Environmental, social and governance (ESG) issues are increasingly at the forefront of business administration and strategy. To help in-house legal teams better navigate the ever-changing ESG landscape, the Association of Corporate Counsel (ACC) developed a curated collection of ESG-focused resources for in-house counsel, the ESG Resource Centre.

The resource centre provides legal departments with valuable strategies and tools to assume a leadership role in identifying, assessing, and capitalising on ESG opportunities, and to develop a leading ESG risk and compliance culture across their organisations. Some of the resources include articles highlighting the critical role of in-house counsel, ESG programme checklists, policies, and practice examples, as well as the evolving ESG regulatory framework and disclosure requirements from around the globe.

Mike Madden, ACC Global board chair noted, “The in-house legal function and the role of the GC have evolved from that of purely a legal function dealing with issues like the execution of intellectual property, litigation and regulations — to also taking on other portfolios such as corporate affairs, communications, procurement and crisis management — as well as ethical issues like ESG.”

ESG covers a multitude of topics, including sustainability, cybersecurity, and diversity, equity and inclusion (DEI), just to name a few. Madden notes that these issues are both driving and being influenced by an evolving legal and regulatory landscape, market dynamics and society’s expectations.

Material ESG factors are now considered crucial to a company’s long-term performance through improved reputation, a quicker economic recovery, value creation and shareholder satisfaction. As a result, Madden sees ESG considerations being proactively integrated into core organisational strategies, operations, and activities in numerous businesses – regardless of geographical location, industry, or size.

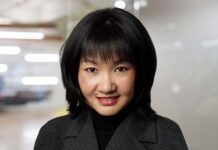

Tanya Khan, the ACC vice president and managing director for Australia and the Asia-Pacific, told Asia Business Law Journal, that in-house lawyers are often considered the moral compass of the business.

“By combining their unique understanding of the business and legal perspective, they are uniquely positioned within organisations to influence and spearhead strategic change,” said Khan. “As such, chief legal officers (CLOs) can have a tremendous impact by providing direction, insights, and guidance when it comes to identifying new opportunities for organisations and legal departments to most effectively leverage ESG issues.”

Since ESG considerations are incredibly broad and can impact every corner of an organisation, Khan sees that successfully identifying, integrating and managing them requires a robust and comprehensive approach to help the business implement an effective strategy, manage disclosures, strengthen relations with external stakeholders, and ensure overall accountability. Corporate leaders are increasingly recognising that CLOs are well-positioned to lead the effort on ESG because the legal function sits at the intersection of legal, compliance, reputation, risk and more – often managing or being heavily involved with the front-line teams responsible for disclosure, reporting and ethics.

Khan highlighted the 2022 ACC Chief Legal Officers Survey that found CLOs had direct oversight of more of the business today than in 2020. The surveyed CLOs directly oversaw 18 of the 21 functions, including compliance, ethics, privacy, government affairs and emerging portfolios such as ESG and DEI.

The survey also found legal department oversight of ESG had increased from 15% in 2020 to 24% in 2022. The nine-percentage point increase was the largest seen out of all of the functions surveyed. Four in 10 CLOs also indicate that ESG issues are forcing companies to improve their compliance efforts to adapt to new environmental regulations and satisfy the growing number of investors and customers emphasising ESG and corporate social responsibility. In addition, one in six respondents in public organisations reported having received pressure from investors regarding ESG matters.