Chinese law firms reveal their fees in our exclusive billing rates survey, shedding light on how reduced corporate budgets have affected the cost of legal services. Luna Jin reports

China’s highly competitive legal sector remains a buyer’s market. On the one hand, more than 50,000 people have been licensed to practise law every year since 2018, according to the Ministry of Justice. On the other, in-house counsel are growing in competence, even as their teams grow in size. This gives companies strong bargaining power during legal procurement.

To control costs, more companies are adopting reverse auctions to pick their legal providers. In turn, some law firms are making every effort to win bids at ever lower prices, while some are choosing to stay out of the race, believing that below-cost offers are market killers in the long run and, more importantly, irresponsible to their clients.

In contrast, some companies do not see low prices as the most important consideration when seeking legal services, and are willing to pay a price that actually matches the quality of service.

This is the fourth year that China Business Law Journal has conducted its billing rates survey. By presenting an overall picture of the country’s legal fee structure, we are encouraging more law firms to be transparent with their legal services, thus helping them build trusting relationships with their clients for the ultimate benefit of the wider market.

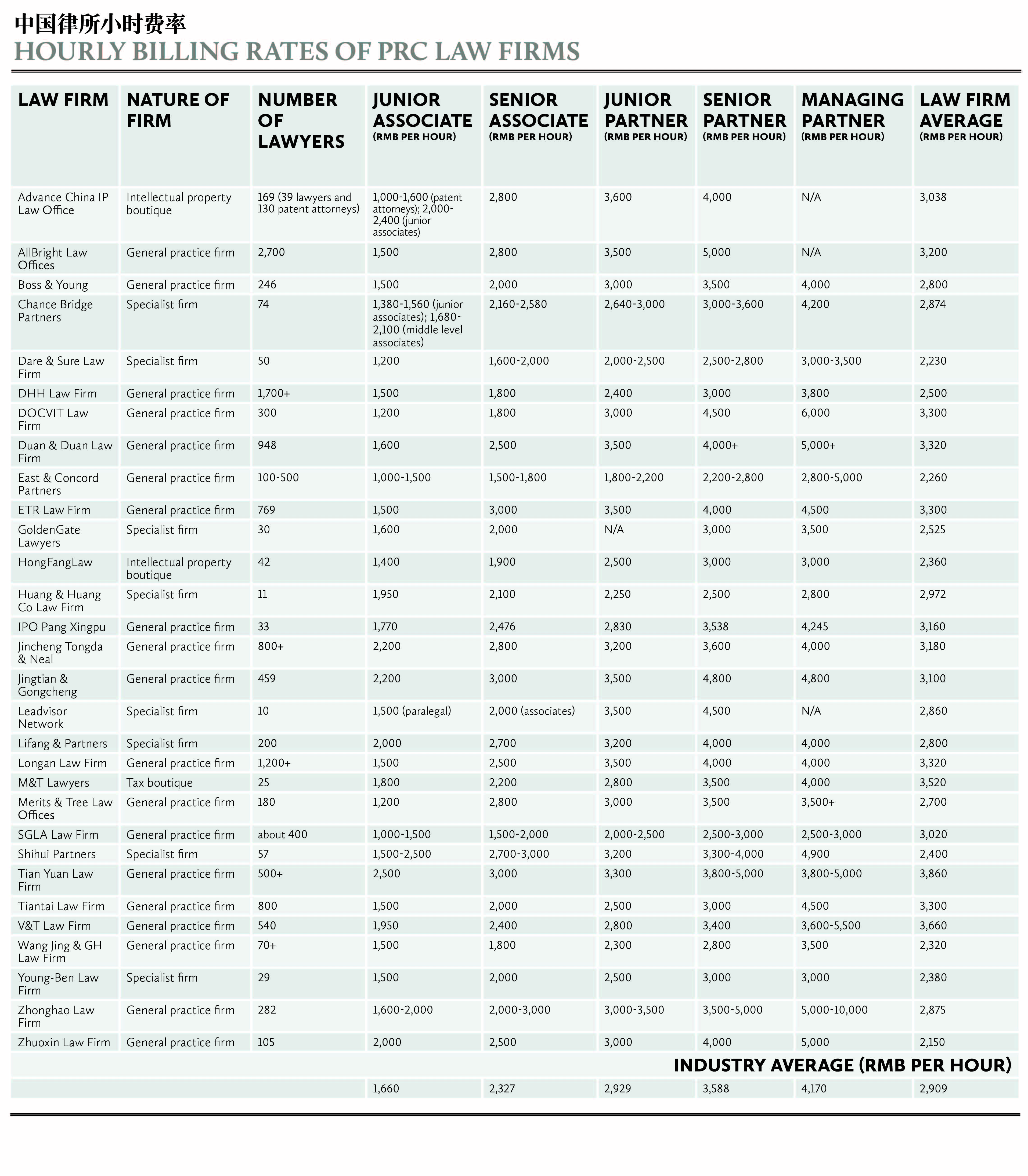

Our survey offers a nap shot of legal billing trends in China’s vast legal market. The size and practice areas of the firms surveyed are varied, ranging from firms with 10 lawyers to those with thousands.

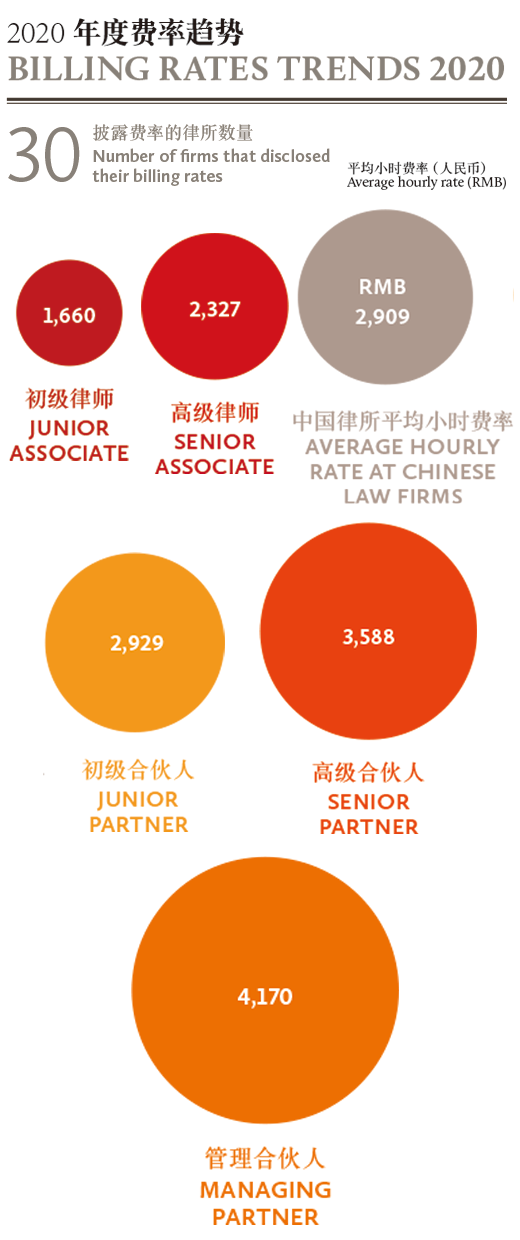

A total of 30 law firms participated in this year’s survey. The firms surveyed range from niche outfits to full-service operations, and all are from Beijing, Shanghai and Guangzhou, the most active legal markets in the country.

