Llinks Law Offices, Herbert Smith Freehills and AllBright Law Offices have advised Hua Hong Semiconductor’s RMB21.2 billion (USD2.95 billion) IPO on the Star Market, making it the largest A-share listing yet this year.

Hua Hong’s listing is also the third-largest Star Market IPO to date, following Semiconductor Manufacturing International Corporation’s RMB53.2 billion and BeiGene’s RMB22.2 billion listings.

Partners Harriet Li and Zhang Zhengyi led the Llinks team advising Hua Hong on PRC law, while Herbert Smith Freehills managing partner Matt Emsley led the team providing the issuer support on Hong Kong law.

Senior partners Ark Bao, Wang Li and Shen Cheng led the AllBright team, with the assistance of partners Chen Wei and Wu Xuri, acting for the main underwriters, Guotai Junan Securities and Haitong Securities.

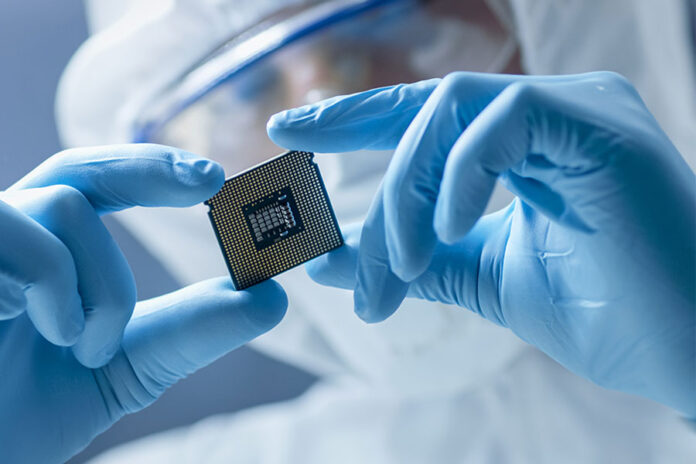

Hua Hong Semiconductor, which is China’s second largest semiconductor foundry and ranked sixth largest globally, mainly produces eight inch and 12 inch wafers.

The company was incorporated by the Hua Hong Group and listed on the HKEX in 2014. It’s the seventh red-chip company to list on the Star Market. Red chip firms are incorporated in jurisdictions outside China and listed in Hong Kong.