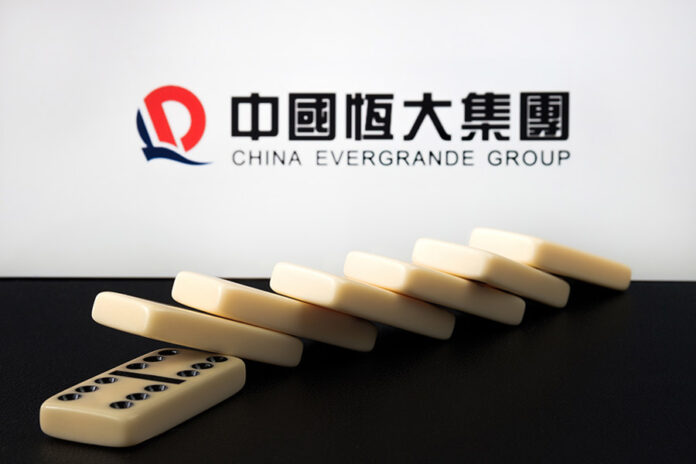

The most indebted real estate giant China Evergrande Group, burdened with RMB2.43 trillion (USD342.2 billion) in debt, is on the path towards liquidation after a high court order from Hong Kong to wind up its business.

Presiding judge Linda Chan ruled on 29 January that China Evergrande should be wound up for lack of progress in its restructuring programme and for being insolvent. “I think it would be a situation where the court would say, enough is enough,” said Chan.

The lawsuit, initiated by Top Shine Global in June 2022, sought to recover HKD862 million (USD110.28 million) from a bungled investment in China Evergrande. However, the winding-up hearing has been adjourned seven times to align with the handling of the debt restructuring programme.

José-Antonio Maurellet SC, from Des Veoux Chambers, represented China Evergrande while K.B. Chau & Co Solicitors advised Top Shine Global.

The court appointed two managing directors from Alvarez & Marsal, Edward Middleton and Tiffany Wong, as liquidators. Wong expressed her commitment to keeping Evergrande group’s business afloat and preserving its value in a systematic way to increase the chances of repayment to creditors and other stakeholders.

Lance Jiang, a partner at Ashurst, said the liquidator may devise a new restructuring plan.

“If this proposal is acceptable to all parties involved, it may be carried out according to the agreed restructuring … If the resources available to the liquidators are insufficient to persuade overseas creditors to agree to a new restructuring proposal, the liquidation administration may need to begin enforcement,” said Jiang.

“The way forward is still quite diverse, and I don’t think it’s necessarily to say that there’s no hope at all for [creditors].”

Jiang expected that, once the liquidation process began, the liquidator would be able to efficiently manage the assets of China Evergrande in jurisdictions that had adopted the UNCITRAL Model Law on Cross-Border Insolvency (1997).

Although the latest mutual recognition of judgments between mainland China and Hong Kong has come into effect, it does not apply to this case as bankruptcy judgments are not covered by the new ordinance.

A mainland court could recognise a winding-up order under the minutes and opinion of the Supreme People’s Court regarding mutual recognition and assistance in insolvency proceedings signed by mainland and Hong Kong authorities in 2021, said Jiang.

However, these provisions have only been piloted in Shanghai, Xiamen and Shenzhen. Not many insolvency cases had followed this route so far.

In April 2023, China Evergrande announced an offshore debt restructuring plan, which was highly anticipated to have a strong chance of approval by the market.

Sidley Austin and Maples Group represented China Evergrande in the restructuring plan, while Kirkland & Ellis and Harneys acted as legal counsel for the ad hoc group of bondholders.

“[The liquidation] provides a fair stance in the market. Otherwise, if property developers believe that Hong Kong courts are unlikely to wind them up easily, they will have a stronger position in negotiations with offshore [creditor] agents, making the negotiations more challenging,” said Jiang.