Home Search

Search results: fdi

FDI blasts off into the space sector

The Indian space sector has become a beacon of excellence and technological development, propelling India to the forefront of the global space business. During the past decade, the sector has seen tremendous growth, including...

India relaxes restrictions on space sector allowing 100% FDI

The government has announced the opening up of the country’s space sector to foreign investors.

Under the new policy approved by the cabinet, foreign direct investment (FDI) restrictions have been relaxed, allowing foreign investors to...

FDI taking up arms in the defence sector

India’s defence sector has long been a government-controlled industry with limited private sector participation. However, the need for modernisation, self-reliance and defence exports has led to significant reforms to attract FDI. FDI of 74%...

AIFs provide safety in numbers for FDI

Foreign Direct Investment (FDI) is significant for the global economy and is also critical to India’s economic advancement. Defying worldwide sluggish performance, India has seen sustainable macro-level growth. This has offered various investor classes...

Gems the jewel in the FDI crown

The government permits 100% foreign direct investment (FDI) in the gems and jewellery sector under the automatic route. The sector is the second largest foreign exchange earner in India. It plays a significant role...

FDI into India through alternative investment platforms

Distributed ledger technology-driven alternative investment platforms (DLT platforms) contribute to the inclusive growth of an economy. They attract every level of society, from low and middle to high class. Traditionally, investments requiring large scale...

India benefits from continued growth in FDI

Foreign Direct Investment (FDI) is an integral part of the Indian economy. Over the years, India has emerged as a popular destination for FDI owing to its huge domestic demand, the availability of natural...

Companies must disclose FDI from neighbours

The Ministry of Corporate Affairs has made amendments under the Companies (Prospectus and Allotment of Securities) Amendment Rules, 2022, requiring Indian entities to reveal if investments are made by a company that is incorporated...

Assured increase of FDI in the insurance sector

On 14 March 2022, the government issued Press Note 1 of 2022 allowing 20% foreign direct investment (FDI) through the automatic route in the Life Insurance Corporation of India (LIC) a corporation established and...

FDI a booster shot for the economy

In 2020, foreign direct investment (FDI) and other policies changed and ushered in a new era for the treatment of non-resident Indian (NRI) investments and income. The Ministry of Commerce and Industry in Press...

Government enables FDI support for self-reliance

In May 2020, the prime minister inaugurated Atmanirbhar Bharat or self-reliant India programme (ANB), and announced various economic packages to boost the economy. The main aim of ANB is to make India a global...

Amendments to FDI in the telecom services sector

The Ministry of Finance has released the gazetted copy of the Foreign Exchange Management (Non-debt Instruments) (Fourth Amendment) Rules, 2021 (amendment rules). The amendment rules revise the Foreign Exchange Management (Non-debt Instruments) Rules, 2019,...

New FDI rules prompt Yahoo News to exit India

Yahoo brought down the shutters on its news websites on 26 August as a result of recently updated foreign direct investment rules that limit foreign ownership of digital media.

“The decision did not come lightly”...

Brief guide to FDI in the Philippines

Bangko Sentral ng Pilipinas, the central bank of the Philippines, recently reported that foreign direct investment (FDI) in the country increased by 41.5% in January 2021 to USD961 million from USD679 million in January...

Trust structures from an FDI perspective

Trust structures are increasingly gaining popularity for wealth and succession planning in India where most businesses are family driven. Increased global business opportunities have led business families, particularly the younger generations, to migrate and...

FDI policy oversees trading on technology platforms

The buying and selling of goods and services on technology platforms has grown exponentially during covid-19. A technology platform connects buyers and sellers and facilitates commercial transactions between them. E-commerce platforms, under the FDI...

Commerce ministry consolidates FDI policy changes

The Ministry of Commerce released the 2020 edition of the consolidated foreign direct investment (FDI) policy on 28 October, incorporating all the changes adopted in foreign investment in the past year.

The 111-page document tries...

FDI limits in defence sector further liberalized

The government on 18 September issued Press Note 4 of 2020 to increase the foreign direct investment (FDI) limit in India’s defence sector to 74% from 49% under the automatic route. The liberalized FDI...

