Leading nickel producer and trader Lygend Resources & Technology sold its shares at HKD15.8 apiece to raise HKD3.67 billion (USD470 million) in a Hong Kong IPO.

Around 60% of the capital was from five cornerstone investors including CATL, the world’s largest electric vehicle battery maker and supplier, and Chinese leading battery recycling company GEM.

More than 60% of proceeds will be used for nickel production projects in two of Lygend’s Indonesian joint ventures.

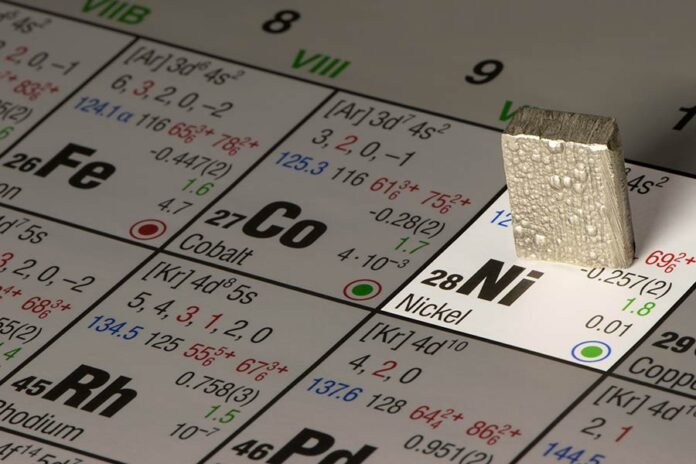

The company said it was the world’s largest nickel products trader in 2021.

Cleary Gottlieb Steen & Hamilton advised Lygend on Hong Kong and US law, while T&C Law Firm and Imran Muntaz & Co advised on PRC and Indonesia law, respectively.

As for the joint sponsors and underwriters CICC and CMB International Capital, Commerce & Finance Law Offices acted as PRC counsel, Herbert Smith Freehills acted as Hong Kong and US counsel, and its associate law firm Hiswara Bunjamin & Tandjung acted as Indonesia counsel.

The T&C team was led by managing partner Lu Chonghua, head of Ningbo office and partner Cheng Hui, and partner Zhao Yan.

The Herbert Smith Freehills team was led by Jason Sung, partner and head of M&A, Asia. Partner Kong Jin also supported the team.