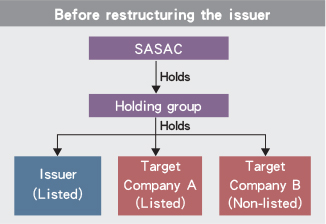

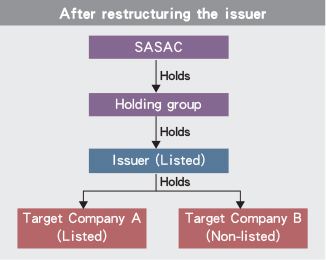

In this case involving a major asset restructuring project, a listed company (the issuer) made a non-public offer of shares to its controlling shareholder (the holding group) for the purchase of the entire shares in another listed company (target company A), and the equity interest in a non-listed company (target company B) respectively, held by the holding group.

Partner

Concord & Partners

Beijing

The project involved three subject matters, i.e. the issuer (the listed company), the counterparty (the holding group) and the underlying assets (target companies A and B). The reorganisation process was so complex that seven intermediaries were engaged to advise on the project. It also needed to comply with all the rules and requirements for various aspects, like the restructuring and acquisition of a listed company, as well as the supervision of state-owned assets. The overall sequence of events in this project in the legal context can be summarised as follows: one main line and two auxiliary lines.

Main line: restructuring the issuer

The project started with a main line that focused on the issue of shares by the listed company to buy assets (i.e. a major reorganisation of assets). Supporting the main line was the Major Asset Restructuring Measures, under which an issuer is required to engage an independent financial adviser, accountants and lawyers. The financial adviser is responsible for the preparation of various application documents such as a restructuring report, while the accountants will issue various reports like an audit report and a profit forecast verification report, and the lawyers will provide a legal opinion.

Auxiliary 1: exemption of offer

In this project, the holding group increased its stake in the issuer by subscribing for the shares in the issuer with the underlying assets in a private placement, while the issuer increased its shareholding in target company A by acquiring the underlying assets (target companies A and B). This resulted in the percentage of shareholding held by the holding group and the issuer in the listed company exceeding 30%, or continuing to increase on top of that 30%, thereby triggering an obligation to make an offer for acquisition. They were required to apply to the China Securities Regulatory Commission for exemption from the obligation.

Supporting this exemption is the Acquisition of Listed Companies Administrative Measures, pursuant to which the independent financial adviser and lawyers engaged by the holding group were required to prepare application documents on exemption of the offer for acquisition, and to issue a legal opinion with respect to the holding group’s increased stake in the issuer. The independent financial adviser and lawyers engaged by the issuer were required to prepare application documents on exemption of the offer for acquisition, and to issue a legal opinion with respect to the increased stake in target company A.

Auxiliary 2: state-owned assets

Since the holding group, the issuer and the target companies were state-owned holding companies, the pricing of the underlying assets, changes in the state-owned shareholding and major asset restructuring were required to be in compliance with relevant laws and regulations for the supervision of state-owned assets.

Pricing of underlying assets: since target company A was a state-controlled listed company, pursuant to the Management of Transfer by State-owned Shareholders of Their Shares in Listed Companies Interim Measures, the price for the transfer of the shares in a listed company as agreed by state-owned shareholders should be determined by calculating the average value of the daily weighted average price over 30 trading days prior to the date of the listed company’s announcement regarding the transfer of the shares.

Target company B is a non-listed company, so pursuant to the Management of the Evaluation of Enterprises’ State-owned Assets Interim Measures, the underlying assets should be evaluated prior to any changes in the percentage of the shareholding held by the state-owned shareholders of a non-listed company. Therefore, appraisers were required to conduct an evaluation of the assets of target company B and report the findings to the relevant administration for the record. The pricing should be based on these findings.

Changes in state-owned shareholding: pursuant to the Management of Transfer by State-owned Shareholders of Their Shares in Listed Companies Interim Measures, the transfer by the holdings group of its shares in target company A to the issuer was required to be reported to the State-owned Assets Supervision and Administration Commission (SASAC) for approval.

According to the Management of Transfer of State-owned Property Rights by Enterprises Interim Measures, with respect to the holdings group’s transfer of its shareholding in target company B to the issuer, the transfer of state-owned property rights should be conducted on an exchange where transferees should be called up from the public, unless approval is given by relevant authorities above the provincial level.

Supervision of major asset reorganisation: the Notice Governing Asset Restructuring by State-owned Shareholders Together with Listed Companies says that asset restructuring programmes carried out by state-owned shareholders together with listed companies should be reported to the state-owned assets supervision and administration authorities at or above provincial level for examination. In this project, the asset restructuring plan was submitted by the holding group to the provincial state-owned assets supervision and administration authorities, and approval documents had been obtained prior to the convening of a general meeting of shareholders by the issuer.

Li Yonggang is a partner at Concord & Partners in Beijing

北京市朝阳区麦子店街37号盛福大厦1930室

Suite 1930, Beijing Sunflower Tower, 37

Maizidian Street, Chaoyang District, Beijing

邮编 Postal code: 100026

电话 Tel: +86 10 85276468

传真 Fax: +86 10 85275038

电子信箱 E-mail:

liyonggang@concord-lawyers.com

www.concord-lawyers.com