FDI relaxations in insurance may not get desired response

In a timely move intended to attract foreign direct investment (FDI), the government has allowed 100% FDI under the automatic route in insurance intermediaries. Industry stakeholders had long requested a relaxation in investment caps...

Defining ‘beneficial owner’ and FDI restrictions

To restrict opportunistic takeovers/acquisitions of Indian companies due to low valuations in light of covid-19, the Department for Promotion of Industry and Internal Trade (DPIIT) via Press Note 3 of 2020 (PN3) revised the...

Standing down the guard and increasing FDI in defence

In one of most significant moves in modern times concerning the defence sector, the finance minister recently announced that the foreign direct investment (FDI) limit in the defence sector under the automatic route would...

Structuring and financing Foreign Direct Investment (FDI) in Bangladesh

The Bangladesh economy continues to grow at an impressive scale, with a GDP growth rate of 8.1%, surpassing that of its neighbouring countries and making it one of Asia’s most remarkable success stories. The...

Virtual currency trade sees challenges with FDI

On 4 March 2020, the Supreme Court (court) quashed the Reserve Bank of India’s (RBI) circular of 6 April 2018 prohibiting entities regulated by the RBI from dealing in virtual currencies (VC) or providing...

FDI in digital media – easing of norms or restriction?

Last year the government, in order to boost the flagging economy, announced policy changes to foreign direct investment (FDI) under which investment norms were relaxed in certain sectors. The announcement was followed up by...

Total’s Adani stake a massive step in FDI

Total will acquire a 37.4% stake in Adani Gas for ₹61 billion (US$864 million). The acquisition forms the largest foreign direct investment in India’s city gas distribution sector to date.

On the significant aspects of...

FDI reforms give embattled economy a shot in the arm

Government data show that economic growth has slipped to 5% for the April-June 2019 quarter, a six-year low. With stock markets tumbling and automobile manufacturers grumbling, the government has gone on a reform spree....

Searching for answers in new FDI proposal

On 28 August 2019 the government announced its new proposal on Foreign Direct Investment (FDI). While the announcement has been made, the fine print of the proposed changes to the existing FDI policy has...

Policy prescriptions to ignite FDI in defence production

The foreign direct investment (FDI) policy allows foreign original equipment manufacturers (FOEM) in the defence sector to acquire up to a 49% stake in Indian joint ventures (JV) under the automatic route and up...

Overcoming legal barriers to FDI in infrastructure

PERHAPS THE SINGLE biggest challenge to developing infrastructure in the Philippines is the decision made long ago to carve foreign direct investment (FDI) restrictions into the provisions of the Constitution itself, rather than retaining flexibility...

Retail FDI in India: restrictions and solutions

India’s policy on foreign direct investment permits such fund flows into the country under either the automatic or approval routes. Under the latter route prior approval from the Government of India is required for...

Ease of doing business: Uneasy reporting of FDI

The past couple of years have seen substantial reforms to further liberalize foreign direct investment (FDI) rules in India, in a bid to attract more foreign investment. While some sectors continue to have restrictions...

Minimum capital norms introduced for FDI entities

The Ministry of Finance in a press release dated 16 April introduced minimum capital norms for foreign investment in entities (unregistered or exempted) involved in other financial services, which are unregulated by financial sector...

Legal framework and advice for FDI in Iran

Foreign investors have polarized views on the investment environment in Iran. Some believe the country is so full of opportunities after the signing of the Joint Comprehensive plan of Action (JCPOA) that doing business...

Instruments and options available under FDI route

The past two to three years have been an exciting time to practise private equity law in India with the government heightening its focus on creating a more navigable terrain for foreign investors. Various...

FDI policy: What is needed to draw more investment?

Start-up India, Make in India and other ambitious government initiatives, coupled with a liberalized policy and legislative improvements in areas such as insolvency and taxation, have resulted in India rising to 100th on the...

India’s FDI climate good for China investment

India’s investment environment is friendly enough for Chinese investors with a little local knowledge and due diligence, a legal expert familiar the market said.

Mumbai-based fintech start-up Kissht recently raised US$10 million in funding primarily from Fosun International, a Chinese...

