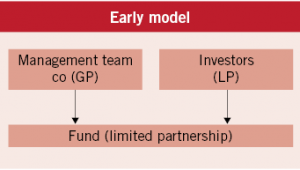

Most private equity (PE) funds are established in the form of a limited partnership. The general partner (GP) manages fund matters and bears unlimited joint and several liability for the debts of the fund; and the limited partners (LPs), as investors of the fund, do not participate in the fund’s management, and bear limited liability only to the extent of their amount of contributions. This column takes a brief look at the evolution of the structure of funds since the broad acceptance of the limited partnership model in China.

The GP may serve as the fund’s management company, or alternatively a separate limited liability company may be established to be the management company after the execution of a management agreement with the fund. In order to simplify the discussion, the author will assume that the GP also serves as the management company as well.

Michelle Jin

百宸律师事务所

合伙人

Partner

PacGate Law Group

Under the early model, the GP obtains the carried interest and distributes dividends to the management team members after deducting the operating costs and paying corporation income tax. Then each team member is required to further pay a 20% personal capital gains tax, resulting in double taxation of the carried interest.

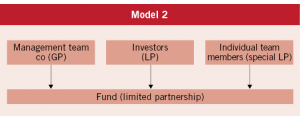

Model 2. For the purposes of tax avoidance, a new structure evolved from the early model, that is, while the management team company serves as the fund’s GP, the individual team members are the special LPs of the fund, establishing a limited partnership fund together with the other LPs of the fund.

With this model, it is possible to avoid the corporation income tax payable when the GP directly obtains the carried interest. The LPs of the fund pay personal income tax or corporation income tax on the profit distributions obtained by them. For individuals, a 20% tax rate shall apply and for enterprises, a 25% corporation income tax rate shall apply after the deduction of operating costs.

In this model, a management team member is a shareholder of the GP and LP of the fund, and such member also participates in the daily operation and management of the fund. Based on their multiple roles, in practice, some tax authorities do not recognize the LP role of management team members, instead deeming them as a GP of the same position of the fund management company, and requiring the application of progressive personal income tax rates from 5-35% upon them.

As an improvement on the foregoing model, in the structure of some funds, individual management team members no longer directly serve as special LP, instead serving as special LP through the establishment of a special purpose limited partnership. As the special LP is a limited partnership, it is not required to pay enterprise income tax at the special LP level, rather it is the individual management team members behind the special LP that subsequently pay tax at the applicable rate of 20%.

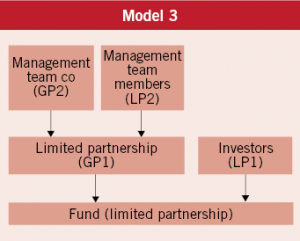

Model 3. In Model 2, the special LPs obtain the carried interest instead of the GP, inconsistent with the internationally accepted idea that the GP normally obtains the carried interest, and the rights and obligations among the partners are relatively complicated. Accordingly, a new model of fund structure has gradually evolved from Model 2. What has now secured general recognition is a two-layer limited partnership structure where the management team company and the management team members jointly establish a limited partnership to serve as the GP of the fund (namely the GP1 in the figure).

GP1, in taking the form of a limited partnership, is not required to pay corporation income tax, rather, the LPs behind it (namely LP2) shall pay capital gains tax, thus avoiding the double taxation.

Additionally, the management team company and GP1 are two different entities. This lends to greater flexibility in incentivizing the management team other than achieving tax optimization. For the purpose of incentivizing the management team in future, part of the equity in the management team company can be transferred to the team members as an equity incentive. Additionally, at the GP1 level, part of GP1’s LP equity can be used as an equity incentive to reward the management team. Different designs may be made of the incentive targets and the equity incentive percentage at the GP or the management team company level.

In Model 3, at the fund level, the rights and obligations between GP1 and LP1 are clear; and from the perspective of the managing person,the tax costs of GP1 are effectively reduced, while the incentive mechanism targeting the management team is more convenient and flexible. Therefore, Model 3 facilitates the design and arrangement of the overall interests of the funds and has gradually become the main structural model for PE funds.

北京市朝阳区东三环中路7号

北京财富中心写字楼A座4201室

邮编100020

Suite 4201, Building A, Fortune Plaza Office Tower

7 East 3rd Ring Middle Road

Chaoyang District, Beijing 100020 China

电话 Tel: +86 10 6530 9989

传真 Fax: +86 10 6530 9980

电子信箱 E-mail:

mjin@pacgatelaw.com

www.pacgatelaw.com