With a growing market and attractive labour incentives, Indonesia should have been a popular destination for investment. However, bureaucracy and legal uncertainty mean the country is often not seen as being as business friendly as its neighbouring countries. The government addressed this challenge in 2020 with the issuance of Law No. 11 of 2020 on Job Creation (the Omnibus Law), which amended and revoked 78 prevailing laws and regulations.

This article highlights major aspects of laws that were amended by the Omnibus Law, and its implementing regulations, which may have an impact on Indonesia’s foreign investment policy.

Partner

Tel: +62 818 103 949

Email: fkaryadi@abnrlaw.com

New KBLI

To establish a company in Indonesia, enterprises must choose an appropriate Standard Business Classification (KBLI). Regulation No. 2 of 2020 amended the KBLI to add new lines of businesses, such as payment services provider, payment systems infrastructure operator, and peer-to-peer lending operators.

Updated negative list

The foreign investment negative list, which regulates maximum foreign ownership for certain sectors, was updated through the Presidential Regulation No 10 of 2021 on Investment Business Field on 2 February 2021.

It now contains only:

(1) 51 lines of business that are reserved for cooperatives and micro, small and medium-sized enterprises (SMEs);

(2) 46 lines of business that are either closed or conditionally open for foreign investment;

(3) six that are prohibited, namely narcotics, gambling or casinos, harvesting of fish listed in the Convention on International Trade in Endangered Species of Wild Fauna and Flora, utilisation or harvesting of coral, chemical weapons, and chemicals that might damage the ozone layer; and

(4) 38 business fields that are open to foreign investments if in partnership with cooperatives and SMEs.

This opens up some popular lines of business to 100% by foreign ownership, such as:

Distributor (wholesale trading) – previously open for 67% foreign investment;

Hospital – previously open for 67% foreign investment, and 70% if investors are ASEAN members; and

Marketplace (online) – previously open for 100% foreign investment if the issued and paid-up capital of the company is IDR100 billion (US$7.1 million), else only open for 49% foreign investment.

Tech startup companies located in a special economic zone may also have an investment value of less than IDR10 billion.

The new regulation also lists prioritised lines of businesses that will be given fiscal incentives such as a tax holiday, tax allowance, investment allowance, customs incentives, as well as non-fiscal incentives such as easier licensing procedures, support on infrastructure, immigration and manpower matters.

Senior Associate

Email: airawati@abnrlaw.com

Taxation amendments

Through Law No. 2 of 2020 on the Covid-19 Pandemic Response the government eased taxation rules, by: (1) reducing the corporate income tax rate to 22% for 2020 and 2021, 20% for 2022, and a further 3% reduction for qualified public companies; and (2) imposition of a VAT in the utilisation of intangible taxable goods and/or taxable services through e-commerce.

The government further amended tax provisions as follows:

Non-taxable dividend. The Omnibus Law makes dividends earned by local taxpayers non-taxable, as long as it is re-invested in Indonesia. Government Regulation No 9 of 2021 on Tax Treatments to Support Ease of Doing Business (PP9) classifies exempted dividends as,

(i) dividends that are distributed by a general meeting of shareholders or interim dividend; and/or

(ii) after-tax income from an offshore permanent establishment and offshore active income not from a permanent establishment. The exemption is only applicable for dividends that are distributed after the issuance of the Omnibus Law.

Adjustment on interest tax tariff. The Omnibus Law regulates that the government may reduce the rate of withholding tax on interest paid to foreign taxpayers, which stands at a rate of 20%, that will be further regulated in government regulation. PP9 reduces the interest rate to 10%, or in line with the tax treaty’s rate, for bond interests received by non-permanent establishment foreign tax subjects.

Exclusion of VAT for capital participation in the form of goods. The Omnibus Law regulates that transfer of goods for capital participation is no longer considered as delivery of taxable goods, which is subject to VAT, if both the transferor and transferee are Indonesian taxable entrepreneurs.