FDI Policy, 2017: Decoding ambiguities

One of the prime targets in policy making has always been attracting greater foreign investment into India. Accordingly, the country’s foreign direct investment (FDI) policy has been frequently amended, as and when required. On...

Processing of FDI proposals: What will the new era hold?

The government of India, through a notification dated 5 June, approved the proposal for phasing out of the Foreign Investment Promotion Board (FIPB). Pursuant to the proposal, the task of granting approval for foreign...

DIPP issues consolidated FDI policy

The Department of Industrial Policy and Promotion (DIPP) issued the Consolidated Foreign Direct Investment Policy Circular of 2017, effective from 28 August. The consolidated foreign direct investment (FDI) policy has made certain general changes...

Processing of FDI proposals standardized

The Department of Industrial Policy and Promotion (DIPP) of the Ministry of Commerce and Industry on 29 June issued a standard operating procedure (SOP) for processing foreign direct investment (FDI) proposals. The SOP sets...

Rules for FDI in limited liability partnerships clarified

The Reserve Bank of India has notified a scheme for foreign direct investment (FDI) in limited liability partnerships (LLPs) through an amendment to the Foreign Exchange Management (Transfer or Issue of Security by a...

Decoding the FDI policy liberalization in food retail

While agriculture employs almost half of India’s population, it contributes only about 14% to the nation’s GDP, resulting in low per capita income of the workforce engaged in the sector. And, while India produces...

Liberalization of FDI in financial services sector

Implementing the change announced in India’s budget for 2016-17, the Reserve Bank of India (RBI) on 9 September liberalized the norms for foreign direct investment (FDI) in the financial services sector. The effect is...

FDI policy amendments approved

On 31 August, India’s cabinet gave ex post facto approval for foreign direct investment (FDI) policy amendments announced by the government on 20 June. The cabinet stated that the amendments are intended to liberalize...

Negotiating joint ventures in FDI restricted sectors

The foreign direct investment (FDI) policy announced by the Department of Industrial Policy and Promotion regulates the extent of FDI permitted across various sectors in India. While due to progressive liberalization in the FDI...

FDI limits eased for asset reconstruction companies

On 6 May the Department of Industrial Policy and Promotion issued press note 4, allowing 100% foreign direct investment (FDI) in asset reconstruction companies (ARCs) under the automatic route. Under the earlier FDI policy, FDI...

DIPP releases guidelines for FDI in e-commerce

The Department of Industrial Policy and Promotion (DIPP) has released press note 3 (2016 series) in order to provide clarity on the existing policy. The press note sets out guidelines for foreign direct investment...

FDI permitted in LLPs under the automatic route

The RBI has amended schedule 9 of the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2000, modifying paragraph 4 to permit foreign direct investment (FDI) in...

Proposed changes to FDI controls under the budget

Up to 49% foreign direct investment will be allowed in the insurance and pension sectors under the automatic route subject to the extant guidelines on Indian management and control to be verified by...

The road ahead for FDI to meet India’s growth target

The prime minister, during “Make in India” week, urged investors to “seize the opportunity and invest” in India. The government’s drive to woo foreign direct investment (FDI) led to reforms in over 15 sectors...

Changes in forex compliance relating to FDI and ODI

On 28 February, the State Administration of Foreign Exchange (SAFE) issued the Notice on Further Simplifying and Improving Administrative Policies on the Direct Investment of Foreign Exchange (Forex Notice) and its complementary Guidelines for...

Details clarified for FDI in construction development

The Department of Industrial Policy and Promotion recently issued a clarification on Press Note No. 10 of 2014 pertaining to FDI in the construction development sector:

No new FDI can be brought in the...

FDI cap rises to 49% for insurance

On 12 March, the Rajya Sabha, India’s upper house of parliament, approved the Insurance Laws (Amendment) Bill, 2015, which will increase the cap on foreign direct investment (FDI) in the insurance sector from 26%...

Chinese FDI: new developments in regulation and approval

In line with the State Council’s requirements for further simplifying policies and delegating authority, the National Development and Reform Commission (NDRC), the Ministry of Commerce (MOFCOM) and the State Administration of Foreign Exchange (SAFE)...