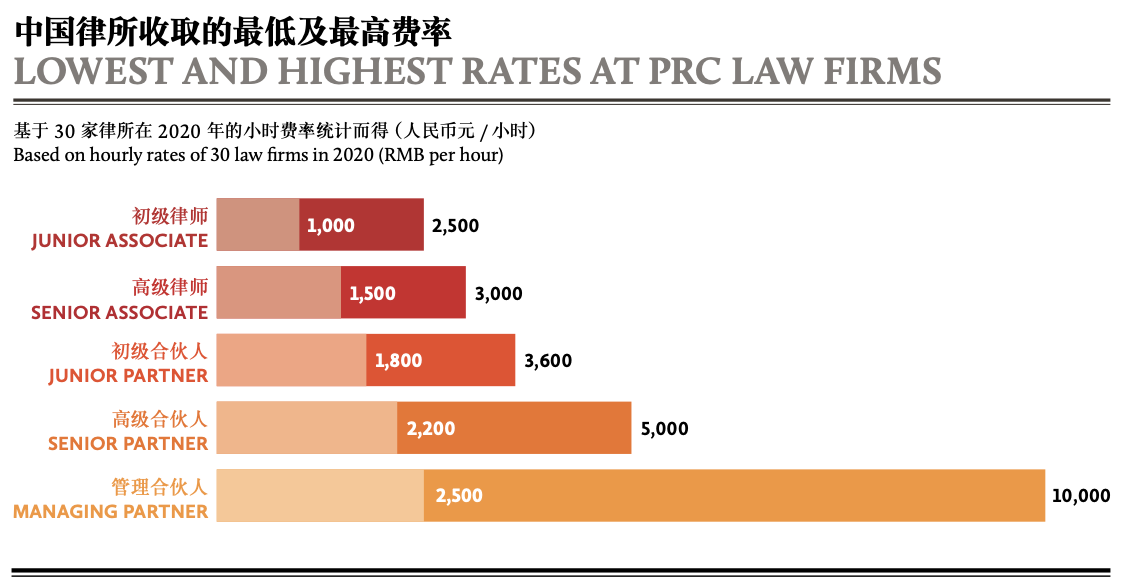

Each firm has revealed their hourly rates for junior associates, senior associates, junior partners, senior partners and managing partners, as well as the percentage of legal work billed by hourly rates. A series of infographics are interspersed throughout this article to help present our findings clearly.

The average hourly rate of the Chinese firms surveyed was RMB2,909 (US$445) in 2020, with a wide gap among firms’ legal service fees and a marked difference in the fees charged by lawyers of different seniority within firms. Hourly rates for junior lawyers ranged from as low as RMB1,200 to as high as RMB10,000 for more senior partners.

