Acquiring a promising Indian company has emerged as one of the most attractive ways for a Chinese company to enter the Indian market. This strategy overcomes the challenges of making a greenfield investment and setting up distribution and supply networks from scratch.

D. H.律师事务所

合伙人

Partner

D.H. Law Associates

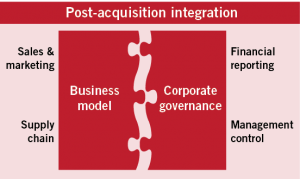

It can potentially reduce the gestation period for market entry from several years to a few months. However, the success of an acquisition depends as much on the post-acquisition integration as it does on the pre-acquisition steps of screening targets and conducting due diligence on them.

The challenges faced by a Chinese company in integrating with the target and realising synergies of an acquisition can be categorised into two broad categories: a) business model challenges; and b) corporate governance challenges. These categories correspond to challenges faced by the Chinese company in the external market environment and on the internal corporate side, respectively.

Business model challenges

Understanding and taking control of the Indian target’s sales and marketing channels is among the foremost challenges faced by the Chinese companies in relation to the business model. In many ways, the extensive reach of the Indian company to its customer base is the main driver of the acquisition strategy. If the Chinese company fails to gain control over the sales and marketing channels of the target in a smooth and effective manner, a significant portion of the potential benefits of the acquisition might be lost. Since many Indian managers rely on longstanding personal relationships to advance the business prospects of their companies, this might prove to be an uphill task for Chinese companies, and hence requires maximum attention and effort.

Key question: how many years will it take for the Indian company to sustain and grow its business under the new Chinese management without relying on any of the top Indian management personnel?

The second challenge would be to integrate the Chinese parent company’s product portfolio into that of the Indian company’s supply chain. The Chinese company would want to use its Indian subsidiary to increase sales of its own products in India. This can only be achieved if the new Chinese management understands the needs and preferences of its Indian customers, bargaining power of existing suppliers, import regulations of India, and pricing policies of its competitors.

Key question: What are the key inputs in the supply chain that can be replaced by Chinese products without harming the Indian company’s market share or reputation?

D.H.律师事务所

合伙人

Partner

D.H. Law Associates

Corporate governance challenges

On the internal front, the first challenge faced by a Chinese acquirer would be to integrate the financial numbers of the Indian subsidiary with that of the Chinese parent company. In most cases, the Chinese management would have already conducted extensive financial due diligence on the Indian target before completing the acquisition. However, it is possible that the quality of the actual financial numbers might differ from those projected during due diligence. To ensure the financial reporting process of the Chinese parent company is completed smoothly, the Chinese management needs to immediately take control of the internal financial function of the Indian subsidiary and make changes in the internal processes where necessary. Depending on the timing of the acquisition, the Chinese management might only have three to six months to complete this process before the first set of numbers have to be absorbed into the parent’s reporting process.

Key question: how long will it take before the Chinese management is fully comfortable with the accounting and financial policies of the Indian target?

The hallmark of a successful post-acquisition integration is the effectiveness of the transition process in which management control changes from the Indian target’s pre-acquisition management team into the hands of the new management team of the Chinese parent company.

This might entail gradual replacement of key management personnel, but more importantly the internal processes that govern core business areas – information sharing, reporting of key performance indicators, risk management, human resource policies and corporate structures – must be adapted to suit the Chinese management’s style of governing. The Chinese management is likely to face cultural difficulties in interacting with Indian employees on a daily basis, so it needs to ensure that most of these concerns are met in a process-driven way, instead of relying heavily on people-to-people interaction.

Key question: how can the Chinese management gain control over, or alter, the internal systems and processes of the Indian subsidiary without losing the confidence of its Indian employees?

Without this, the trust levels between the acquirer and target can quickly erode, and the timelines required to achieve integration can quickly spin out of hand.

From a legal perspective, post-acquisition integration in India requires the Chinese acquirer to be familiar with various laws governing corporate compliance, antitrust, imports, labour practices, accounting standards and business contracts.

Santosh Pai and Nusrat Hassan are partners at D H Law Associates. D H Law Associates is the only full-service Indian law firm with an active China practice since 2010

孟买总部 Headquarters in Mumbai

111, Free Press House

Free Press Journal Road

215, Nariman Point, Mumbai – 400 021

邮编 Postal code:400021

电话 Tel:+91 22 6625 2222

传真 Fax:+91 22 2285 5821

电子邮件 E-mail:

china@dhlawassociates.com

www.dhlawassociates.com