On 30 March 2018, the China Securities Regulatory Commission (CSRC) released Several Opinions on Launching the Pilot Programme for Issuance of Shares or Depository Receipts by Innovative Companies in Domestic Market, clarifying the new paths for innovative companies seeking initial public offerings (IPOs) in mainland China, and the key principles to which they are subject.

LIU TAO

通商律师事务所合伙人

Partner

Commerce & Finance

Law Offices

On 4 May, the CSRC published the Measures for the Administration of Issuance and Trading of Depository Receipts (Draft for Comment), which, together with the pilot programme opinions, form the “new Chinese depositary receipts (CDR) policies”, to solicit comments from the public. The new CDR policies establish a unified regulatory framework for the issuance and trading of depository receipts.

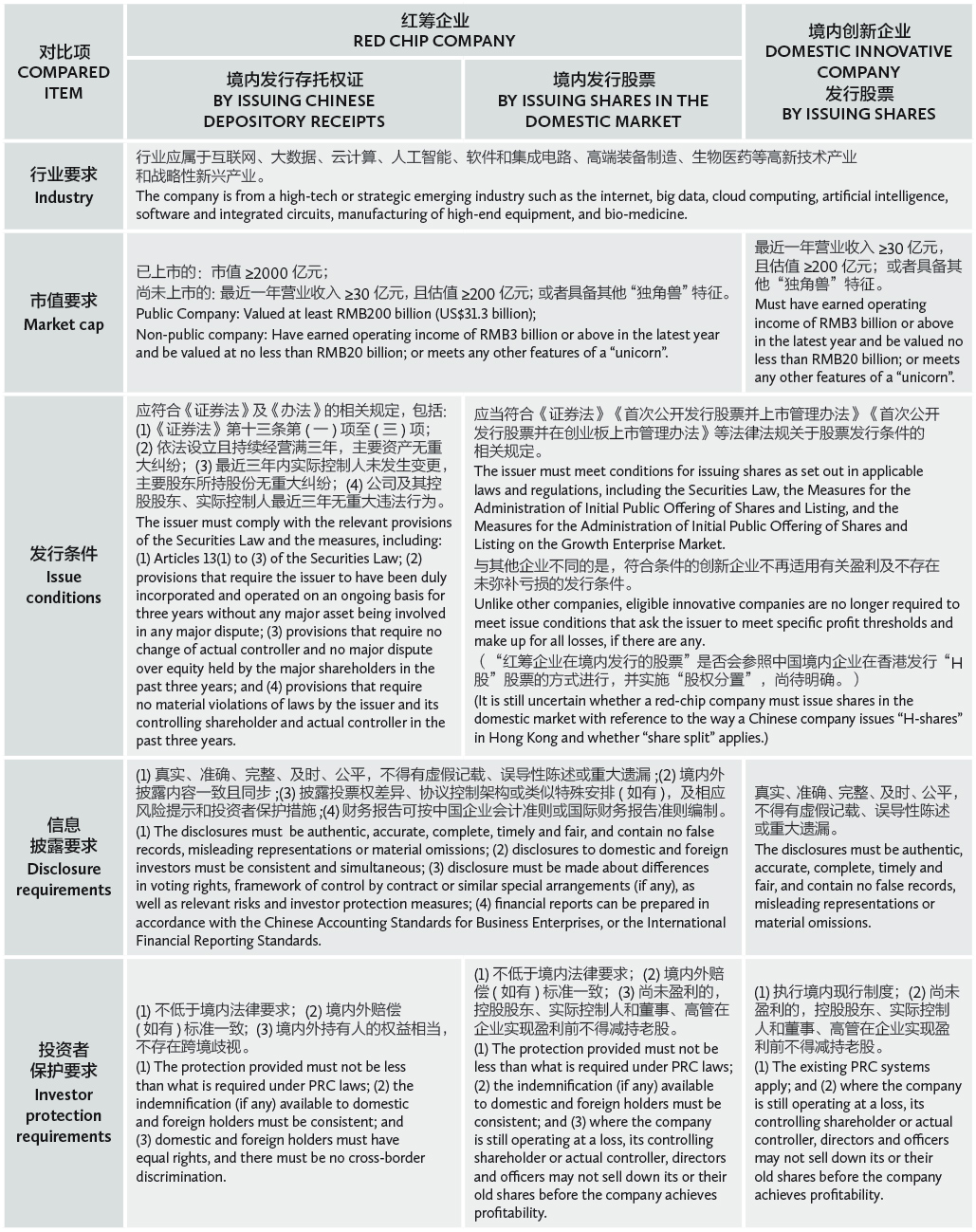

New options of IPO paths for innovative companies. The pilot programme opinions make it clear that there are three options for an innovative company to go public in mainland China: a red chip company may go public by issuing depository receipts, or shares in the domestic market; and a Chinese innovative company may go public by issuing shares in the domestic market.

Comparative analysis. Based on relevant provisions of the pilot programme opinions and the measures, a comparative analysis of the three options is summarized in the table on the page.

CONCLUSION

Before the introduction of the new CDR policies, the A-share market imposed profit requirements on issuers and prohibited them from allowing control by contract or maintaining an equity structure that allows “different rights attached to shares of the same classes”. These requirements have forced some innovative companies to go public on overseas capital market with a red-chip structure. As a main approach to returning to the A-share market, a public red-chip company needs to undergo privatization before it can become an IPO issuer in mainland China. However, privatization exposes the company to certain legal risks, not to mention the substantial cost of capital and time necessary to complete the process.

HUANG QINGFENG

通商律师事务所律师

Associate

Commerce & Finance

Law Offices

Specifying that eligible innovative companies are no longer required to meet specific profit thresholds and make up for all losses before going public in the domestic market, the new CDR policies remove profitability obstacles from eligible innovative companies’ access to capital through an IPO in the domestic market.

At the same time, by allowing a red-chip company to be structured with control by contract, or with “different rights attached to shares of the same classes”, the new CDR policies pave the way for direct IPOs in mainland China, helping red-chip companies to save the substantial capital and time cost that it may otherwise incur for undergoing a privatization as a prologue to an A-share IPO.

The authors believe that the new CDR policies will help the Chinese capital market attract a number of outstanding innovative companies. They will also help attract a growing number of foreign investors to the A-share market. As such, the new CDR policies will improve the investment value of the Chinese capital market, while enhancing the internationalization level and global influence of the A-share market.

Liu Tao is a partner at Commerce & Finance Law Offices in Shanghai. He can be contacted on +86 21 6019 3260 or by email at liutao@tongshang.com

Huang Qingfeng is an associate at Commerce & Finance Law Offices in Shanghai. He can be contacted on +86 21 6019 2695 or by email at huangqingfeng@tongshang.com