Amazon isn’t smiling about the proposed Reliance-Future deal, arguing that it will call into question the enforcement of contracts in India. Freny Patel finds out whether its arguments hold water

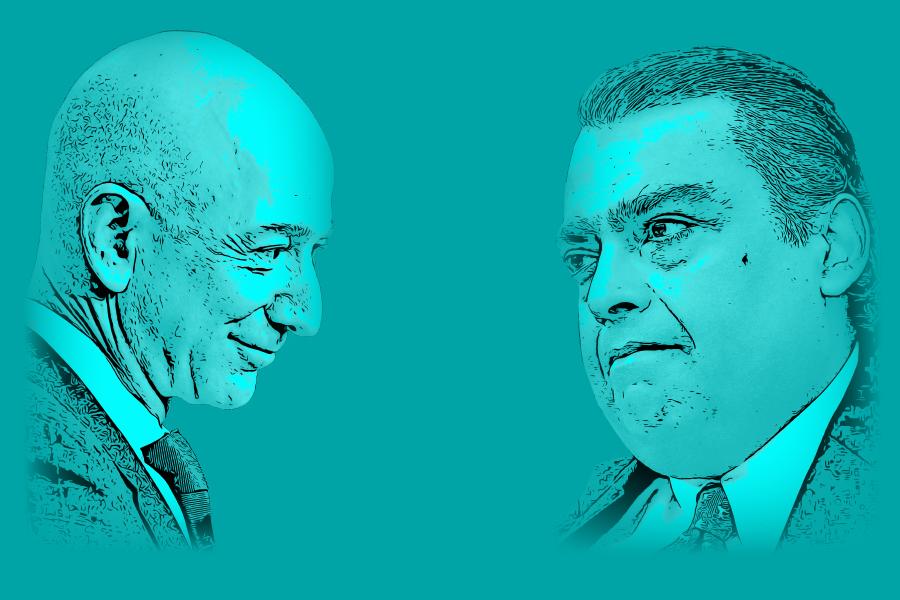

The world’s richest man, Jeff Bezos, and Asia’s richest man, Mukesh Ambani, are locked in a bitter legal battle that will eventually decide the future of India’s biggest brick-and-mortar owner, Kishore Biyani, whose retail business is heavily in debt.

The fate of Reliance Industries’ US$3.4 billion acquisition of Biyani’s Future Retail – which operates more than 1,500 stores, including 290 budget outlets and the Big Bazaar retail chain in the country – will be decided largely by the courts in New Delhi.

The Jeff Bezos-led US giant, Amazon, had won an emergency award from the Singapore International Arbitration Centre (SIAC) to temporarily restrain the sale of Future Retail to Reliance Industries, owned by Ambani. However, the parties paid little heed to the SIAC ruling and statutory authorities in India gave the multibillion-dollar transaction a clean chit.

In another twist to the ongoing feud, Amazon responded by petitioning Delhi High Court to jail Kishore Biyani (chairman of Future Group) and seize the assets of the cash-strapped Future Retail for disobeying SIAC’s ruling.

“The scramble to try and enforce the order of the emergency arbitrator through Delhi High Court comes in the wake of the SIAC having constituted the final arbitral tribunal,” says Ajay Thomas, independent arbitrator and member of the International Chamber of Commerce (ICC) Commission on Arbitration and Alternative Dispute Resolution in New Delhi. “As upon application, the parties would have the opportunity to revisit the order.”

The emergency arbitrator would have no powers to act after the tribunal is constituted and the body could reconsider, modify or vacate an interim order issued by the emergency arbitrator as per SIAC rules. The interim order of the emergency arbitrator, which was valid until 23 January, has been extended pending further modification by the constituted tribunal.

“There was an award and one expects it to be abided by,” says Percival Billimoria, counsel and head of chambers at Chambers of PS Billimoria in New Delhi. “As the parties took steps to proceed, despite the Delhi High Court ruling recognizing the award of an emergency arbitrator, it means Future Group wants to close the deal. Hence the only possible consequence would be claiming damages.”

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.