A bitter pill: FDI curbs in pharma and hospital

Over the past decade, India’s pharmaceutical sector has seen one of the largest influxes of foreign investment and has outperformed amid the generally negative market sentiments. Since the pharma sector was liberalized in 2000,...

Revised FDI policy in defence: Cause for cheer

The percentage of foreign direct investment (FDI) to be allowed in the defence sector has long been a bone of contention among industry players with conflicting business interests. Focus on real consequences of increased...

Circular revises pricing guidelines for FDI

The pricing guidelines for the transfer or issue of shares and for exits from investments in equity shares with or without optionality clauses of listed and unlisted Indian companies have been revised to provide...

Warrants and partly paid shares can be used for FDI

A Reserve Bank of India (RBI) circular issued on 14 July provides that warrants and partly paid equity shares issued by an Indian company are now eligible instruments for the purpose of foreign direct...

Government liberalizing pattern for FDI reforms

The government of India is further liberalizing its foreign direct investment (FDI) policies in various sectors in an attempt to thwart what is being called a trend of “economic policy paralysis”. The measures are...

Winds of change: a look at some recent FDI reforms in India

On 1 August 2013, the Indian central government’s cabinet committee on economic affairs formally ratified the decision taken by the prime minister, on 16 July, to introduce the latest set of foreign direct investment...

DIPP clarifies FDI in multi-brand retail trading

On 6 June, the Department of Industrial Policy and Promotion (DIPP) issued a clarification on the provisions for multi-brand retail trading (MBRT) under the consolidated foreign direct investment (FDI) policy issued by the DIPP...

Supreme Court upholds FDI policy in multi-brand retail

Holding that “on matters affecting policy, this court does not interfere unless the policy is unconstitutional or contrary to the statutory provisions or arbitrary or irrational or in abuse of power”, the Supreme Court...

DIPP releases new consolidated FDI policy

The Department of Industrial Policy and Promotion (DIPP) has released a new consolidated foreign direct investment (FDI) policy via circular 1 of 2013, which came into force on 5 April. The new FDI policy...

India outbound FDI trends and recent developments

In today’s global environment, emerging market economies are playing a significant role in foreign investment around the world. Outward foreign direct investment (OFDI) is also a key aspect in the globalization of the Indian...

FDI in the defence sector: Should India allow more?

India’s global perspective, with its pioneering concepts and vision, has made it a lucrative market for foreign defence giants. In addition to being one of the fast developing economies, India has also focused on...

What are the M&A options for Chinese FDI in Switzerland?

In our previous columns we featured the advantages of Switzerland as a place for Chinese direct investments in Europe. This column gives an overview of the M&A options available to establish such investments.

As a...

Pharmaceutical area poses FDI conundrum in India

The pharmaceutical sector is one of the fastest growing sectors in India, with an estimated growth in production turnover from about ₹50 billion (US$925 million) in 1990 to over ₹1,000 billion in 2009-10. The...

FDI in aviation sector: Flying high or lying low?

On 3 January, Jet Airways issued a statement to stock exchanges confirming news reports that it was in talks with Abu Dhabi’s Etihad Airways for a potential investment. These discussions, it stated, had commenced...

Mall developers welcome FDI in multi-brand retail

The Indian government’s recent decision to allow foreign direct investment (FDI) up to 51% in multi-brand retail has been received with much optimism and some apprehension by the country’s real estate sector. Before we...

Paving the road ahead for FDI in real estate in India

With India’s policy makers emphasizing and working towards developing adequate infrastructure, the Indian real estate sector has turned out to be a large employment generator. Since the early 1990s, India has liberalized its foreign...

Will FDI in civil aviation end the sector’s troubles?

On 17 December 1903, the Wright Brothers made the first controlled and powered human flight and fulfilled mankind’s dream to fly, and in December 1912, with the first flight between Karachi and Delhi, the...

FDI limit raised to 100% for single-brand retailers

By a press note issued by the Department of Industrial Policy and Promotion on 10 January, the Indian government has raised the foreign direct investment (FDI) limit in single-brand retail trading companies to 100%...

FDI in retail: proposal, rollback and road ahead

In an ambitious move to respond to demands of the recent times, the Union cabinet on 25 November gave its approval to foreign direct investment (FDI) in multi-brand retail trading (MBRT) and increased the...

