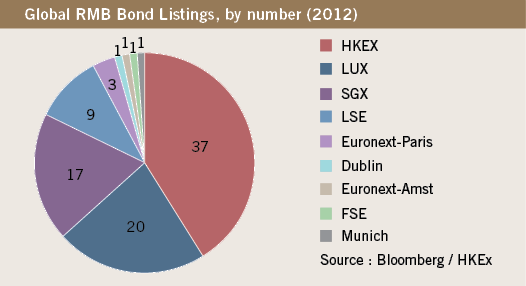

HongKong continues to be the leading venue for the listing of offshore RMB bonds, or so-called dim sum bonds). In 2012, there were 37 dim sum bond listings in Hong Kong, followed by 20 dim sum bond listings in Luxembourg and 17 in Singapore. RMB-denominated bonds made up approximately 34% of all bonds listed in Hong Kong in 2012. In terms of issue size, Hong Kong was also the top venue for dim sum bonds in 2012, with a total of approximately RMB61 billion (US$9.8 billion) raised.

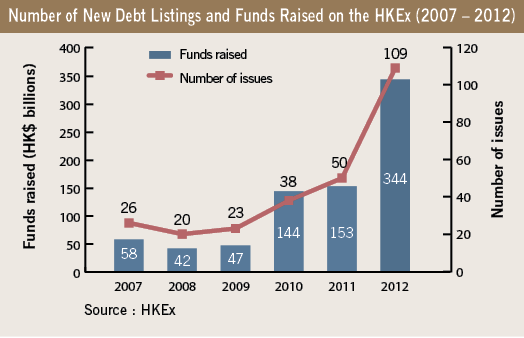

Hong Kong’s status in the dim sum bond market is cemented by numerous characteristics, including its reputation as the world’s leading offshore RMB deposit centre, as well as the world’s primary offshore trade settlement centre for RMB trade transactions, and continued support from Beijing, which generally encourages mainland Chinese enterprises to launch international offerings in Hong Kong. Recently, the Hong Kong Stock Exchange (HKEx) took steps to streamline the rules governing the listing of debt securities offered to professional investors. Since coming into effect in November 2011, these rules have significantly increased the number of new debt listings in Hong Kong as compared to previous years. Funds raised by newly listed debt securities in Hong Kong in 2012 totalled HK$344 billion (US$44.3 billion), more than double the amount of funds raised by new debt listings in 2011.

The new rules included four key amendments. First, HKEx eliminated the checklist-based approach to offering documents, replacing it with a general obligation that the applicant includes information that is customary for offers of debt securities to professional investors. As a result, HKEx will no longer review and comment on the substantive contents of an offering document, and the only specified requirements are responsibility and disclaimer statements in prescribed forms, and a statement limiting distribution of the offering document to professional investors.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

John Moore is a partner at Morrison & Foerster in Hong Kong. He can be contacted on +852 2585 0869 or by email at johnmoore@mofo.com

Melody He-Chen is a partner at Morrison & Foerster in Hong Kong. She can be contacted on + 852 2585 0887 or by email at mhechen@mofo.com

Norman Ho is an associate at Morrison & Foerster in Hong Kong. He can be contacted on +852 2585 0853 or by email at NHo@mofo.com