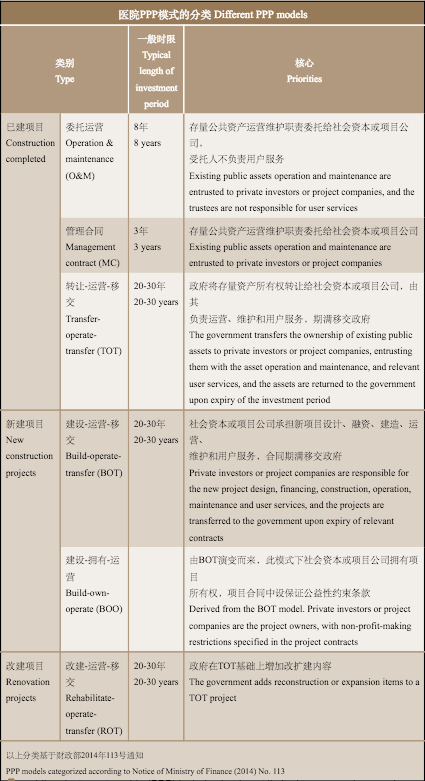

A public-private partnership (PPP) includes but is not limited to concession, service procurement and equity co-operation. Medical services are one of the sectors for which the adoption of the PPP model is encouraged by the state, and applying the PPP model among hospitals has huge market potential.

According to the Opinions to Promote Healthcare Industry Development, issued by the State Council in October 2013, it is planned that a well structured full-lifecycle healthcare service system with comprehensive business coverage will be established by 2020, representing total market volume of over RMB8 trillion (US$1.23 trillion). Furthermore, market-oriented healthcare reforms also lay the groundwork for introducing PPPs in the health sector.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Wang Zhijian is a senior partner at Zhonglun W&D Law Firm and head of the firm’s healthcare practice. He can be contacted on +86 28 6504 1007 or by email at wangzhijian@zlwd.com

Song Cheng, the firm’s associate in Chengdu and secretary-general of the healthcare practice, and Cao Yang, the firm’s associate in Chengdu, also contributed to this article