For mainland Chinese entities, there are two ways to list in Hong Kong – through H shares or by setting up as a so-called red chip. If the red-chip route is chosen, the primary tasks are the formulation of a restructuring plan and the setting up of a red-chip structure.

Managing partner of the Hong Kong office

Guantao Law Firm

Once the existing shareholders of the mainland company have carried out the overseas investment procedures in accordance with relevant laws and regulations, they establish a listing entity outside China and set up a multi-tiered overseas equity holding structure, ensuring that it reflects to the greatest extent possible the existing domestic equity holding structure. They must then select the appropriate approach to inject the domestic assets and business into the overseas structure.

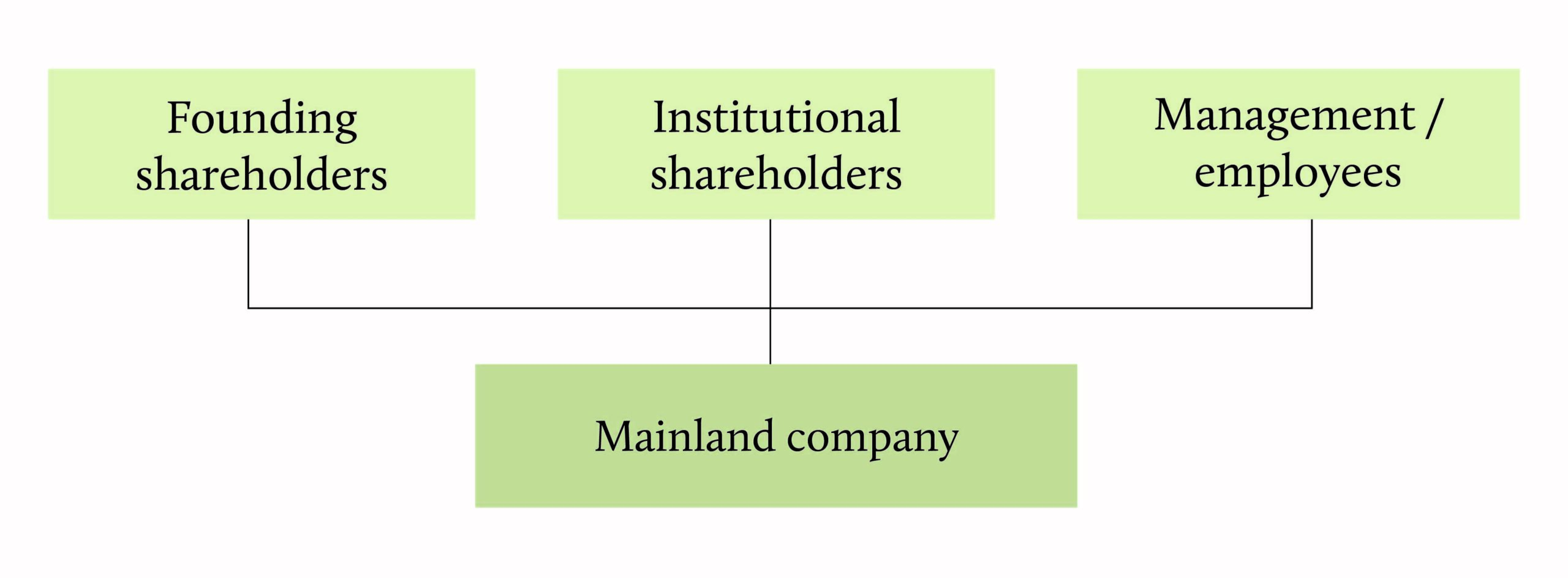

The structure of a Mainland enterprise prior to the proposed listing is shown below (assuming that all of the existing shareholders of the Mainland Company are entities established in the Mainland).

