While several practice areas have been particularly active this year, Chinese law firms are actively optimising their billing arrangements to meet the rising demand for high-quality services in a legal market where fee structures are still dominated by businesses. Luna Jin reports

a

fter five years of reporting on the dynamics of billing models, it is perhaps easy to default to the notion that China’s legal market is bound to become more accepting of the hourly rate model over time. But when it comes to pricing lawyers’ services, what criteria does the setting of cost profit margins for legal services reflect in the marketplace?

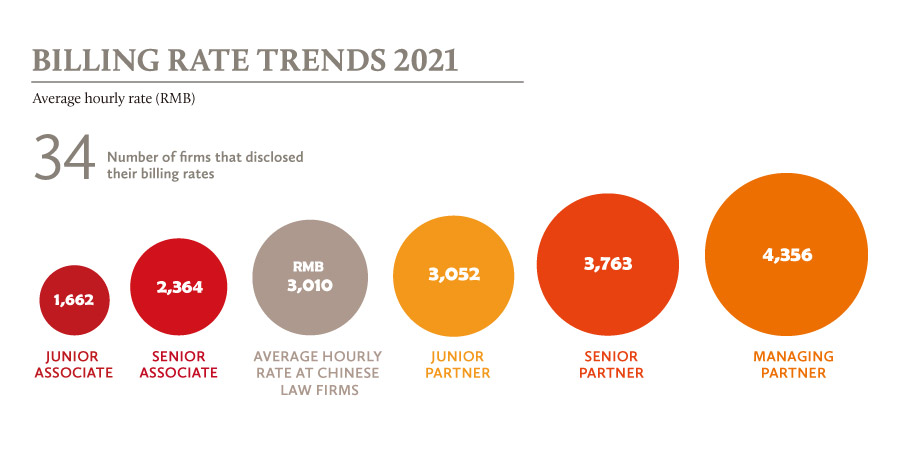

This year, we continue to collect and present data of the hourly rates of Chinese law firms for our readers, with a total of 34 leading law firms in the nation disclosing their hourly rates, by lawyers’ seniority, to China Business Law Journal.

In addition, we have sifted through the billing preferences of in-house counsel in mainland China and Hong Kong from a survey of Asia’s general counsel launched in September by our sister publication, Asia Business Law Journal.