Manpower amendments

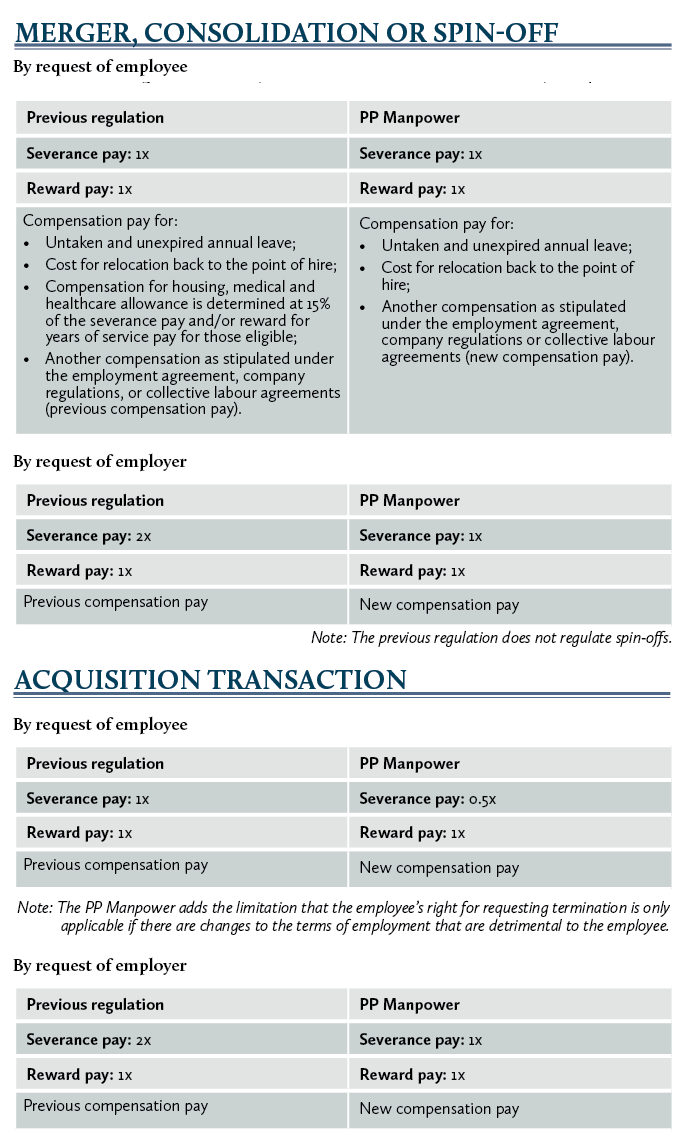

One of the major concerns for M&A transactions in Indonesia is the trigger of an employee’s right to request termination, which will result in a severance package payment, a factor to be added as a cost of the transaction. The calculation of severance packages for mergers, consolidations, acquisitions is now amended by the Government Regulation No. 35 of 2021 on Definite Employment Agreement, Outsourcing, Working Hours and Resting Hours, and Termination of Employment (PP Manpower), which took effect on 2 February 2021. (See table).

Merger filings

The Indonesian Competition Commission (KPPU) issued a new merger control regulation, Regulation No 3/2019, which was followed by the Merger Control Guidelines, issued in 2020, which updated the previous merger filing regulation issued in 2010.

The merger guidelines stipulate a merger, consolidation and acquisition of shares and/or assets must be notified to the KPPU if it meets the following threshold requirements:

. Combined asset value exceeds IDR2.5 trillion, or IDR20 trillion for the banking sector; and/or

. Combined sales value exceeds IDR5 trillion.

. With the merger guideline, the KPPU confirms that the calculation is on a worldwide basis, and not just the assets located in Indonesia as was the case previously.

According to the merger guidelines, foreign-to-foreign transactions will need to be notified if:

(1) they result in a change of control;

(2) they will impact the Indonesian market;

(3) they fulfill the threshold for mandatory notification filing, as stipulated above; and

(4) they are non-affiliated transactions.

The notification should be made within 30 business days after the transaction becomes legally effective. Failure to notify the transaction within the deadline may result in fines of IDR1 billion per day.

Partner

Tel: +62 818 103 949

Email: fkaryadi@abnrlaw.com

Anastasia Irawati

Senior Associate

Email: airawati@abnrlaw.com

Ali Budiardjo Nugroho Reksodiputro Counsellors At Law (Abnr)

Graha CIMB Niaga, 24/F Jl. Jend. Sudirman Kav.

58 Jakarta – 12190, Indonesia

Email: info@abnrlaw.com

www.abnrlaw.com