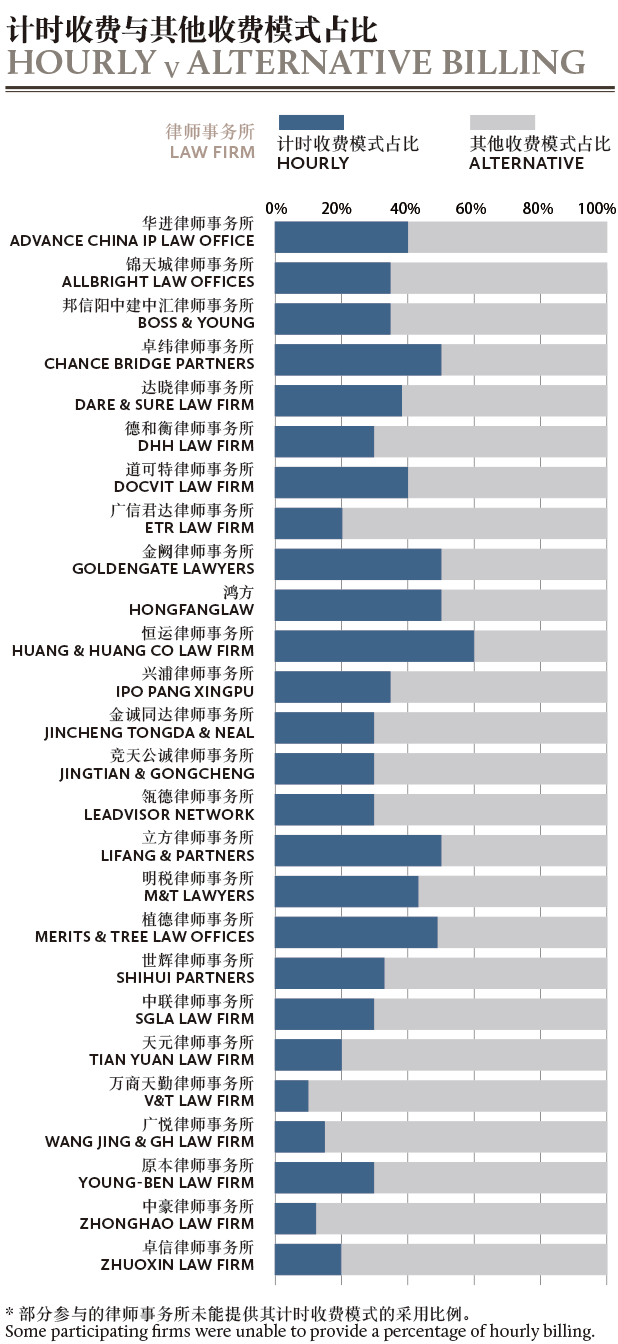

It should be noted that hourly billing is not the dominant fee model in the China market, and there are a variety of alternatives adopted by the firms surveyed. For the majority of firms participating, the percentage of legal work billed by hourly rate is not more than 50%.

Compared to domestic clients, foreign clients are more receptive to hourly billing. Paul Zhou, the Shanghai-based managing partner of SGLA Law Firm, says: “About 70% to 80% of foreign clients are charged by the hour, while merely 20% to 30% of domestic clients are charged in this way.”

Control, Flexibility, Certainty

Many firms offer flexible billing options, and alternatives include fixed fees (i.e., lump sums by assignment or project), phase-by-phase fees, contingency fees, project commissions (in proportion to the amount of the subject of mandate), and capped fees.

Depending on the nature of the case, the billing arrangement often varies. Li Jingjue, legal director of Huayi Brothers, says that non-litigation services such as consultancy and negotiation on ordinary transactions, as well as the drawing up and revision of papers, are often charged by the hour.

Huang Hui, managing partner at Huang & Huang Co Law Firm in Guangzhou, notes that in the maritime, insurance and aviation sectors, cases are usually billed by the hour.

Different fee models are also adopted in combination. Wang Jing, managing partner at Wang Jing & GH Law Firm in Guangzhou, says at times, and when the case allows, “they cap our time basis professional fees and charge a contingency fee on civil litigations and arbitrations”.

Wang says this mixed professional fee charging arrangement “allows us to share, to some degree, with our clients the risks and benefits of a litigation’s outcome”.

For some civil litigation cases, Zhonghao Law Firm adopts a semi-contingency billing model, i.e., the client pays the basic fee first, and then pays a certain amount depending on the stage reached in the proceedings.

“The advantage of a semi-contingency billing model is that it can fully motivate the client and the lawyer to achieve a good outcome for the case, while also reducing the burden of upfront payment for the client,” says Robin Yuan, Zhonghao’s chairman in Chongqing.

Another common charging arrangement is “fixed fee + excess hourly rate”, where the firm and the client agree on a maximum number of hours and, if exceeded, the excess is billed by the hour. Companies are more willing to accept this combination of billing models when it comes to large transactions.

“This is because the workload is closely linked to the negotiation process, which is an uncontrollable variable affected by multiple factors,” says Li, of Huayi.

At the outset of a large transaction, corporate clients need to have a relatively precise budget amount in mind when making cost estimates. “This integrated billing arrangement eliminates the worries of us clients, and instead allows for closer and more efficient communication and collaboration with the external team,” says Li.

