Cravath, Swaine & Moore and Cyril Amarchand Mangaldas have advised Tata Technologies on its INR30.4 billion (USD366 million) initial public offering.

Partners Yash J Ashar and Devaki Mankad led the CAM team advising on India legal matters for Tata Technologies. Principal associate designate Rushab Dhandokia, senior associate Chinar Gupta, as well as associates Ayana Banerjee, Neel Mehta and Arikta Shetty supported the team.

Cravath was international counsel for Tata Technologies with partner Philip J Boeckman leading the team. Associates Nadia Odai-Afotey, Wonnie Song Hall and Nathaniel Hatter advised on capital market matters. Partner Andrew Davis with associates Carlos Nicholas Obando and William Swisher worked on tax issues.

Singapore partner Rajiv Gupta, with associates Esha Goel and Isabel Yu led the Latham & Watkins team assisting the book running lead managers, JM Financial, Citigroup Global Markets India and BofA Securities India.

S&R Associates represented JM Financial, Citigroup and BofA Securities in the IPO. Partners Sandip Bhagat and Jabarati Chandra led the team, with support from associates Mohnish Mathew, Durga Prasad Mohapatra, Mohit Kumar and Sudipta Choudhury.

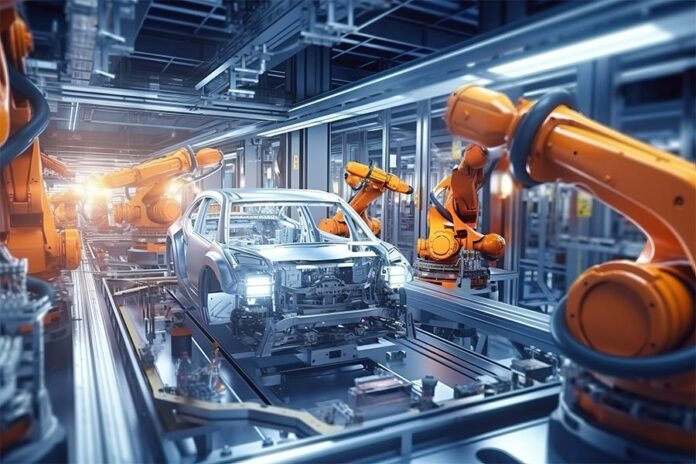

Tata Technologies specialises in engineering and technology services for the automotive, aerospace and heavy machinery sectors. It is the first IPO from the Tata group in almost two decades.