As property prices in the UK have fallen, Chinese investors are well placed to profit from cheaper prices. Traditionally, wealthy Chinese buyers have bought properties in London, especially properties near universities for their sons or daughters to live in while studying in the city. In recent months, however, the trend has shifted to buying purely for investment purposes.

Partner

Moore Stephens

According to Knight Frank, an estate agent, people from Hong Kong and the Chinese mainland are now the biggest overseas buyers of central London new-build property, accounting for one in 10 of all new purchases.

Adding to the attractiveness of buying in the UK is the weaker pound. Falls in the value of sterling effectively mean a 30% price reduction for a Chinese buyer, and with yields of around 4% to 5% many are looking to build property portfolios.

Affluent Chinese buyers are looking hard at new properties around London’s former wharves and docks. One real estate agency reported that 30% of buyers at its Canary Wharf offices have been Chinese, mainly looking for two bedroom flats at prices of up to around £600,000 (US$945,000). In addition, fashionable areas such as Mayfair and Knightsbridge are now attracting buyers at the higher end of the market.

Chinese buyers are also looking beyond the centre of London in the home counties: affluent areas around London including Surrey, Buckinghamshire and Kent.

The role of a Jersey company

A considerable amount of UK commercial and residential real estate is owned through Jersey companies by non-UK residents and non-UK domiciled individuals. Why is this and what are the benefits?

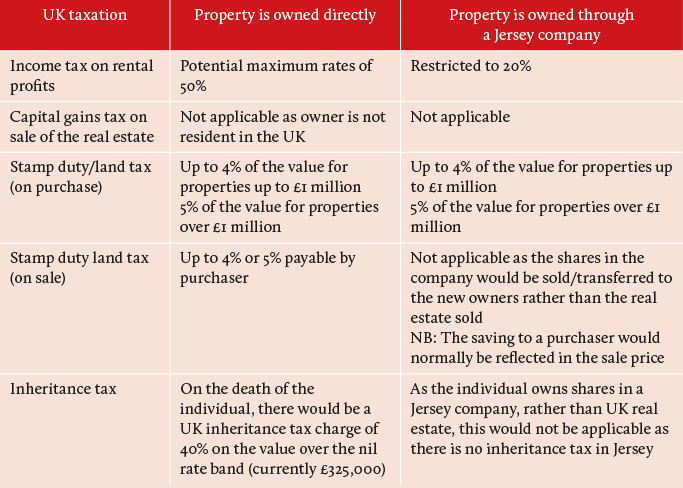

The tax implications of whether to buy direct or through a Jersey company are significant:

If UK real estate is leased, further UK taxation savings can be achieved through appropriate loan arrangements as the interest on the loan can be wholly deductible when determining the taxable profit subject to UK income tax. The Jersey company can apply to receive gross rental payments under the UK’s Non-Resident Landlord’s scheme, giving a cash flow advantage.

There will be no taxes (that is, no income tax, capital gains tax, stamp duty or inheritance tax) payable in Jersey.

As ownership of UK real estate and the associated tax implications will be different for each individual, it is important that appropriate professional advice is taken at the earliest possible stage.

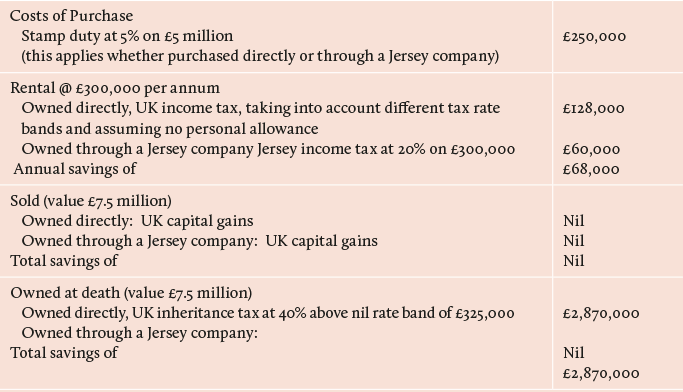

Case study

The following case study table covers real estate purchased in the UK for £5 million that is let for £300,000 per annum. The value of the property increases to £7.5 million and is either sold or still owned by the individual on death.

Kathy Gillen is a partner at Moore Stephens, an international accounting firm, in Jersey

Peter Street

St Helier

Jersey

JE2 4SP

Tel: +44 (0) 1534 880088

Fax: +44 (0) 1534 880099

E-mail:

kathy.gillen@moorestephens-jersey.com

www.moorestephens-jersey.com