When Japanese companies invest in Taiwan, they mostly establish a Taiwanese company, either by a sole proprietorship or joint venture (JV) with others, or by becoming a new shareholder of an existing Taiwanese company. In the case of a JV, whether the shares can be transferred freely between the parties, the method and ratio of capital contribution, and the allocation of management rights are all key to the design of the JV contract.

CEO and Managing Partner

Email: lipolee@mail.fblaw.com.tw

The types of companies in Taiwan are mainly divided into limited companies, and companies limited by shares. A limited company is more suitable for a sole proprietorship or a number of shareholders with a close relationship, such as a family business. If the plan is to establish a JV company with a business partner, setting up a company limited by shares is usually the preferred option. Therefore, this article focuses on the company limited by shares, and introduces how to apply the provisions of Taiwan’s Company Act to design a JV contract that suits the needs of Japanese companies.

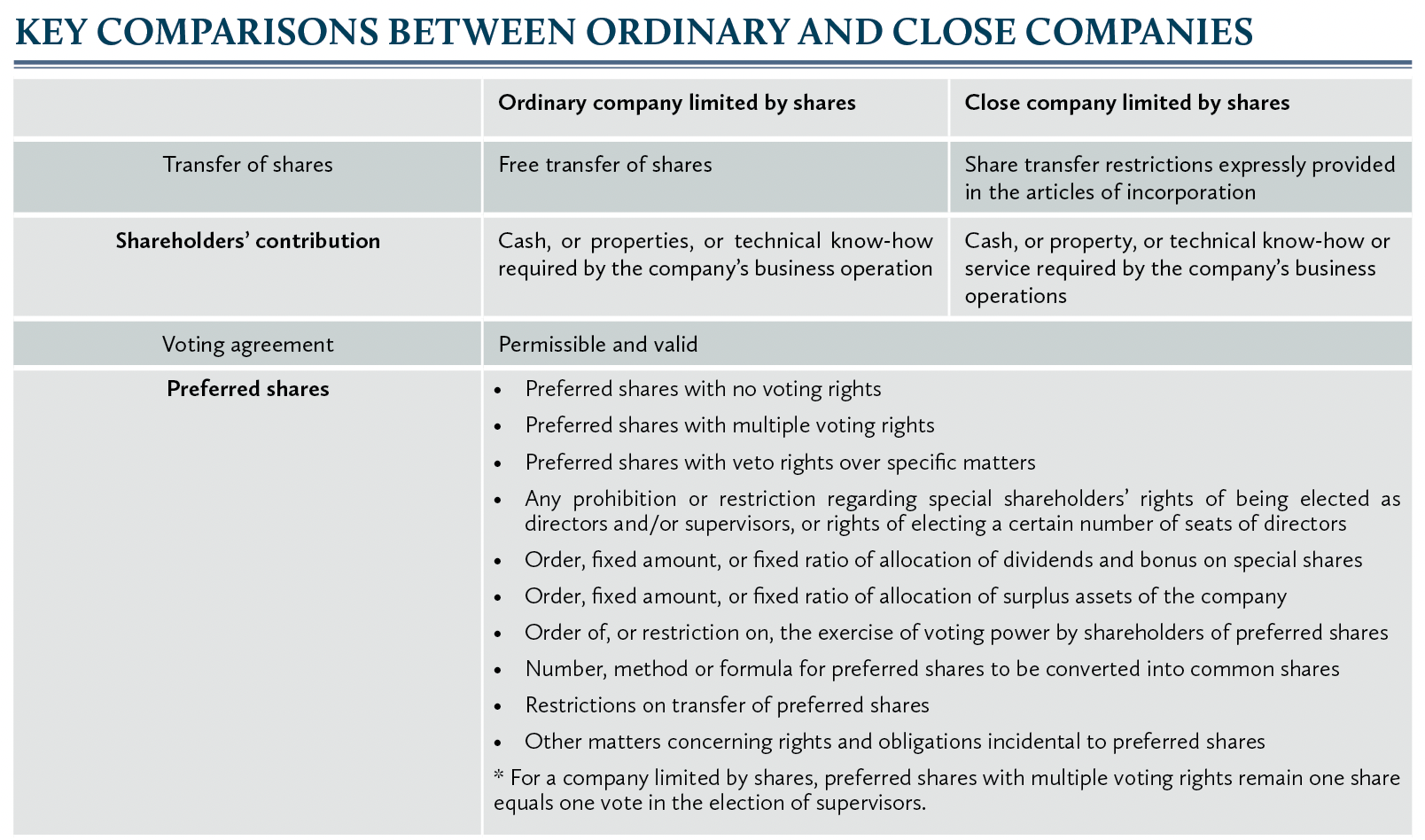

In terms of shareholder composition, the JV contract often stipulates that within a certain period of time, or before certain conditions precedent are met, shareholders cannot transfer shares freely, in order to maintain the company’s stable development at its initial stage. However, in principle, the shares of a company limited by shares can be freely transferred according to the laws of Taiwan. Specifically, if a party to the JV contract transfers shares in violation of the contract, the transfer of shares is still valid, and the other parties can only seek an indemnification for the breach of contract as remedy.