Overseas structure

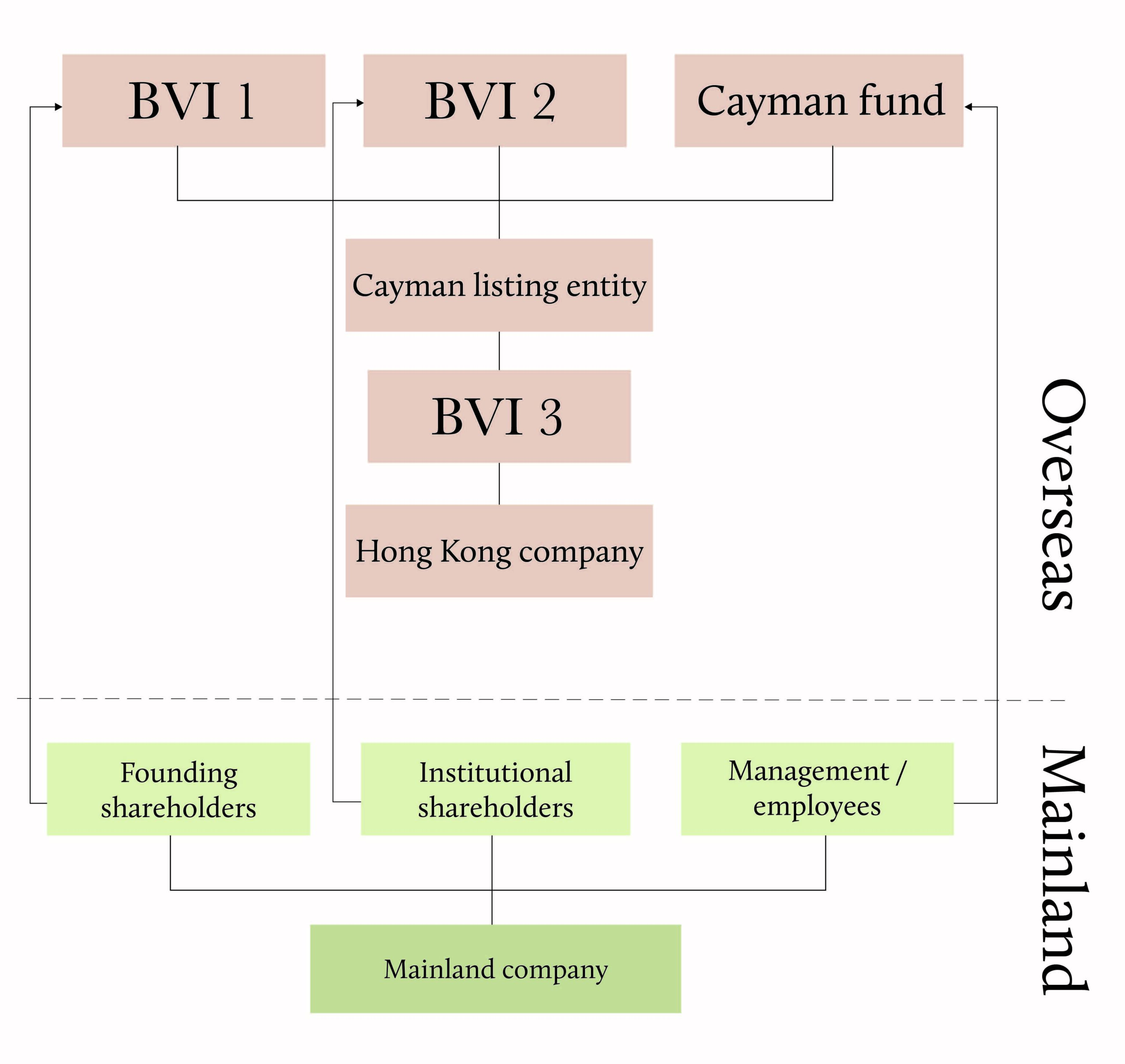

In the case of a red-chip listing in Hong Kong, it is usual to incorporate the future listed entity in the offshore jurisdiction of the Cayman Islands, with the other tiers usually being British Virgin Islands (BVI) companies and the domestic interests held through a Hong Kong company. The steps typically taken are as follows:

Existing shareholders carry out overseas investment approval and registration, and foreign exchange registration, to establish the tiers of overseas companies. A natural person shareholder is required to carry out foreign exchange registration procedures for overseas investment and may also consider setting up an overseas family trust at the same time. An institutional shareholder is required to carry out approval and/or registration procedures for overseas direct investment (ODI) by a domestic entity.

