An increasing number of Japanese companies, including Willcom (a mobile telephone service provider) and Aiful (a consumer finance company), are seeking to effect a merger or acquisition through commercial negotiation in accordance with certified alternative dispute resolution procedures prescribed in the Act on Special Measures for Revitalization of Industry and Innovation in Industrial Activities.

However, most acquisitions of insolvent Japanese companies are still conducted by means of a court-supervised restructuring process in accordance with either the Civil Rehabilitation Act or the Corporate Reorganization Act.

In this article we will discuss key issues for acquiring Japanese companies through the court-supervised restructuring processes.

Civil rehabilitation versus corporate reorganization

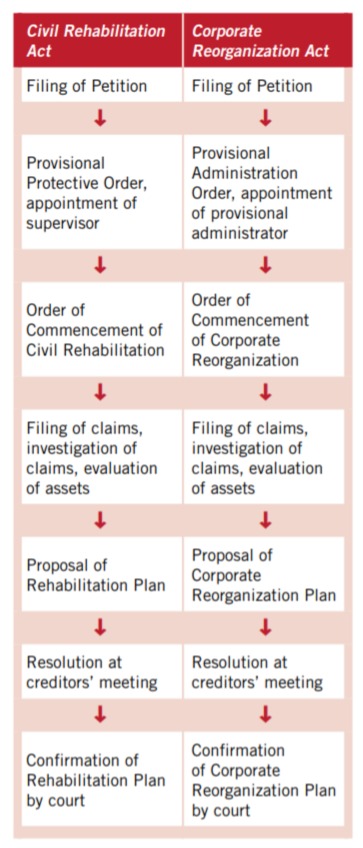

The term “restructuring process” typically refers to the insolvency proceedings under either the Civil Rehabilitation Act or the Corporate Reorganization Act. These two processes are distinct from each other in a number of ways. Firstly, a company filing a petition under the Civil Rehabilitation Act retains the right to conduct its business and to manage and dispose of its property.

In contrast, if a petition is filed under the Corporate Reorganization Act, a provisional administrator must be appointed, who will exercise such rights. Secondly, under the Civil Rehabilitation Act, secured claims are, in principle, excluded from the scope of the proceedings.

However under the Corporate Reorganization Act, secured claims must be exercised during the reorganization process and the rights of secured creditors may be altered under a corporate reorganization plan.

The management of companies undergoing the corporate reorganization process was, in the past, often deprived of its right to manage the company. Today, however, the prevailing view is that if management has not acted illegally, and the principal creditors of the company agree, there is no need to deprive management of its right to manage.

Under the process in the Civil Rehabilitation Act, however, no secured creditor is entitled to participate in the process, and therefore if the entitlements of secured parties are complex, the preference will be for the corporate reorganization process which allows secured creditors to participate.

The two processes, are outlined in the table below.

An acquiring party will seek to maintain the value of a target company by continuing to carry out the target’s daily operations, streamlining its human resources, maintaining relationships with suppliers and customers, and taking over the business as quickly as possible. If the target company is insolvent, the acquiring party can reduce the capital in the target company to zero in the first instance and then inject new capital into it in the capacity of a capital contributor to acquire control. This decrease and increase of capital are often carried out simultaneously upon approval of a rehabilitation plan or a reorganization plan by a court. The restructuring process from an acquirer’s perspective

An acquiring party will attempt to have the value of an insolvent company set as low as possible. Creditors of the company, however, will argue for as small a reduction as possible in the amount of repayment they will receive. So if a rehabilitation plan or a reorganization plan fails to ensure that repayments of debt are set at a reasonable proportion of the original amount owed, the plan will not be approved at a creditors’ meeting.

Usually, an acquiring party will be selected by an insolvent company by means of a bidding process, and ultimately the winner of the bid will be the party that makes the most appropriate offer in various respects including the offer price, the maintenance of corporate value and protection of employees’ interests. (It is normally the supervisor and the court which evaluate bids under the civil rehabilitation process, and the administrator and the court who do the same under the corporate reorganization process.) Therefore, acquiring parties must work out a competitive rehabilitation plan based on an overall assessment of many factors, including a reasonable assessment of the value of the target.

Acquisition plan is key

Most foreign companies which have acquired insolvent Japanese companies previously had business dealings with the acquisition target, and the acquisitions were carried out primarily for the purpose of protecting and consolidating existing business relationships.

It is particularly important for a foreign corporation seeking to acquire a Japanese company to work out a specific and reliable acquisition plan in order to convince the management of the target company and the court that it should be the preferred buyer.

Hiroshige Nakagawa is a partner at Anderson Mori and Tomotsune and a chief representative of its Beijing Office.

北京市朝阳区东三环北路5号

北京发展大厦809室

Beijing Fortune Bldg., Room 809

No. 5, Dong San Huan Beilu, Chao Yang Qu, Beijing, China

邮编 Postal code: 100004

电话 Tel: +86-10-6590-9060

传真 Fax: +86-10-6590-9062

电子信箱 E-mail:

hiroshige.nakagawa@amt-law.com

网址 Website: www.andersonmoritomotsune.com, www.andersonmoritomotsune.cn