China, the world’s number one consumer of iron ore, is investigating whether the Anglo-Australian mining groups BHP Billiton and Rio Tinto, and Vale of Brazil, are guilty of exerting illegal monopoly control over global iron ore supplies.

An announcement to this effect was made by the Ministry of Commerce on 15 April, confirming reports earlier in the week in the Chinese media that such an investigation was possible.

“The commerce ministry’s anti-trust bureau is currently studying the issue,” said Yao Jian, the ministry’s spokesman, saying it had noticed the question as steelmakers elsewhere, including in the European Union and Japan, had raised anti-monopoly concerns.

This may seem surprising. Under the PRC Anti-monopoly Law, which came into effect in August 2008, monopoly agreements and abuse should be policed by the National Development and Reform Commission (where price-related) and the State Administration of Industry and Commerce (where non price-related). MOFCOM’s remit extends only to merger control.

China has so far initiated very few investigations into monopoly agreements, although it has been much more active in policing the anti-competitive effects of mergers and acquisitions, including some that have taken place entirely outside the PRC.

The move came as reports surfaced that the three big mining companies had shifted to a quarterly pricing system for their ore, and had already signed price agreements with some Asian steel mills of over US$110 a ton in the April-June contracts, more than twice the fixed price last year. The global iron ore pricing system has moved towards market pricing following the demise of the old “benchmark” system, under which major iron ore producers negotiated a price each year with their key customers in Japan and South Korea, which other purchasers would then also pay.

China’s steel lobby, the China Iron and Steel Association (CISA), claimed on the same day as the ministry’s statement that the mining companies were fixing prices.

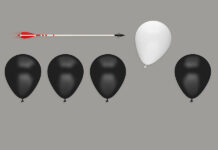

“The three giant miners have been using their position to control prices at unreasonably high levels, putting global steel mills in a difficult situation,” said Luo Bingsheng, vice-chairman of CISA, at an iron ore conference. “They fix a price and you have to accept it. If not, they cut off the supply.”

The World Steel Association last month called on competition authorities worldwide to look into the iron ore market after Vale ended the 40-year tradition of selling ore on annual contracts and squeezed a 90% price hike from Japanese mills for the quarter beginning on 1 April.

Eurofer, which represents European steelmakers, has also complained to the European Commission, saying that there are “strong indications of illicit coordination of price increases and pricing models and pressure on individual steel producers to accept these changes.”

But Credit Suisse said in a recent note: “We cannot see why the adoption of a quarterly pricing mechanism that follows a market index is perceived as being anti-competitive or that it creates market distortions.”