The other tiers in the overseas structure are usually BVI companies, but if a limited partnership is opted for, it will, in most cases, be established in the Cayman Islands. Such an arrangement of equity holdings with offshore entities at multiple tiers and a Hong Kong company affords flexibility for possible future disposals of equity interest, reduces transaction costs and provides tax benefits such as the avoidance of double taxation.

Attorney

Guantao Law Firm

Ensuring compliance with the Hong Kong listing requirements of continuity of ownership and control. When setting up an overseas equity holding structure, certain adjustments may be made to the composition and equity holding percentages as compared to the original structure of the mainland company. For example, a mainland institutional shareholder might be substituted by an overseas affiliated entity if the overseas entity has carried out ODI procedures; or when the ultimate interests of an institutional shareholder can be traced back to a natural person, that person – after carrying out foreign exchange registration – can establish an overseas equity holding entity that closely reflects the domestic institutional shareholder equity structure; or a new investor may be added overseas.

While this optimisation and adjustment is carried out, it is vital to ensure that the revised overseas structure satisfies the Hong Kong listing requirements of continuity of ownership and control.

Tax. As the tax implications of different approaches of overseas investment vary, a comprehensive analysis and evaluation is needed to formulate a restructuring plan that best meets the interests of all parties.

An established overseas structure is shown below:

