To regulate information disclosures on acquisitions and restructurings of listed companies, the Standards for the Substance and Format of Information Disclosures by Companies that Issue Securities to the Public, No 26: Material Asset Restructurings of Listed Companies (Standards No 26) issued by the China Securities Regulatory Commission sets forth express provisions, such as basic information on the subject matter of a transaction and equity details (Article 16 of Standards No. 26), the main business relating to the subject matter of the transaction (Article 21 of Standards No 26), etc.

Salary Partner

Grandway Law Offices

Provisions on exemptions from information disclosure relating to subject matter of transactions. Article 4 of Standards No.26 specifies that, “where the disclosure or provision of certain information or documents specified herein is genuinely inconvenient due to such special reasons as the same involving state secrets or trade secrets (e.g., confidential information on core technology, specific provisions of commercial contracts, etc.), a listed company may opt not to disclose or provide the same, but shall explain in detail in the relevant sections the reason for not disclosing or providing the same in accordance with the requirements hereof. If the CSRC deems the disclosure or provision thereof necessary, the listed company shall disclose or provide the same.”

The rules of the Shenzhen Stock Exchange for the listing of stocks specify that “where information that a listed company proposes to disclose constitutes a state secret or trade secrets, or another circumstance recognized by the stock exchange applies thereto and disclosure or performance of the related obligations pursuant hereto could result in the listed company violating state laws or administrative regulations on confidentiality or harming its own interests, it may apply to the stock exchange for an exemption from disclosure or performance of related obligations in accordance herewith”.

Circumstances for determining if subject company involves state secrets and exemption from disclosure of such information. Article 6 of the Law of the People’s Republic of China on the Maintenance of State Secrets (Confidentiality Law) specifies that “a state authority or an entity that involves state secrets (hereinafter Authority and Entity) shall manage its own confidentiality work. The Authority shall, within its purview, manage or guide the confidentiality work in its hierarchy”. Article 26 of the Implementing Regulations for the Law of the PRC on the maintenance of state Secrets (Confidentiality Regulations) specifies that: “If an Authority or Entity procures works, goods or services that involve trade secrets, it shall determine the level of confidentiality in accordance with state confidentiality regulations and comply with state confidentiality regulations and standards.”

Given the express provisions of the abovementioned, Standards No.26 on information disclosures relating to the restructuring of subject companies, if relevant information of a subject company involves state secrets, the relevant competent authority overseeing the subject company needs to issue, pursuant to relevant provisions of the Confidentiality Law and the Confidentiality Regulations, a document determining that the subject company involves information related to state secrets and agree to exempt it from disclosing the relevant information, following which the listed company will submit an application to the exchange for an exemption from information disclosure.

Relevant cases

Based on the explanation of Baotou Beifang Chuangye disclosing its response to the feedback opinion notice from the CSRC, Beifang Chuangye “carried out its disclosure by scrubbing the confidential information, and for information from which confidential information could not be scrubbed or in respect of which there remained a risk of secrets being leaked even after scrubbing, it secured an exemption from disclosing the same after obtaining an official reply and the consent of the State Administration for Science, Technology and Industry for National Defence”. Furthermore, in Section 4, Basic Particulars of the Subject Assets, of the restructuring report, it completed narration of the content of the relevant sections through a generalized disclosure and exemption from disclosure.

Article 2 of Standards No.26 specifies that, “when a listed company carries out an asset transaction act that requires the making of an application to the CSRC for administrative permission, it shall additionally prepare and submit its application documents in accordance with the requirements hereof. If a listed company fails to prepare or submit its application documents in accordance with the requirements hereof, the CSRC may refuse to accept the same or demand it prepare and submit the same again”.

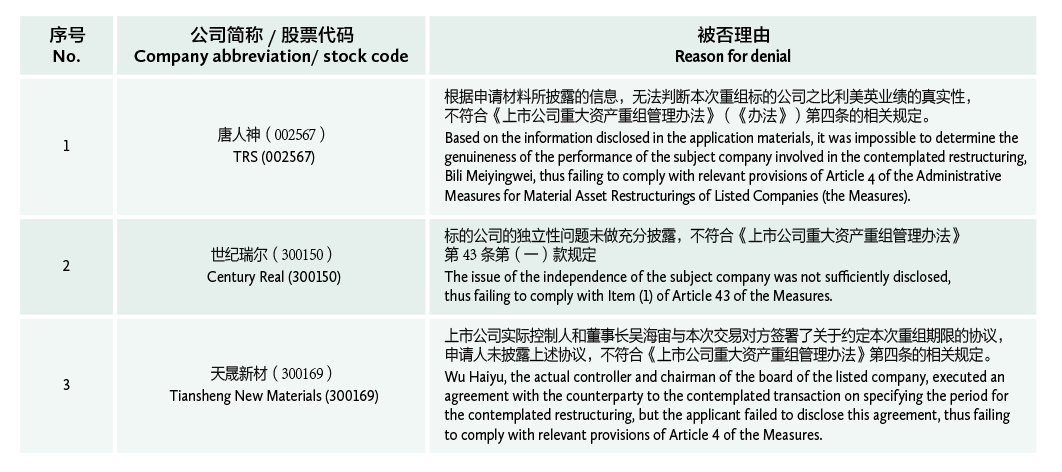

Based on publicly available cases, where an exemption from the disclosure of information has not been secured, if there is a defect in the information disclosure it could give rise to the risk of the restructuring plan not passing review by the Listed Company Merger and Restructuring Review Committee of the CSRC. The specifics of relevant cases are shown in the table above.

Tang Shi is a salary partner at Grandway Law Offices

7/F, Beijing News Plaza

No. 26 Jianguomennei Dajie

Beijing 100005, China

Tel: +86 10 8800 4488 / 6609 0088

Fax: +86 10 6609 0016

E-mail:

tangshi@grandwaylaw.com