In recent years, China has launched relevant policies in support of the development of receivables finance and supply chain finance. Several ministries and authorities have also issued regulations and rules to support development of supply chain finance business vigorously in order to develop a market environment featuring mutual trust and benefit, and coordinated development among the downstream and upstream enterprises on the supply chain.

Equity partner

Zhong Lun Law Firm

In this context, online receivables exchange platforms arise to make good use of receivables for upstream suppliers of core enterprises and to facilitate those core enterprises in reducing costs and increasing revenues. Moreover, such platforms also attract wide attention in the market as it brings huge factoring businesses for commercial factoring companies. There are several well-developed receivables exchange platforms in the market, including Jian Dan Hui, Yun Lian Finance and CRCC Yinxin.

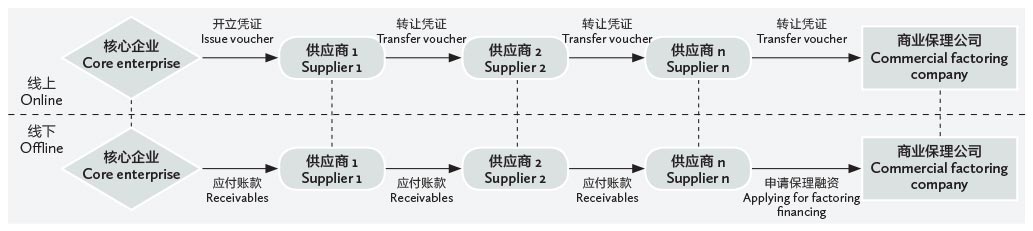

Online receivables exchange platform is a novel “internet + supply chain finance” platform that is based on core enterprises and puts management, transfer and financing of receivables as its core business. As a general rule, such a platform operates in the following business mode (see the illustration): firstly, the core enterprise converts the payables it owes to the upstream supplier into online electronic receivable vouchers, and it then bears the obligation of paying such a voucher when it is due; secondly, after the real trade occurs, the voucher is transferred on the platform so as to realize the flow of the receivable amounts that the voucher represents; and finally, the voucher holder can obtain funds by transferring the voucher to commercial factoring companies on the platform.

Selection of the platform domain name. To establish a receivables exchange platform, the first step is to select a domain name in which the platform is established and business is carried on. The platform operator that previously never registered or held any domain name can either register a domain name directly or select the related party lawfully holding the relevant domain name and then apply to such a related party for authorization to use the domain name. (The relevant regulations such as Measures on Administrating Internet Domain Names do not prohibit the holder of a domain name from authorizing any other person to use it.)

It should be noted that if a platform operator uses a domain name in the capacity of a licensee, then the actual operator of the website may be different from the holder of the domain name. Based on awards of the courts in the relevant cases, in the event that the website operator is different from the domain name holder, and that the operator cannot prove that it is the actual and independent operator of the website (e.g., by holding a value-added telecommunications business licence), the operator and domain name holder may have to share the possible liability for infringement of the operator’s use of the domain name upon the interests of any third party.

Application for the value-added telecommunications business licence. In accordance with the Telecommunications Regulations, value-added telecommunications business licence shall be obtained to carry on such business. When it comes to the business type of receivables exchange platforms, such platforms may be theoretically classified as B21 online data processing and transaction processing business or B25 information service business, as outlined in the Catalogue of Classification of Telecommunication Businesses (2015).

According to the Ministry of Industry and Information Technology, classification of online receivables exchange platforms shall be determined by the telecommunication authority where the enterprise intending to apply for the licence is located, but criteria across the country are not the same. For example, Zhejiang Telecommunication Administration Authority requires the operator of a receivables exchange platform to obtain the licence since the authority believes that any such platform by its nature is a third-party transaction platform. Telecommunication administration authorities of Beijing and Guangdong hold that the licence is not required for a receivables exchange platform if it targets internal enterprises and suppliers of the group of the operator but not the public.

Supervision of internet finance. According to the Guiding Opinions on Promoting the Sound Development of Internet Finance, receivables exchange platforms are theoretically classified as internet finance business, but do not fall into those internet finance businesses detailed therein.

It was learned that the Finance Development Service Office of Shenzhen, the Finance Office of Hangzhou, and the Finance Bureau of Beijing do not subject any business other than those internet finance businesses set out in the guiding opinions to their regulation and, therefore, receivables exchange platforms are not any business subject to licensing/registration for the time being and, moreover, no procedures for the licensing/registration of any such platform are available.

According to the Finance Bureau of Guangzhou, however, if the operator of a receivables exchange platform directly or indirectly collects funds, that platform shall be regulated by reference to online lending information intermediary platforms. The Finance Bureau of Zhuhai also expressed that receivables exchange platform shall be regulated by reference to online lending information intermediary platforms. These two finance bureaus have suspended the registration of new online lending information intermediary platforms, which means the receivables exchange platform cannot go through registration formalities that should be performed to establish a new platform.

To sum up, if an enterprise intending to establish a receivables exchange platform gives its considerations to such aspects as the selection of a platform domain name, the application for a value-added telecommunication business licence and the supervision of internet finance, then it could better determine the architecture of the platform and ensure its lawful and compliant operation, allowing it to stand well in the increasingly competitive market.

Author: Zhi Hui is an equity partner at Zhong Lun Law Firm

中国广东省深圳市福田区益田路6003号

荣超商务中心A栋9-10楼 邮编:518026

9-10/F, Tower A, Rongchao Tower

6003 Yitian Road, Futian District

Shenzhen 518026, Guangdong, China

电话 Tel: +86 755 3325 6666

传真 Fax: +86 755 3320 6888/6889

电子信箱 E-mail:

zhihui@zhonglun.com