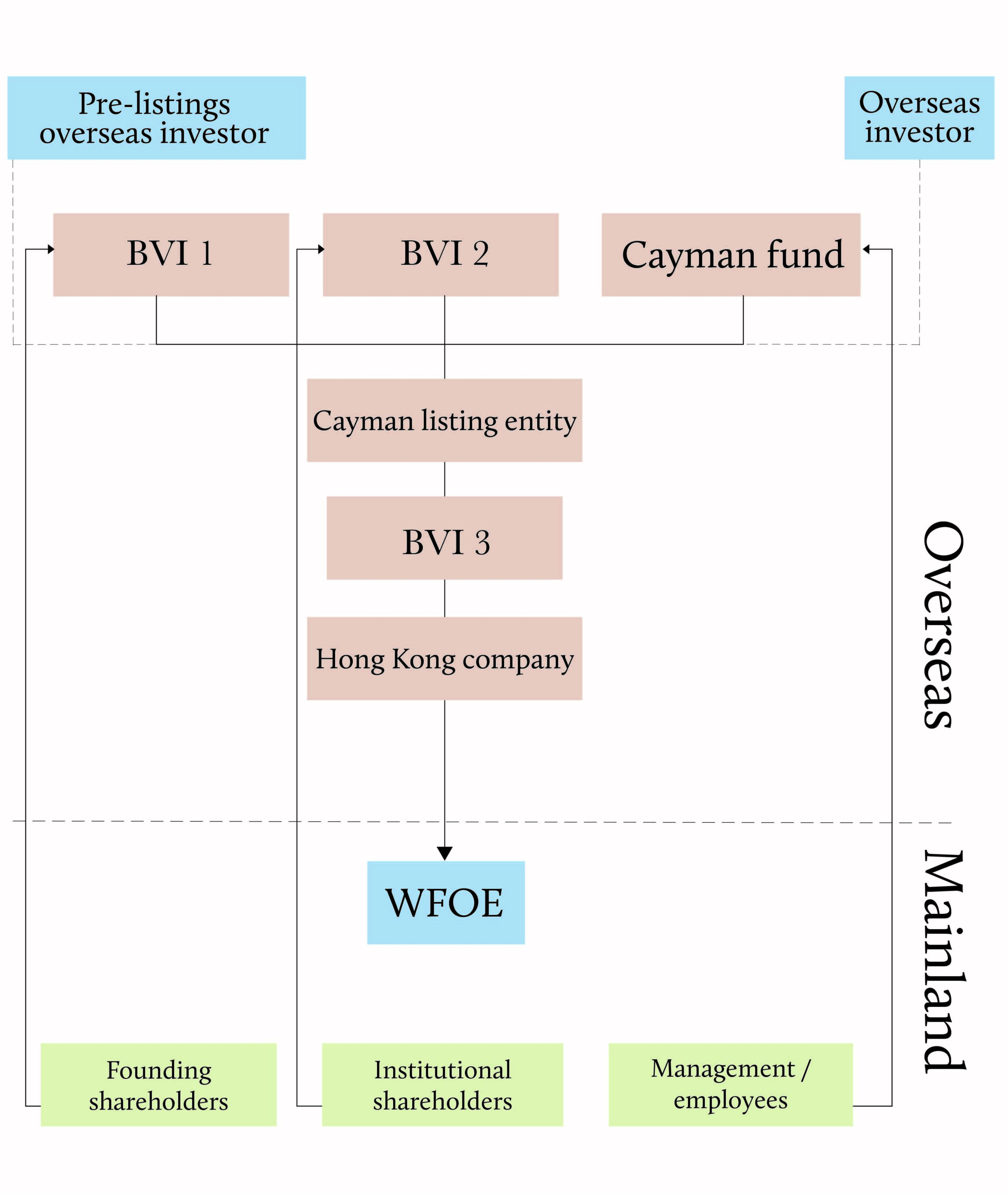

Injecting domestic interests

If the domestic interests to be injected do not fall in a prohibited or restricted sector for foreign investment, the equity control structure may be adopted. In practice, a “two-step” arrangement is usually adopted. That is, the mainland company is first converted into a Sino-foreign equity joint venture and subsequently into a wholly foreign owned enterprise (WFOE). Depending on the number of domestic entities and the pre-restructuring equity holding structure, a restructuring under the equity control model may involve multiple equity transfer transactions. The relevant tax implications need to be evaluated in detail.

The equity control structure is shown below:

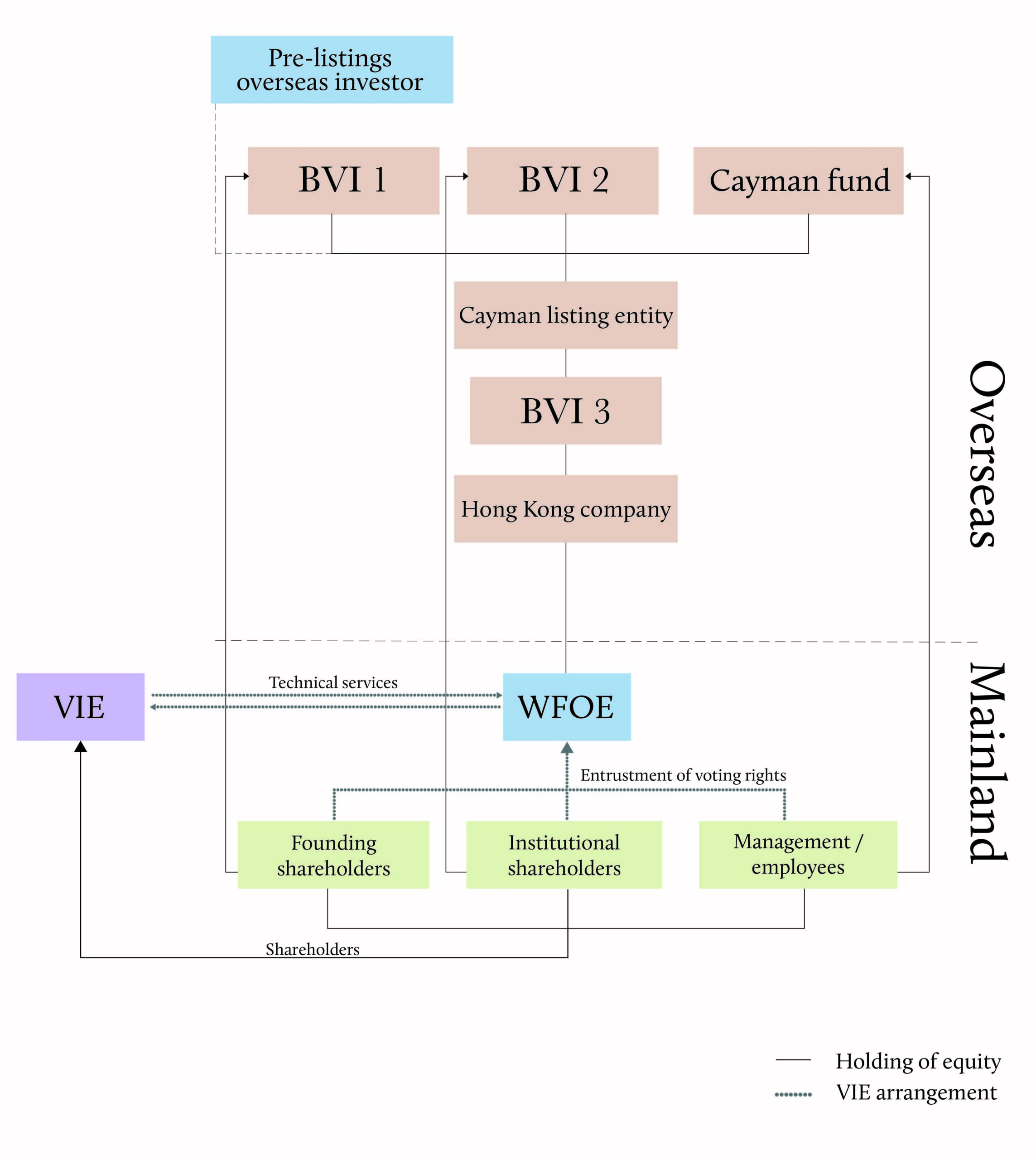

If the domestic interests to be injected are in a sector in which foreign investment is prohibited or restricted, then the variable interest entity (VIE) structure will usually be used. In relevant listing decisions of the HKEX, this is described as a “structured contractual arrangement”. Under the VIE structure, the listing entity does not hold equity in the domestic entity either directly or indirectly, but establishes a new WFOE in China through the Hong Kong company, and subsequently enters into a series of agreements with the domestic operating entity (i.e., the VIE) and the relevant shareholders through the WFOE to achieve control over and acquire the interests in the domestic entity.

A typical VIE structure is shown below:

Regardless of which of the approaches is chosen, it is key to ensure the integrity, independence and sustainability of the assets and business of the proposed listed group after the restructuring and satisfy the “suitability” requirements for a listing in Hong Kong.

To sum up, the restructuring and set-up of a red-chip structure prior to listing in Hong Kong involves multiple jurisdictions. The Hong Kong listing rules and the relevant listing decisions and guidance letters of HKEX also need to be satisfied in addition to the laws and regulations. Such a process also involves taxation, finance and numerous other aspects.

The steps to implement the restructuring must also be closely interlinked. As the circumstances and situation of each listed enterprise are different, the restructuring plan needs to be tailored for each by the lawyer together with other professional service firms.

Grace Yan is the managing partner of Guantao Law Firm Hong Kong office. She can be contacted on +852 2878 1230 or by email at yan@guantao.com

Rong Yan is an attorney at Guantao Law Firm. She can be contacted on +86 10 6657 8066 or by email at rongyan@guantao.com