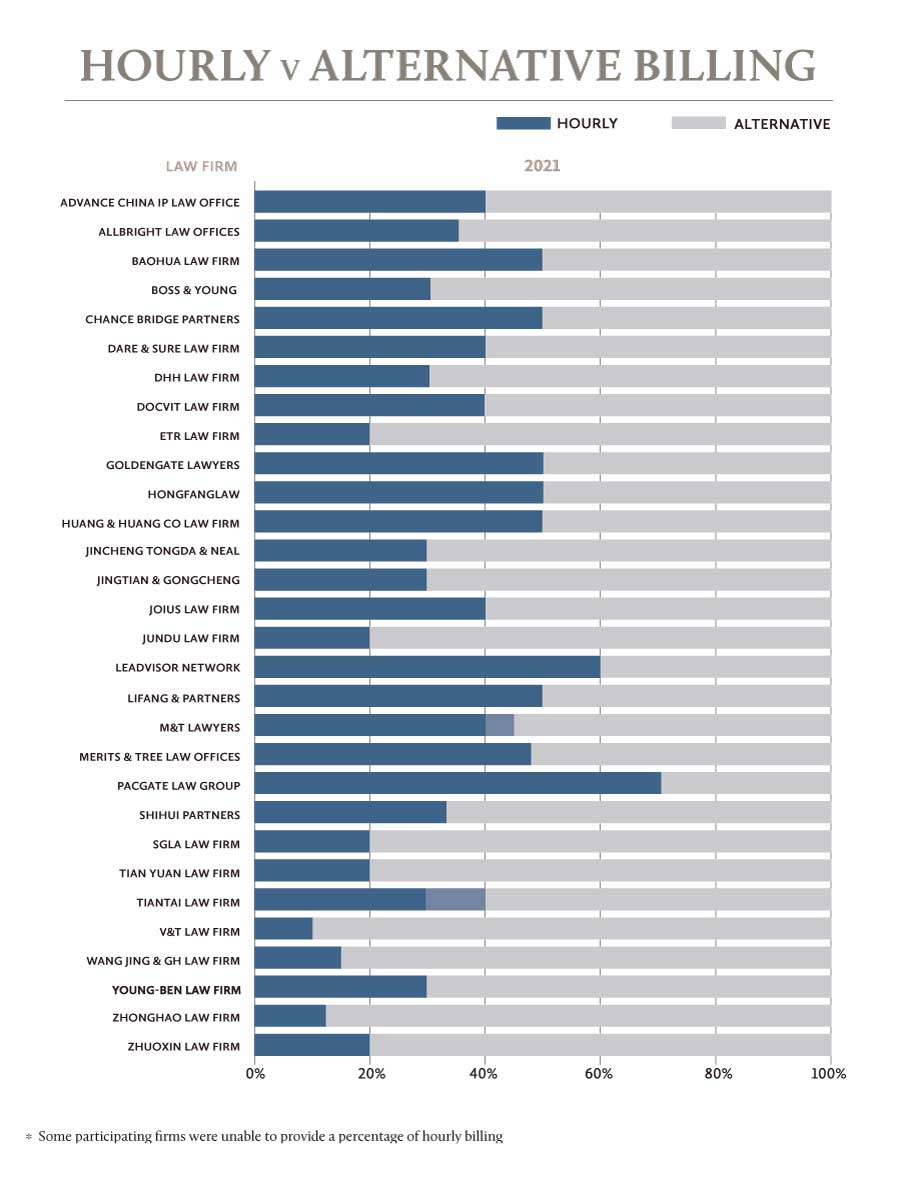

So, how well is hourly billing, a wholly imported industry practice, currently accepted by the market in China? We have found that project-based and fixed fees are still the mainstream billing arrangements in China’s legal market, supplemented by alternatives such as hourly billing, retainers and contingency fees.

Dispute resolution deals are more likely to have a capped fee due to the uncontrollable nature of dispute cases, while non-litigation practices tend to adopt a mixed “hourly + capped fee” billing arrangement for budget control. The proportion of hourly billed business has increased each year, but this trend is not significant.

Amid the current economic woes, the unit price of the hourly rate has also not shown significant change this year. According to our survey, the average industry hourly rate in 2021 is RMB3,010 per hour (USD472), an increase of 3.5%, year-on-year.

On the buyers’ side – for in-house counsel in mainland China and Hong Kong – 63.2% preferred project-based fees, 26.3% preferred fixed fees, while 7.9% and 2.6% preferred hourly and mixed billing models, respectively.

Whether to adopt hourly billing in real-life transactions is not solely a matter of the firm’s own volition, but is also closely related to clients’ trading habits. Yu Yongqiang, a Beijing-based partner at JunHe, says it is difficult for law firms in China to charge entirely according to hourly rates, and domestic clients are generally less receptive than their overseas peers. Even when hourly billing is used, the price point they can accept is lower than for overseas clients.

Larger corporate clients are also more likely to accept hourly rates on their long-term legal service than individual project requests, says Yu, “as they often require the services of multiple lawyers in different practice areas, and the firm is therefore able to propose an internally unified hourly rate arrangement”.

Our survey shows that in mainland China and Hong Kong, more than half of the responding companies preferred to choose law firms through existing relationships, while 23.7% placed more importance on the reputation of the firm, with 13.2% and 7.9% preferring referrals and beauty pageant/bake-offs, respectively.

As for the top considerations behind their choices, 60.5% cited service quality, while 18.4% and 13.2% prioritised track record and price, respectively, with a few also citing big-name partners.

A law firm’s brand image is closely related to its management model. Paul Zhou, director of SGLA Law Firm in Shanghai, notes that among the law firms under corporate management, “the administrative team usually has stronger service capability, and the marketing and branding departments are working more effectively”.

The ability of a law firm to prescribe an internally recognised and effective set of hourly rates is also linked to the management model. Daniel Ding, director of Joius Law Firm in Shanghai, says that firms under corporate management can issue firm-wide rules on service fees, so that there are written codes to abide by when offering hourly billing arrangements.