History provides clues to attack on options in FDI

The recent decision of the Department of Industrial Policy and Promotion (DIPP) to classify all equity shares with in-built options or supported by options sold by third parties to non-resident investors as debt, and...

FDI in retail could spur M&A and Indian markets

The Indian government suffered a political setback in early December when it was forced to shelve its proposal to further liberalize foreign direct investment (FDI) in India’s retail sector. The cabinet of the Congress...

Further FDI policy easing needed to promote LLPs

The recent introduction of foreign direct investment in limited liability partnerships (LLPs) has finally ended the debate initiated in 2009, when this relatively novel concept was introduced in India. LLPs are a hybrid form...

DIPP removes bar on options in FDI policy

The Department of Industrial Policy and Promotion (DIPP) has deleted clause 3.3.2.1 of the foreign direct investment (FDI) policy relating to equity securities with built-in options. The clause was introduced on 30 September.

Clause had...

DIPP unveils revised FDI policy

The Department of Industrial Policy and Promotion (DIPP) has released its revised consolidated foreign direct investment (FDI) policy (circular 2 of 2011). The new FDI policy, effective from 1 October, supersedes the previous version...

Rationalizing FDI policy: review of sectoral caps

The Department of Industrial Policy and Promotion (DIPP) of India’s Ministry of Commerce and Industry recently issued a discussion paper on the relevance of sectoral caps for inbound investment. As a result of these...

FDI in LLPs: an unchartered voyage

In 2009, in an important step that gave enterprises the flexibility to combine the features of a partnership with that of a limited liability company, the government of India enabled the creation of limited...

FDI and convertible instruments: trial and error

The foreign direct investment (FDI) regime relating to convertible instruments has been the changed several times over the years. This almost gives the impression that the regulators are relying on trial and error to...

FDI in limited liability partnerships

The Department of Industrial Policy and Promotion (DIPP) has released Press Note 1 (2011 Series) (Press Note 1) allowing foreign direct investment (FDI) in limited liability partnerships (LLPs). Press Note 1 modifies circular 1...

The new FDI policy: signs of progressive liberalization

The eagerly awaited new consolidated FDI policy was released by the Department of Industrial Policy & Promotion (DIPP) on 31 March. We round up the major highlights of this document, which is commonly known...

Consolidated FDI policy: easing investments in India

On 31 March, the Department of Industrial Policy & Promotion (DIPP), Ministry of Commerce & Industry, issued circular 1 of 2011. It reflects the policy framework on foreign direct investment (FDI) in India as...

New circular clarifies FDI guidelines

On 1 October, the Department of Industrial Policy and Promotion issued a new circular on foreign direct investment (FDI) policy. Circular 2 of 2010 clarifies the following points:

The manufacturing of “cigars, cheroots, cigarillos...

Consolidated FDI policy – introducing changes

On 31 March, the Department of Industrial Policy and Promotion (DIPP) issued circular 1 of 2010 to consolidate all policy on foreign direct investment (FDI). This includes policy contained in the Foreign Exchange Management...

Tobacco’s FDI plans go up in smoke

The Ministry of Commerce’s Department of Industrial Policy & Promotion has revised its foreign investment policy to impose a blanket ban on foreign direct investment (FDI) in the manufacture of cigars and cigarettes.

Prior to...

Consolidated FDI policy: A welcome move

On 31 March the Department of Industrial Policy and Promotion (DIPP) of the Ministry of Commerce and Industry issued a consolidated foreign direct investment (FDI) policy circular. It became effective on 1 April and...

Master Press Note could clarify India’s FDI policy

While most of the world was preparing for the holiday season, the Department of Industrial Policy and Promotion (DIPP), without much notice and publicity, released a draft Master Press Note on foreign direct investment...

FIPB has no objection to FDI from Mauritius

According to a report in the Business Standard dated 7 November the Foreign Investment Promotion Board (FIPB) has pulled up the Department of Revenue for rejecting foreign direct investment (FDI) proposals routed through Mauritius...