Andrew Zhang, a Beijing-based partner at Commerce & Finance Law Offices, says the revised fixed-fee model “allows firms to allocate manpower more appropriately to better serve clients, meeting their requirements on controllability of fees and quality of service”.

Specifically, the allocation of manpower, when reflected in large projects, means that the proportion of lawyers at different levels of seniority will be adjusted according to the client’s budget, in order to meet their different demands and to match the urgency of achieving their objectives.

The fee model is also related to the size of the law firms. According to Guan Rui, the general manager of group affairs department at New Oriental Education and Technology Group, the above-mentioned “fixed fee + excess hourly rate” model is commonly found in foreign firms or top-tier Chinese firms, while small and medium-sized local firms are more likely to adopt a fixed-fee model.

Bianka Bian, vice president and general counsel of Nestle (China), says that the application of hourly billing is limited, and may only be adopted by larger law firms in the process of advising foreign enterprises or large companies in first and second-tier cities, while in third and fourth-tier cities, or small and medium-sized law firms, the fixed-fee model dominates.

Hourly billing is also not as well accepted in state-owned enterprises (SOEs). Cui Ruijie, general counsel of China State Shipbuilding Corporation (CSSC), explains that SOEs generally have stricter rules and regulations for the use of intermediaries such as law firms, where approval for budgets is a requirement. Therefore, legal work billed by projects or cases are more common, which is results-oriented with a capped fee.

“If billable hours are up, yet the actual outcome is not good, SOEs would be dissatisfied with such a charging arrangement and it would be difficult for decision-makers to fathom,” says Cui.

Pandemic hits rates

The pandemic undoubtedly was the most significant variable for companies when negotiating their billing arrangements last year. It not only disrupted economic activities and sliced the revenue of many businesses, but it also created extra legal matters as the flux in budget and workload put a strain on many in-house counsel.

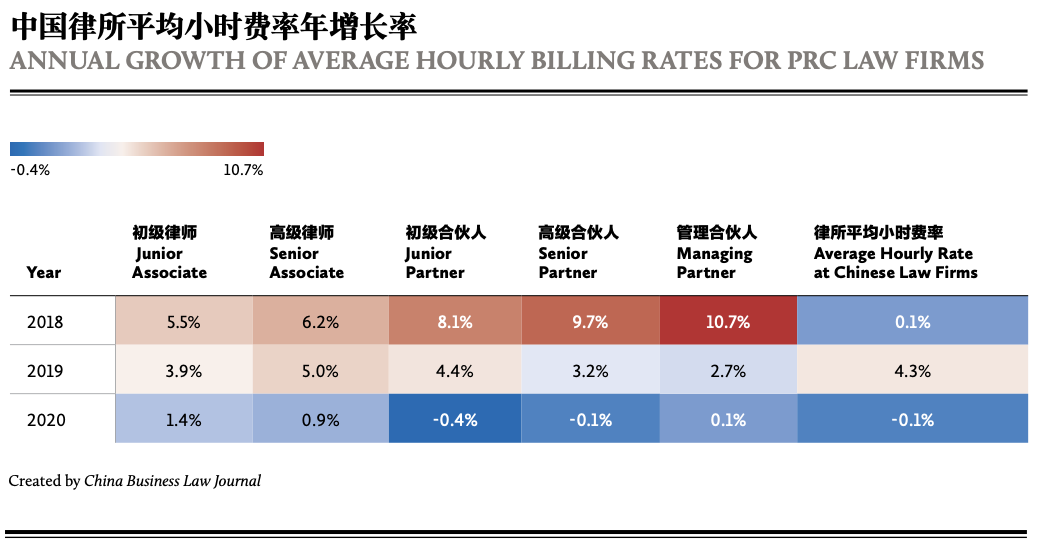

Looking back, since our first survey in 2017, the average hourly rate has generally risen year-on-year in the past four years, with a greater increase in 2018 and 2019, including a 10.7% increase in the average hourly rate for managing partners in 2018.