Therefore, to ensure that shareholders cannot freely transfer their shares, the parties can choose to establish a “closely held (or close) company limited by shares”, which is a special form of a company limited by shares. The basic conditions for establishing such a company are that shareholders cannot exceed 50 entities, and the restrictions on the transfer of shares for all shareholders must be expressly provided in the articles of incorporation, which may impose different restrictions on different shareholders.

Managing Partner

Email: chchen@mail.fblaw.com.tw

As there are restrictions on the transfer of shares in the articles of incorporation, if shares are transferred in violation of the articles of incorporation, such transfer shall be invalid. It should also be noted that, according to the interpretation of the competent authority, simply restricting the transfer period (e.g., “the shareholders cannot transfer the shares within five years after acquiring the shares”) does not meet the requirements for setting up a close company limited by shares, and there must be additional restrictions on the transfer of shares.

In terms of capital contribution, Taiwan’s Company Act stipulates that, in addition to cash, the capital contribution may be in the form of property or technical know-how required by the business of the company. A shareholder of a close company limited by shares may also choose to contribute the capital in the form of service.

In the event of a joint investment between the cash equity investors and the technical know-how holders or service providers, different types of capital contributions can be used to allocate shareholding so that the technology holder or service provider can invest with less cash, while obtaining a certain percentage of shareholding, which would encourage them to contribute actively in technical know-how or service. However, it should be noted that, because a Japanese company is a foreign investor, the company must obtain prior approval from the Ministry of Economic Affairs Investment Commission (MOEAIC) before investing, and set up a Taiwanese company.

If a foreign investor plans to invest in forms of property or technical know-how other than cash, other than mergers and acquisitions, the types of capital contributions that are currently expressly approved by the MOEAIC are “machine, equipment and raw materials for company own use” and “intellectual property rights”. The parties to a JV contract that desire to make capital contributions in the form of other properties or services should confirm with the MOEAIC in advance, to ensure that such a form of investment is feasible.

Partner

Email: teresa@mail.fblaw.com.tw

Regarding the allocation of management rights, it is common that the parties stipulate the number of directors and supervisors of each joint venturing party in the JV contract, and each party will agree to vote for the directors and supervisors’ candidates nominated by the other party. Before the amendment to the Company Act came into effect, on 1 November 2018, such voting agreements were often considered unlawful and invalid by the courts.

After the effective amendment date, a written agreement between shareholders to exercise shareholder voting rights jointly is legal and permissible, and a shareholder voting rights trust contract can also be set up so that the trustee can exercise the voting rights according to this contract. This means shareholders can agree in writing on how to exercise their voting rights in order to allocate seats for directors and supervisors, and they can also agree on other voting matters in the shareholders’ meeting.

However, it should be noted that the Company Act does not stipulate that a company is subject to the voting agreement between shareholders. Therefore, if one party violates the voting agreement, the voting shall still be considered valid, and the breaching party shall be liable for the breach of contract.

The allocation of management rights can also be carried out through the issuance of preferred shares. The Taiwan Company Act allows a company limited by shares to issue different types of preferred shares, such as preferred shares with no voting rights, preferred shares with multiple voting rights, and preferred shares with veto rights over specific matters.

Preferred shares may also be issued to restrict or prohibit the rights of shareholders of preferred shares to be elected as directors, supervisors, or the rights to elect a specific number of seats of directors. For example, to meet the needs of the company, preferred shares may be issued to attract pure financial investors who are entitled to a fixed amount or a fixed rate of dividends or bonuses, but have no voting rights, and cannot be elected as directors or supervisors.

To attract strategic investors, preferred shares may be issued with multiple voting rights, or veto rights on specific matters important to business operation decisions, or the right to elect a specific number of seats of directors. The JV contract can also specify how to design the types of preferred shares, and the target subject.

Taiwan and Japan have very similar laws and regulations, and the geographical and language barriers are relatively small. These characteristics have allowed most Japanese companies to invest in Taiwan for a long period, and quickly. During the covid-19 pandemic last year, Taiwan’s economic activities were mostly unaffected. Stable social and economic activities are expected to continue in 2021.

The economic environment of Taiwan is very suitable for investment by Japanese companies. If Japanese companies can make good use of the provisions of Taiwan’s Company Act and design suitable JV contracts with their business partners, such co-operation will create greater benefits for both Japan and Taiwan.

Lee Li-pu

CEO and Managing Partner

Email: lipolee@mail.fblaw.com.tw

Chen Chiu-hua

Managing Partner

Email: chchen@mail.fblaw.com.tw

Teresa Pan

Partner

Email: chchen@mail.fblaw.com.tw

Formosan Brothers Attorneys-at-Law

16F-6, No. 376, Sec. 4, Ren-Ai Rd.

Taipei, 106 Taiwan

Tel: +886 2 2705 8086 (ext. 515)

Email: fblaw@mail.fblaw.com.tw

www.fblaw.com.tw