Affected by novel coronavirus outbreaks, new infrastructure is deemed to be an important tool to stabilize growth, and the urban development investment corporation (UDIC) will remain an important player in infrastructure investment. Infrastructure requires a large amount of capital investment. As far as financing for a UDIC is concerned, it is still the regulatory red line for local governments not to add new hidden debts.

Partner

Jingtian & Gongcheng

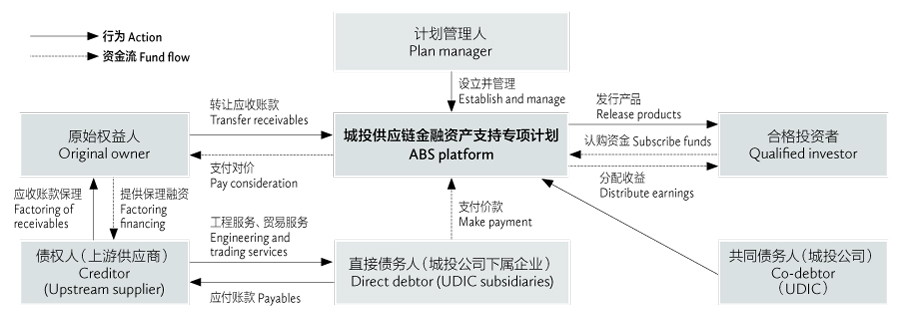

With the local governments gradually requiring UDICs to clear out debt financing with higher costs, the traditional non-standard debt financing method available to a UDIC will be further restricted. With this in mind, the asset-backed securitization of supply chain payables of a UDIC is quietly emerging as an innovative standardized debt financing method.

For a UDIC, the advantages of a supply chain’s asset-backed securitization financing over UDIC bonds and other traditional financing methods are as follows: (1) it can extend the accounts payable period of a UDIC and its subsidiaries, and improve the cash flow of the enterprise; (2) it is not included in the interest-bearing liabilities of the enterprise, does not increase the asset liability ratio of the enterprise, and is not subject to the bond issuance index of the enterprise; (3) it can adopt the shelf registration mode (one-time declaration, phased issuance), with high-financing efficiency; and (4) there are fewer restrictions on the use of raised funds.

Main legal issues

Identification of local financing platform companies. In addition to the general provisions of the Guidelines on the Negative List of Underlying Assets of Asset Securitization Business (the Negative List), in practice, when the stock exchanges review the asset-backed securitization of supply chain involving a UDIC, they will generally refer to the regulatory requirements for corporate bonds and identify local financing platform companies on the basis of the list of local government financing platforms prepared by China Banking and Insurance Regulatory Commission (CBIRC), and on the principle of substance over form.

Associate

Jingtian & Gongcheng

In accordance with the local financing platform screening standard revised by the Shanghai Stock Exchange in September 2016, the above-mentioned list is only a reference for identifying platform companies, while the substantive standard for identifying platform companies is that the income of relevant enterprises from their local governments accounts for more than 50% in the reporting period, which is the so-called “single 50” requirement.

Whether a debtor or credit enhancement entity can be a platform company. The Negative List provides that the platform company shall not be a debtor of the underlying assets, but it does not specify whether it can be a credit enhancement entity. In the asset-backed securitization of supply chain payables of a UDIC, the UDIC is generally the debtor and/or credit enhancement entity, and the subsidiary of a UDIC is the debtor.

The authors understand that if the platform company is a credit enhancement entity, although it does not directly violate the relevant provisions, it may actually be subject to restrictions due to the problem of new local government debts or hidden debt. It should be noted that enterprises that are only listed in the list, but meet the “single 50” requirement of the stock exchange for platform companies, are not subject to the above-mentioned restrictions.

Plan for financial asset support of UDIC investment supply chain

Whether projects involving local government debts can be pooled. In the authors’ experience, it is not suitable for the projects involved in the underlying assets to be pooled to be invested in and constructed by financial funds, to be provided by local governments for credit enhancement, or to involve local government debts or local government hidden debts.

In practice, the intermediary agencies need to make a comprehensive judgment by reviewing the approval for establishment of the projects to be pooled, financing and security contracts, financial budget and final accounts data, and the hidden debt list submitted by the enterprise to the local government departments.

Whether public welfare projects can be pooled. The Shanghai Stock Exchange requires that urban construction enterprises cannot apply for issuing corporate bonds for public welfare projects, except under certain circumstances. In the asset-backed securitization business of the supply chain of a UDIC, the exchange also does not encourage the underlying assets related to public welfare projects to be pooled.

Influence of Circular No. 205 on asset-backed securitization of supply chain payables. In October 2019, the CBIRC issued the Notice on Strengthening the Supervision and Administration of Commercial Factoring Enterprises (Circular No. 205), which sets out specific requirements for risk concentration, related-party transactions, and other indicators of factoring enterprises, and requires that the clearing and standardization work be completed by the end of June 2020.

Factoring enterprises being the original equity owner and asset service organization in the asset-backed securitization of supply chain payables, if their relevant indicators do not comply with regulations, and the rectification is not completed on time, the establishment of the special plan may be affected. Certainly, this is a common problem for factoring enterprises to participate in the asset-backed securitization of supply chain payables.

Matthew Ching is a partner and Zhang Dong is an associate at Jingtian & Gongcheng. Lin Sha, a paralegal at the firm, also contributed to this article

Jingtian & Gongcheng

45/F, K. Wah Centre

1010 Huai Hai M. Road, Shanghai 200031, China

Tel: +86 21 2613 6209

Fax: +86 10 5809 1100

E-mail:

qin.maoxian@jingtian.com

zhang.dong@jingtian.com

www.jingtian.com