FDI in real estate: rules need further clarification

In India, foreign direct investment (FDI) of up to 100% is permitted under the automatic route in township, housing and construction projects, subject to certain conditions in the Department of Industrial Policy and Promotion’s...

New FDI policies create confusion in retail industry

India has so far not allowed any foreign direct investment (FDI) in the multi-brand retail industry, due to internal political opposition to the entry of multinational retail giants. Voices both within and outside government...

FDI in print media promises readers more variety

The Indian press is undergoing continued liberalization following the government’s decision in 2002 to allow foreign direct investment (FDI) in print media. The decision to permit 26% FDI came with several conditions aimed at...

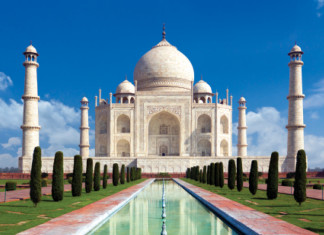

A passage to India: Tourism boosted by FDI

Economic liberalization has given new impetus to the hospitality industry with the Government of India permitting 100% foreign direct investment (FDI) in hotels and the tourism sector under the automatic route.

FDI and technical collaboration...

Rationalizing FDI policy for petroleum and gas

The Indian oil and gas sector is one of India’s core industries and has a very significant contribution towards the country’s economy. In the recent past, it has been observed that the consumption of...

Rationalizing FDI policy for petroleum and gas

The Indian oil and gas sector is one of India’s core industries and has a very significant contribution towards the country’s economy. In the recent past, it has been observed that the consumption of...

FDI limits relaxed to boost aviation investment

Civil aviation is one of the fastest-growing sectors in India’s transport industry; its domestic market alone saw dramatic growth, with a 25% increase in the number of flights scheduled in May 2007 compared to...

FDI route facilitates more real estate investment

India can be acknowledged as one of the fastest growing economies in the world and real estate has emerged as one of the most appealing investment areas for domestic as well as foreign investors.

This...

FDI cleared to climb to new heights

The latest reforms to India’s foreign investment regulations are significant because they tackle sensitive sectors that the government has previously been reluctant to liberalize. But concerns persist over the scope of the changes and...

Cautious moves towards greater FDI in retail

The retail sector in India is highly fragmented and organized retail in the country is at a nascent stage. Recently, however, it has emerged from the shadows and become one of the most talked-about...

Influx of FDI could drive real estate market

In recent years, the government has moved to promote the use of public private sector partnerships in building the country’s infrastructure and liberalize foreign direct investment (FDI) in real estate.

FDI up to 100% is...

ACC Singapore explores India’s legal landscape

The Association of Corporate Counsel (ACC) Singapore and Khaitan & Co hosted a lunch seminar themed “Essential Legal and Regulatory Insights: Navigating Indian Matters for Singapore-Based In-House Counsel” on 20 March.

The event at Altro...

Roadmap for a superhighway

Mukul Shastry details how India’s state and central governments can plug the legal and regulatory gaps holding back the nation’s massive infrastructure sector

Human civilisation has been in existence for at least 5,000 years. During...

Japan outbound investment guide

Japan experienced a significant 76% jump in foreign direct investment (FDI) outflow in the first nine months of 2023, against the same period in 2022. It became the top Asian creditor nation in 2023.

This...

Zhu Wangying > Jingtian & Gongcheng > Beijing > Lawyer Profile 2024

The Rising Star (PRC Law)

Zhu Wangying

Partner

Jingtian & Gongcheng

Beijing

Tel: +86 10 5809 1121

Email: zhu.wangying@jingtian.com

Practice areas

Capital markets; Investment & financing; Private equity, venture capital & funds; Technology, media and telecommunications

Introduction

Zhu Wangying graduated from Beijing Normal University...

Fintech goes mainstream through new incentive scheme

The fintech sector in India has become a global leader. It has built the largest ecosystem and enjoyed the fastest growth. By 2025, its valuation will hit USD150 billion-USD160 billion, making the country a...

Barriers to investing in the nuclear sector

Following the grant of the Nuclear Suppliers Group waiver in 2008, India divided its nuclear operations into military and civilian facilities. While nuclear power has civilian uses such as energy supply, civilian participation in...

