The Shanghai Stock Exchange Science and Technology Innovation Board has been a stellar success, even in the past year, paving the way for broader changes to Mainland capital markets. With these reforms, A-shares now have clearly positioned, multi-layer boards that let market forces play the starring role, writes Sophia Luo

The pandemic-ravaged year of 2020 marked the 30th anniversary of the establishment of China’s capital markets. As China emerges from the chaos still seen in much of the world, the country’s capital markets will be put to bigger tests in 2021 – a critical year that sees the beginning of the nation’s 14th Five-Year Plan.

“In the span of two years, the Star Market has played a notable role in guiding the allocation of resources. The number of listings and amount of funds raised have been rising year by year, and listed companies continue to post strong earnings growth,” says Zhang Liguo, founding chief partner at Grandway Law Offices in Beijing.

“The Star Market has played an exemplary role in promoting the implementation of registration-based initial public offering mechanisms. Based on that, we have seen the revised Securities Law make clear that a phased registration-based IPO reform will be implemented more generally across China’s capital markets. The startup board, ChiNext on the Shenzhen Stock Exchange [SZSE], will begin accepting IPO applications under the registration-based IPO regime,” notes Zhang.

According to Liu Tao, a Shanghai-based partner at Commerce & Finance Law Offices, 281 companies had debuted on the Star Market as of 26 May, with market capitalisation totaling RMB3.79 trillion (USD592.78 billion). In less than two years, the Star Market has contributed to 7% of the total market capitalisation of the Shanghai Stock Exchange [SSE].

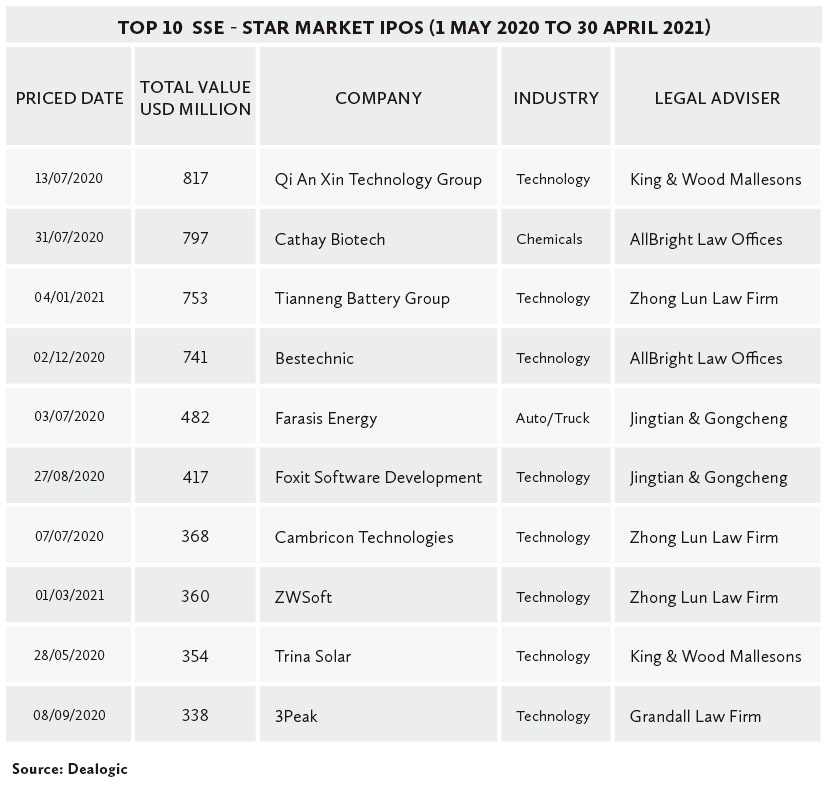

Zhang Zhiqiang, a Beijing-based partner at Jingtian & Gongcheng, says the Star Market has shouldered two missions since its inception. One is functioning as the test ground for registration-based IPO reform, and the other is constructing a more inclusive mechanism for the listings of companies with core technologies.

“This can be seen by the fact that as much as 90% of listed companies on the Star Market come from high-tech industries and strategic emerging industries such as IT, biomedicine, high-end equipment manufacturing and new materials,” he says.

Chen Yang, a partner at Han Kun Law Offices in Beijing, says the Star Market puts the focus on sustainable operation rather than profitability, and emphasises the company’s scientific and technological innovation attributes.

“This offers opportunities for different types of companies and firms at different stages of development – such as red-chip companies, pre-profit companies and companies with weighted voting rights – to raise funds, which helps sci-tech enterprises scale up input in research and development, as well as quicken the pace to make technological breakthroughs and convert technological achievements into real productive forces,” says Chen.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.