However, last year witnessed an abrupt slowdown in the average hourly rate, with all average hourly rates for different seniorities almost unchanged compared to 2019. Among these, the average hourly rate for junior partners actually fell by 0.4%.

Compared to last year, five law firms surveyed showed a decrease in the percentage of legal work billed by hourly rates. “This year, due to the pandemic, there is an increase in clients accepting fixed fees for budget considerations,” says Lin Wei, the Beijing-based managing partner at Dare & Sure Law Firm.

Lin estimates that in 2021, the model and trend of billing arrangements will remain the same for law firms, “as there is still uncertainty about the pandemic, which may lead to a further decrease in hourly fee arrangements”.

Yuan, of Zhonghao, echoes this sentiment. “The economic situation is expected to remain grim for the next two years, and the number of litigation cases is likely to rise. With declining affordability for companies, the percentage of legal work billed with a semi-contingency fee model is likely to increase further.”

Billing standards: transparency and clarity

Unlike Europe and the US, the hourly billing model hasn’t found popularity in China, which many companies believe is due to a lack of transparency in the billing standards.

“[Law firms should] develop a more reasonable and scientific hourly rate and pricing system, differentiating rates and billing schemes according to different areas (e.g., civil law, criminal law, etc.) and different types of services (e.g., litigation, consulting, etc.),” suggests Bian, of Nestle (China).

Jia Zheng, the legal director of Yuanli Education Science and Technology, believes “a more granular billing scale” should be made available to clients.

Meanwhile, Liu Qiang, the director of legal and compliance centre at Panasonic Corporation of China, says lawyers “should increase the openness of their work, and how their opinions are formed”.

It is clear that law firms are more likely to win the trust of companies by taking the initiative to disclose their billing standards throughout their services process. “In terms of fee payment, we hope that the timetable and the basis of payment can be clarified, so as to better meet management requirements,” says Cui, of CSSC.

Huang Yongqing, a partner based in Beijing and Shanghai at Jingtian & Gongcheng, says that offering budget estimates and going through the workload expectations with clients in advance can enhance the co-operation with the in-house and project team of the clients. By providing training sessions and sharing knowledge with the clients, law firms not only help control billable hours for the sake of clients, but also enhance the value of their own services.

Legal technology may also offer a way forward. Zhang, of Commerce & Finance, suggests that firms should “make use of modern technology to have more accurate statistics on the number of hours lawyers actually put in, as well as clearer and more detailed records of the services they provide”.

Timing and billing features are now standard configurations for law firm management systems such as Alpha, Elite 3E and Bitzsoft, which are commonly found in the market. According to Jeffery Quan, a senior partner at ETR Law Firm in Guangzhou, the active use of legal technology to reduce information asymmetry between law firms and clients is a reciprocal act.

“Reducing repetitive work and gradually implementing standardised business processes through legal technology will not only reduce costs for clients, but will also increase the compliance rate, business volume and professionalism of law firms,” says Quan.

As overall competence and quality of service at Chinese law firms continue to improve, a trend of adopting a refined billing model has become inevitable. “In recent years, specialised services, especially in areas such as entertainment and the internet industries, have become increasingly sophisticated and far-reaching,” says Li, of Huayi. “Through internal management and optimisation of law firms, a more reasonable subdivision of the specialised services and creating of a team of top lawyers in a particular industry will become part of the trend.

“There will also be a wider range of ‘products’ of legal services for the industries in which they are offered, and with this will inevitably bring more reasonable and varied billing arrangements for niche services,” says Li.

In the future, billing arrangements from the financial industry may also be applied to the legal industry. Joseph Chan, chief legal officer of Yum China, says: “The market as a whole has not embraced investment banking-type pricing methodology, wherein professional fees are tied to the value of a transaction and only payable when the transaction is consummated.”