Li Weiming, a Shanghai-based partner at Tiantai Law Firm, adds that law firms under corporate management and those that are able to mobilise and integrate firm resources for their clients are more proactive in terms of billing arrangements and bargaining power.

John Dong, a Shanghai-based partner at Baohua Law Firm, emphasises that “an efficient management system gives clients numerous options for billing arrangements other than hourly rates”.

Rise and fall

The cost of legal services is not only affected by the macroeconomic environment, but is also closely related to the level of development and competition in specific practice areas. Huang Yongqing, Beijing-based partner at Jingtian & Gongcheng, observes that the rates for A-share related capital markets business has risen considerably.

Early this year, the regulators strengthened their scrutiny of listed companies, and the number of IPO applications withdrawn by companies on their own initiative reached 140 as of July due to the pressure of on-site inspections, exceeding the total number for all of last year.

Meanwhile, the China Securities Regulatory Commission (CSRC) is proposing to revise a document that will raise the qualification requirements for securities service providers, including law firms, and strengthen the review of application documents, as well as add to the due diligence obligations of institutions.

“The riskiness of A-share related business is recognised and valued by the industry, and there has also been an increase in the market entry barriers for legal service providers, leading to a higher premium for attorneys’ fees,” says Huang.

Wang Dong, a Beijing-based managing partner at East & Concord Partners, also sees a rise in fees for the emerging practice of corporate criminal compliance. The Supreme People’s Procuratorate has this year expanded the scope of its pilot “compliance non-prosecution system”, a judicial experiment in China modelled on deferred prosecution systems in countries such as the UK and the US, which will give companies and clients the opportunity to develop compliance plans in exchange for not being prosecuted in criminal cases.

Wang also sees a rise in fees in the area of data compliance. This year has witnessed the enactment of two major laws in the data sector, the Data Security Law and the Personal Information Protection Law, and consequently a rise in fees for services in the closely related practices of anti-monopoly and unfair competition.

A significant rise in fees for IP, particularly in patent practice, has also been observed. “Lawyers’ offers are more likely to be accepted when legal business is linked to the lifeblood of an enterprise, which includes technology and pharmaceutical companies with advanced patents,” says Yu of JunHe.

Fees for civil and commercial dispute resolution, on the other hand, are in a decline. Peng Qing, a founding partner of TianTong Law Firm in Beijing, points out the reasons for this are, on the one hand, the increasingly strict and standardised management of admissions and tenders for companies such as financial institutions, central state enterprises and listed companies. On the other hand, he says, “the current financial budgets are all tightening in the general economic environment, private enterprises are not doing well, and defaulting on fees is becoming increasingly serious”.

Fees in the M&A sector have also fallen as a result of the economic downturn, notes Lin Haining, a Beijing-based partner at Tian Yuan Law Office, particularly for M&A business in the real estate sector.

Despite the accelerated consolidation of resources by the top-tier real estate companies and the Matthew Effect becoming evident with active M&A transactions, Zhou, of SGLA, says there is even more competition for such traditional practices this year. “The pandemic has affected the domestic economic circle, leading to burnout competition within the legal industry, and clients are finding it difficult to accept rate increases,” says Zhou.

The counter-cyclical insolvency practice and the maritime and shipping practice – which has been critical to supply chains during the global health crisis – have been very active this year, but the corresponding service fee rates have not increased significantly. Wang, of East & Concord, explains that there is an “imbalance between the demand side and the supply side” of legal services in these two practice areas due to excessive competition.

Ding, of Joius, concludes that because of the advent of legal technology tools, legal services that can be standardised and bulked up are trending downwards in terms of fees. Those that are on the rise tend to be “new business, majorly complex and more personalised”.

So, how do companies allocate their legal budgets? Our survey of companies in mainland China and Hong Kong showed that over a quarter of legal budgets are spent on dispute resolution, while transaction costs, and corporate and commercial matters, account for 21% and 16.7%, respectively, with about one-tenth of budgets going to regulatory & compliance and intellectual property, and the remainder split among areas such as data compliance, cybersecurity and taxation.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.