China’s booming e-business industry is one of the key areas foreign investors focus on. Many e-business enterprises are backed by private equity funds. Before the release of the Circular on Removing the Restrictions on Foreign Equity Ratios in Online Data Processing and Transaction Processing (Operating E-commerce) Business in China (Shanghai) Pilot Free Trade Zone, (FTZ Circular) on 13 January 2015, businesses engaging in e-commerce operations were often classified as the second category, “information services”, according to the Catalogue of Classified Telecommunications Operations 2003.

Eric He

百宸律师事务所

律师

Associate

PacGate Law Group

E-business enterprises, according to their business models, can be classified into “e-malls” and “online stores”. E-malls refer to the third party that provides a platform for online stores to be set up, and the e-business is responsible for maintaining and managing the platform. “Online store” e-businesses run their own online shops to sell the products they manufacture or own in store.

According to the Circular of the General Office of the Ministry of Commerce on Some Issues Concerning the Approval and Administration of Foreign Investment Projects of Sale through Internet and Automat, issued on 19 August 2010, foreign e-business enterprises selling their products through the internet are required to do record filing as an internet content provider (ICP). Since then, the basic opinion in the industry has been that the requirement for operating an online store is ICP record filing. On the other hand, operating an e-mall requires obtaining an ICP licence.

Sheldon Wang

百宸律师事务所

律师

Associate

PacGate Law Group

Since the Shanghai FTZ was set up in 2013, the policies concerning e-business enterprises within the zone have undergone a series of changes. Ever since the FTZ circular was released, e-business operations have been categorized as within the scope of “online data processing and transaction processing”. However, this belongs to the first category of “value-adding telecommunications businesses”, according to the 2003 catalogue, and is commonly understood as businesses based on the scope of facilities and resources.

Despite the changes made to the policies concerning e-businesses in the Shanghai FTZ, before the Circular of the Ministry of Industry and Information Technology on Removing the Restrictions on Foreign Shareholding Ratio in Online Data Processing and Transaction Processing (Operating E-commerce) Business (Circular No. 196) was released on 19 June 2015, enterprises that truly operated in the scope of “online data processing and transaction processing” were very few. Only the e-commerce website 1haodian operates within the scopes of “online data processing and transaction processing” and “information services business”.

As most major e-business enterprises have already obtained ICP licences, the policies concerning e-business enterprises in the Shanghai FTZ have not brought about any revolutionary changes to the e-commerce industry.

The revised Guiding Catalogue for Foreign Investment Industries, released on 10 March 2015, opens the nationwide e-commerce industry to foreign investment. Ratios of foreign ownership in value-added telecoms enterprises should not exceed 50%, with the exception of e-commerce businesses.

On 19 June 2015, Circular No. 196 cleared the restrictions on foreign ownership in operating e-businesses within the scope of online data processing and transaction processing nationwide. Foreign equity ownership can now reach 100%. This is no doubt big news for foreign investors.

However, the circular also stated that the Administrative Provisions on Foreign-invested Telecommunications Enterprises has to be followed when it comes to other conditions and requirements for the approval of e-businesses. So the requirement that “foreign investors should have a good track record and experience in operating value-adding telecommunications enterprises” is still the major obstacle for foreign investors, other than strategic investors, to invest in the e-commerce industry. This, in practice, has significantly reduced the impact of Circular No. 196.

As China honours its World Trade Organization commitments, the gradual relaxation of restrictions on e-business enterprises will continue as a major trend. On this front, the authors have consulted with communications administrations in Beijing and Shanghai, and have been verbally assured that e-businesses only need to obtain electronic data interchange (EDI) licences. Therefore, the authors believe that operating e-malls now only requires an EDI licence.

The Classification Catalogue of Telecommunication Services 2015, released on 28 December 2015, has been effective from 1 March this year. Compared to the 2003 catalogue, the 2015 catalogue categorizes online data processing and transaction processing as the second category, value-adding telecoms businesses, which is commonly understood as businesses based on the public application e-platforms. This would agree with the nature of e-businesses. One could interpret the changes made in the 2015 catalogue as an adjustment to Circular No. 196. As the 2015 catalogue has just been published, telecoms authorities have not released its details for implementation. Therefore, it is not clear whether there will be changes in the requirements when foreign investors apply for EDI licences.

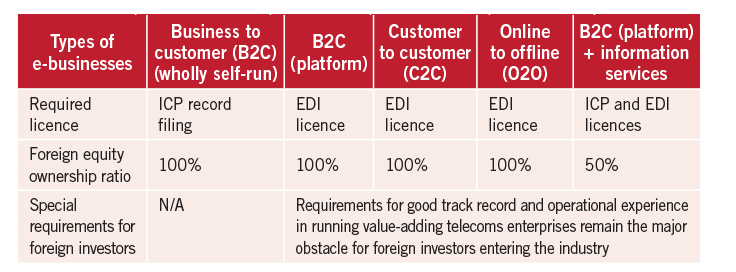

As both Circular No. 196 and the 2015 catalogue have been published, the requirements for operations and the ratio of foreign equity ownership in e-businesses are summarized below:

Based on the search of licences for value-adding telecoms enterprises granted after the release of Circular No. 196, conducted on the website of Ministry of Industry and Information Technology, the authors have not found any e-commerce enterprises that have obtained EDI licences. The licence for value-adding telecoms enterprises disclosed in domestic renowned e-business platforms is still the ICP licence. Therefore, whether the requirements in obtaining EDI licences would be materially different from that for ICP licences still needs to be confirmed.

北京市朝阳区东三环中路7号北京财富中心写字楼A座4201室邮编100020Suite 4201, Building A, Fortune Plaza Office Tower7 East 3rd Ring Middle RoadChaoyang District, Beijing 100020 China电话 Tel: +86 10 6530 9989

北京市朝阳区东三环中路7号北京财富中心写字楼A座4201室邮编100020Suite 4201, Building A, Fortune Plaza Office Tower7 East 3rd Ring Middle RoadChaoyang District, Beijing 100020 China电话 Tel: +86 10 6530 9989

传真 Fax: +86 10 6530 9980

电子信箱 E-mail:

ehe@pacgatelaw.com

swang@pacgatelaw.com

www.pacgatelaw.com