Under the leadership of former prime Minister Kevin Rudd, the Australian federal government, announced its intention to introduce a new resources super profits tax (RSPT) on existing and future resources projects in Australia. Following a change of prime minister, and consultation with certain industry stakeholders, the RSPT has been revised to become a new resources tax regime comprising a new Mineral Resources Rent Tax (MRRT) and an extended Petroleum Resources Rent Tax (PRRT). The taxes are to be applied to future and existing projects, at headline rates of 30% and 40% respectively, from 1 July 2012.

Partner

Blake Dawson

Brisbane

Clearly, the new resources tax regime is a significant issue for all participants in the Australian resources sector (including financiers).

If implemented, the new resources tax regime would apply on a project basis (as opposed to on the entities themselves) and would be likely to affect Chinese entities participating in the Australian resources industry. In contrast to the proposed but now abandoned RSPT, the new MRRT will only apply to coal and iron ore projects. The existing PRRT regime will be extended to all oil, gas and coal seam methane operations in the country.

The proposed MRRT

The MRRT will apply to new and existing projects relating to coal and iron ore projects, with existing projects to transition into the MRRT system in accordance with specific rules.

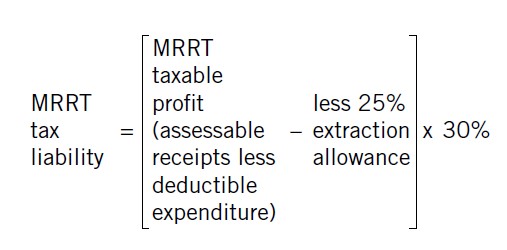

The MRRT will be payable at a rate of 30% on “MRRT taxable profits”. The MRRT adopts a net calculation to determine MRRT taxable profit, and then reduces that profit by 25% under a new extraction allowance, so that liability is assessed by reference to the following basic structure:

This means that the effective tax rate for the MRRT is 22.5%. MRRT taxable profit will be calculated on an annual basis, by reference to rules in the MRRT legislation. These rules are distinct from those relevant to determining “assessable income” and “deductions” for Australian income tax purposes.

Partner

Blake Dawson

Perth

Taxpayers will be entitled to deduct the cost of MRRT from their assessable income for Australian income tax purposes.

Importantly, the taxpayer’s “deductible expenditure” for MRRT purposes will include a range of expenses (but not interest or financing costs) relating to the cost of extracting the relevant resource. Qualifying expenditure after 1 July 2012 can be written off immediately. Existing projects will be brought into the regime at book value or market value, at the taxpayer’s election. If book value is used, the book value of the project (excluding mining rights) will be depreciated over five years, and an uplift of 7% above the Australian long-term (10 year) Commonwealth bond rate (LTBR) will apply. If market value is used, depreciation will be over the effective life of the project (up to 25 years) on the market value of the project (including mining rights). However, no uplift will apply.

MRRT losses can be carried forward at the LTBR plus a flat rate of 7%, and, upon completion of a project, will be transferable to other iron ore or coal projects in Australia.

State and territory-based royalty systems remain, but the Commonwealth will provide taxpayers with credits against their MRRT liability in respect of this expenditure. Any unused credits can also be carried forward at the LTBR plus a flat rate of 7%.

The extended PRRT

Australia’s PRRT regime will now extend to cover all oil, gas and coal seam methane projects, onshore and offshore. The PRRT applies at a headline rate of 40% and also calculates liability by reference to “taxable profits” (assessable receipts less deductible expenditure). There is no 25% expenditure allowance under the PRRT.

The Australian government’s announcement refers to the ability to elect to use market value in determining the starting base for existing project assets. As with the MRRT, royalty expenses will be creditable against PRRT liabilities from a project. In contrast to the MRRT, carry forward losses are uplifted at different rates depending on the expenditure to which they relate: 5% above the LTBR for project expenditure and 15% above the LTBR for exploration expenditure.

Issues for the resources sector

In light of the proposed reforms, energy and resources companies and contractors to those companies should:

- review material contracts to consider whether the introduction of the new resources tax regime constitutes a change of law or material adverse affect under these contracts, and to determine whether the cost of the relevant resource tax can be passed through via contractual provisions;

- revisit the drafting of contracts that are currently being negotiated, to ensure the cost of the relevant resource tax is taken into account;

- consider the impact of the expected changes on financial models (and related assumptions). Such modelling is likely to be particularly complex for existing projects that come into the new tax regime on 1 July 2012, due to the need to consider transitional rules, coupled with the income tax deduction afforded by the MRRT and PRRT and credits for state royalties; and

- consider asset acquisition and disposal programmes and the nature of asset investment.

We expect that further information on the new resources tax regime will come to light as the Australian government increases its focus on implementing the new regime. Clearly any further detail on the operation of the new resources tax, and changes to its application, will be essential to participants in the Australian resources sector.

Teresa Dyson and Len Hertzman are partners in the Perth office of Blake Dawson

Blake Dawson Shanghai office

Suites 3408-10, CITIC Square

1168 Nanjing Road West, Shanghai

Postal code: 200041

Tel: 86 21 5100 1796

Fax: 86 21 5292 5161

E-mail:

teresa.dyson@blakedawson.com

www.blakedawson.com