H Law Firm, KaiRong Law Firm, Kangda Law Firm, King & Wood Mallesons, Lanbai Law Firm, Landing Law Offices, Lantai Partners, Leadvisor Law Firm, Llinks Law Offices, Longan Law Firm, Merits & Tree Law Offices, Ning Ren Law Firm, PacGate Law Group, PW & Partners, Qin Li Law Firm, RICC & Co, River Delta Law Firm, Ronly & Tenwen Partners, S&D Partners, Saelink Law, Sanyou Intellectual Property Agency, SF Lawyers, SG & Co PRC Lawyers, SGLA Law Firm, Shanghai Pacific Legal, Shihui Partners, Shu Jin Law Firm, Silkroad Law Firm, Sloma & Co, Sundy Law Firm, Sunshine Law Firm, T&D Associates, Tahota Law Firm, Tian Yuan Law Firm, Tiantai Law Firm, TianTong Law Firm, Tiger Partners, V&T Law Firm, Wang Jing & GH Law Firm, Wanhuida Intellectual Property, Watson & Band, Winners Law Firm, Wintell & Co, Yinghe Law Firm, Yingke Law Firm, Young-Ben Law Firm, Zhenghan Law Firm, ZHH & Robin, Zhilin Law Firm, Zhong Lun Law Firm, Zhonglun W&D Law Firm.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

The following firms participated in the survey (in alphabetical order): AllBright Law Offices, An Tian Zhang & Partners, AnJie Law Firm, Anli Partners, Baohua Law Firm, Beshining Law Office, Boss & Young Attorneys at Law, Bridgeon Law Firm, CCPIT Patent and Trademark Law Office, Chance Bridge Partners, Chang Tsi & Partners, Chen & Co Law Firm, China Commercial Law Firm, CM Law Firm, Co-effort Law Firm, Commerce & Finance Law Offices, Corner Stone & Partners, Dare & Sure Law Firm, DeHeng Law Offices, Dentons, DHH Law Firm, DOCVIT Law Firm, East & Concord Partners, ETR Law Firm, Exceedon & Partners, Fangda Partners, Gaopeng & Partners, Gaowo Law Firm, Global Law Office, GoldenGate Lawyers, Gong Cheng Law Firm, Grandall Law Firm, Grandway Law Offices, Guantao Law Firm, Hai Run Law Firm, Haiwen & Partners, Han Kun Law Offices, Hansheng Law Offices, Hengdu Law Offices, HHP Attorneys-At-Law, Hightac PRC Lawyers, Hiways Law Firm, HongFangLaw, Huang & Huang Co Law Firm, Hui Ye Law Firm, Hui Zhong Law Firm, Hylands Law Firm, Jia Yuan Law Offices, JianLingChengDa Law Firm, Jiaxuan Law Firm, Jin Mao Law Firm, Jincheng Tongda & Neal, Jingtian & Gongcheng, Joint-Win Partners, JOIUS Law Firm, Jundu Law Firm, JunHe, JunZeJun Law Offices, K&H Law Firm, KaiRong Law Firm, Kangda Law Firm, King & Wood Mallesons, Lanbai Law Firm, Landing Law Offices, Lantai Partners, Leadvisor Law Firm, Llinks Law Offices, Longan Law Firm, Merits & Tree Law Offices, Ning Ren Law Firm, PacGate Law Group, PW & Partners, Qin Li Law Firm, RICC & Co, River Delta Law Firm, Ronly & Tenwen Partners, S&D Partners, Saelink Law, Sanyou Intellectual Property Agency, SF Lawyers, SG & Co PRC Lawyers, SGLA Law Firm, Shanghai Pacific Legal, Shihui Partners, Shu Jin Law Firm, Silkroad Law Firm, Sloma & Co, Sundy Law Firm, Sunshine Law Firm, T&D Associates, Tahota Law Firm, Tian Yuan Law Firm, Tiantai Law Firm, TianTong Law Firm, Tiger Partners, V&T Law Firm, Wang Jing & GH Law Firm, Wanhuida Intellectual Property, Watson & Band, Winners Law Firm, Wintell & Co, Yinghe Law Firm, Yingke Law Firm, Young-Ben Law Firm, Zhenghan Law Firm, ZHH & Robin, Zhilin Law Firm, Zhong Lun Law Firm, Zhonglun W&D Law Firm.