The flourishing India and Japan business partnerships

In a world of shifting trade allegiances, the business alliance between India and Japan testifies to longevity, stability and shared ambitions. The ever-deepening ties between the two Asian powerhouses are built on common aims...

Building an infrastructure superhighway

Mukul Shastry details how state and central governments can plug the legal and regulatory gaps holding back the infrastructure sector

Human civilisation has been in existence for at least 5,000 years. During much of those...

Tuan Anh Nguyen > Bizconsult Law Firm > Vietnam Top Lawyers 2023

Vietnam Top Lawyers 2023

Tuan Anh Nguyen

Bizconsult Law Firm

Tel: +84 90 340 4242

Email: tuanna@bizconsult.vn

Practice areas

Corporate & commercial; IP; licensing & franchising; M&A; real estate

Introduction

Mr. Tuan is one of two founders of Bizconsult Law Firm,...

Anh Dang > VILAF > Vietnam Top Lawyers 2023

Vietnam Top Lawyers 2023

Anh Dang

VILAF

Tel: +84 912 518 818

Email: anh@vilaf.com.vn

Practice areas

Corporate/M&A; infrastructure & energy; project finance; real estate & property; mining, FDI

Introduction

Senior partner Anh Dang has been a partner at VILAF since 2004...

Cross-border tax sole benefit still a good object

Foreign Direct Investment (FDI) in India has greatly increased in the past decade, particularly after the pandemic. This has led to more cross-border transactions in which foreign investors transfer their company holdings as a...

MSME sector not so small for Korean businesses

India’s economy is growing rapidly, with GDP expected to grow by 6% year-on-year. The Micro, Small and Medium Enterprises (MSME) sector contributes significantly to GDP and is crucial to its overall increase.

The MSMEs are...

Turbulence at Lumiere as exodus of legal talent continues

Tough times are continuing at Lumiere Law as three partners, along with their teams, leave to join DMD Advocates, while partner Dhruv Gupta heads to Trilegal.

Vihang Virkar, Monika Deshmukh and Ayesha Rai, along with...

Daizy Chawla > S&A Law Offices > New Delhi > India Top Lawyers 2023-24

The India A-List 2023-2024

Daizy Chawla

S&A Law Offices

New Delhi

Tel: +91-11-46667000

Email: daizy@sandalawoffices.com

Practice areas

Corporate & commercial; IP; labour & employment; restructuring & insolvency

Introduction

Daizy Chawla heads the Intellectual Property Practice Group and Corporate and Tax Practice Group....

Bob Mo > King & Wood Mallesons > Guangzhou > Lawyer profile 2023

The Visionaries (PRC Law)

Bob Mo

Managing Partner of Corporate Department (South China)

King & Wood Mallesons

Guangzhou

Tel: +86 20 3819 1088

Email: mohaibo@cn.kwm.com

Practice areas

Banking & finance; Capital markets; Cross-border investment; M&A

Introduction

Bob Mo joined King & Wood Mallesons (KWM)...

Feng Yao > Sunland Law Firm > Beijing > Lawyer profile 2023

The Visionaries (PRC Law)

Feng Yao

Special Counsel

Sunland Law Firm

Beijing

Tel: +86 10 6595 8667

Email: yao_feng@sunlandlaw.com

Practice areas

Antitrust & competition; Foreign direct investment; International trade & bilateral investment treaties

Introduction

Feng Yao worked in the Department of Treaty and Law...

Foreign direct investment in Jammu and Kashmir

In the early 1990s India began to attract foreign direct investment (FDI) through economic liberalisation. A large and growing domestic market, favourable demographics, consistent growth, liberalised policies and improved ease of doing business combined...

A regional comparison of real estate markets

What developments are affecting the property sector in often volatile regional markets?

CHINA

INDIA

JAPAN

MALAYSIA

CHINA

China’s real estate market has experienced a continual downward trend since 2022, with investment and sales significantly decreased. The land premium rate is...

LEP strengthens long-term ties with Malaysia

2023 marks the 40th anniversary of Malaysia’s co-operation with South Korea since adopting its Look East Policy (LEP). The enduring relationship saw bilateral trade reaching MYR114.55 billion (USD26 billion) last year, which Malaysia aims...