The number of investments made in Japan by Chinese enterprises has increased sharply in the past two years, with the amount invested more than doubling over the same period to around US$225million.

Starting with this article, we will examine a series of M&A projects conducted in Japan by Chinese enterprises, and Japan’s M&A regulations.

Partner

Anderson Mori and Tomotsune

Suntech Power – MSK

On 2 August 2006 Wuxi’s Suntech Power, a major producer of solar cells in China which is incorporated in the Cayman Islands and listed on NASDAQ, announced the acquisition of Japan’s MSK, the biggest producer of solar modules in Japan. The project received extensive media coverage and provides a point of reference concerning how to manage a target company after it has been acquired.

The acquisition was divided into two stages. First, Suntech Power acquired two-thirds of the shares in MSK for US$107 million by the end of September 2006. It subsequently acquired the remaining 476,600 shares in MSK in a swap for 1,310,300 of its own shares in June 2008.

Through the acquisition, Suntech moved into the rapidly growing integrated building materials-solar photovoltaic market. The project sparked concerns, as Suntech made use of the expertise and global sales network of MSK to improve its operations and sales by introducing Japanese technology into China. In another development, all the employees of one of MSK’s factories in Japan were dismissed in March 2007 after the factory was suddenly shut down upon completion of the acquisition. Subsequently, a new company was formed by the dismissed employees to continue operation by means of an employee buyout.

Suning Appliance – Laox

In June 2009 Suning Appliance announced its acquisition of Laox, a leading Japanese home appliance retailer with its main store in Akihabara, which is listed on the Second Board of the Tokyo Stock Exchange. It is the first acquisition by a Chinese listed company of a Japanese listed company.

Suning Appliance’s subsidiary in the Cayman Islands became the largest shareholder in Laox, holding nearly 30% of the shares, by subscribing for new Laox shares worth approximately 800 million yen (US$8.8 million) and subscribing for share acquisition rights – options to subscribe for new shares – over new shares exercisable at a price of approximately 210 million yen. Meanwhile, Laox placed new shares and new share acquisition rights (exercisable at a total price of approximately 190 million yen) worth 700 million yen with its regular client Nihon Kanko Menzei, a Japanese duty-free company whose business is targeted at Chinese tourists.

The proceeds raised through the placing amounted to approximately 1.9 billion yen and were used to buy more supplies for the business in Akihabara, to improve cash flow, and to redeem preference shares. If all of the shareholders of Laox exercise their new share acquisition rights, Suning Appliance will hold 29.33% of Laox, and Nihon Kanko Menzei will hold 25.67%, making a total shareholding of 55%. Laox having become a subsidiary of Suning Appliance, Suning Appliance appointed four directors and Nihon Kanko Menzei appointed two supervisors to Laox.

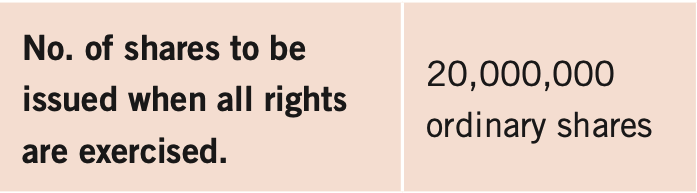

A highlight of the project was the use of share acquisition rights, which are not provided for in the PRC Company Law. Under Japanese law, a share acquisition right is an independent right not attaching to particular corporate bonds or shares; the holders of such a right may exercise it within a certain period and acquire new shares by paying the exercise price, or they may choose not to exercise the right until it is financially profitable to do so due to the movement of share prices. In this transaction, Laox issued the following new share acquisition rights:

Thus Suning Appliance can acquire 20 million ordinary shares, if it exercises all of its share acquisition rights before the exercise date in 2013, by paying 400 million yen.

The share acquisition rights regime in Japan is very flexible. The exercise price in the project is fixed; however, share acquisition rights with revised terms can also be issued.

Distressed company takeovers

Unlike in the PRC, it has become common in recent years for investors to use court proceedings to acquire financially distressed companies in Japan. This trend became particularly noticeable after the Civil Rehabilitation Law came into force in 2000. Under this law, a financially distressed company may file an application for court protection, with management maintaining control over the company.

This is similar to the Chapter 11 procedure in the US. A pre-packaged plan, agreed by an acquirer and target company in advance of filing an application, is more likely to rehabilitate the bankrupt company with new capital to be injected by the new investor.

There are several precedents for ChinesecompaniesacquiringJapanese companies through court proceedings, one of which is Shanghai Electric’s acquisition of Akiyama Electric in 2001. Shanghai Electric formed a new Japanese acquisition vehicle, and upon approval from a court-appointed supervisor, the new entity acquired the business of Akiyama Electric under the Civil Rehabilitation Law. By the court proceedings, the debt of the target company was legally reduced, and Shanghai Electric efficiently acquired the technology, human resources and customer relationships of Akiyama Electric.

Hiroshige Nakagawa is a partner at Anderson Mori and Tomotsune and chief representative of its Beijing office.

Beijing Fortune Bldg., Room 809

No. 5, Dong San Huan Beilu

Chao Yang Qu, Beijing, China

Postal code: 100004

Tel: +86 10 6590 9060

Fax: +86 10 6590 9062

Email: hiroshige.nakagawa@amt-law.com