Beating low-price competition

As China’s legal industry enters a phase of rapid development, low-price competition is becoming more intense. Chen Jianbin, managing partner of Zhuoxin Law Firm in Guangzhou, says the race to the bottom is most obvious with reverse auction projects.

Zhou, of SGLA Law Firm, says there are even scenarios where free legal services are offered in these projects. “It is a total lack of understanding of the legal profession, and a lack of respect for the professionalism of legal services,” adds Zhou.

Luan Shan, Beijing-based executive vice president at DHH Law Firm, observes a significant increase in low-price competition in 2020, and notes that larger firms were also involved in this activity.

He Jiawei, chief strategy and development officer at Merits & Tree Law Offices in Beijing, has also noticed this phenomenon, and says his firm will insist on maintaining a certain bottom line on pricing. “Instead, we help clients control budget from a holistic perspective by providing them with a one-stop-shop for legal services, linking up their various legal fronts and making full use of our firm’s integrated practice edge,” says He.

This is particularly beneficial for large firms with many projects – managing a multitude of external law firms can be very expensive, and in the end, companies have to painstakingly find ways to reduce the number of firms they have retained.

Liu Guangchao, managing partner at DOCVIT Law Firm in Beijing, says there is no future for low-price competition. “DOCVIT will not engage in low-price competition,” says Liu. “We have a minimum fee system for partners; for example, the rate must not be lower than a certain number, the percentage of work billed by hour must not be lower than a certain ratio, and fees charged by project or case must not be lower than a certain amount.”

In order to maintain a better bonding with clients, DOCVIT would offer some value-added services “to give clients a better impression and fulfilment”, he adds.

Quan, of ETR, says comprehensive, meticulous and independent due diligence is necessary for M&A transactions and handling disputes, “for which the costs incurred remain indispensable, otherwise the costs of non-compliance that may arise thereafter will be even higher”.

Speaking of the current trend of competition, Wang, of Wang Jing & GH, says: “There is no better way to face challenges than being the best at what we do.”

In fact, companies are more than willing to pay for quality service. Huang, of Huang & Huang Co, says that the firm has made good progress in maintaining old clients and identifying new ones in recent years, with rates rising rather than falling. Lin Zhong, the founder partner of new boutique firm Leadvisor Law in Shanghai, believes that low-price competition will have little impact on his firm, since the team is made up of leading lawyers in the industry and “clients place more importance on the qualifications and competence of lawyers”.

Li Junwei, head of greater compliance at Midea Group, goas as far as saying he would like to pay a higher price if he judged the value of legal service met his standards. “Establishing mutual trust and long-time co-operation is key to better judging the ‘value’ of legal services,” adds Li. Chan, of Yum China, agrees that under-cutting is not healthy. “We do not believe in rock bottom pricing. Rarely do we ever choose our service providers based on pricing alone.”

So then, what specific qualities in legal services are most attractive to companies? “Superb professional skills, independent legal advice, rigorous attitude, exquisite in paperwork detail, and honest communication habits are the factors we consider in selecting our partners,” says Li, of Huayi.

The criteria for judging the value of legal services, says Ye Peili, the legal manager of Junshi Biosciences, are “good professional ethics, solid knowledge and understanding of the industry background of the client and what the client really wants, rather than repeating what the book says and offering some off-the-cuff legal advice”. Law firms are also in competition with growing corporate legal teams. Liu, of Panasonic, points out that“law firms should be able to help fill the gaps in the in-house legal team, or enhance the professionalism of the corporate legal team, such as providing forward-looking interpretation of legislation, sorting judicial practice, and assisting in the provision of internal compliance management tools, which is what we deem valuable.”

Li, of Huayi, believes that after full competition, the market will eventually be tiered in terms of quality and price. She says the market will eventually return to rationality after some corporate clients receive a “setback education” when blindly choosing low price over quality. “Paying a reasonable and matching price for a quality service is bound to become the market consensus,” she says.