New money is targeting India from surprising directions

George W Russell investigates

Globalization is just a word. But when it takes the form of surging foreign direct investment (FDI) into India from sources better known until recently as recipients rather than exporters of capital, promising opportunities for complex legal work beckon.

Some prescient firms say they are already reaping the benefits: “We started our South Asia practice in February 2005,” says Leena Pinsler of Rajah & Tann in Singapore “and while there was [only] a trickle of work [in the beginning], we have seen a tangible ballooning of interest in 2007.”

The complex tapestry of international trade and investment is not a “zero sum” game. Rather than replacing incoming funds from traditional sources of investment – the US, Britain, continental Europe and Japan – the “new money” merely constitutes a larger slice of an ever-growing pie.

“Foreign investment from India’s traditional economic partners in Europe and the US will continue to grow,” said Siddharth Raja, a partner with technology specialist law firm Narasappa, Doraswamy & Raja in Bangalore.

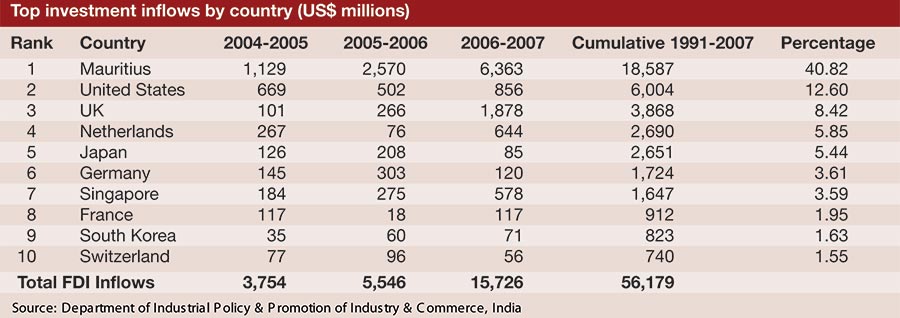

Overall, FDI into India has soared in recent years. According to the Indian Ministry of Commerce and Industry, the year 2006 saw investment of US$11.122 billion, compared with just US$4.362 billion in 2005. Most of the investment has come from the US, the United Kingdom, Japan and Germany, but “new money” is now joining the game.

India’s attractions as a destination for investment are increasingly grabbing the attention of the fastest-growing economies in Asia, the Arabian peninsula and eastern Europe. Energetic Indian diplomacy is also playing its part, see the emergence of India’s IT and business process outsourcing sectors as harbingers of opportunities to come.

Each of the source countries is at a different stage of its economic relationship with India. And, nominally, the top foreign investment source remains the tiny Indian Ocean islet of Mauritius – a quirk of bilateral tax treaties. (See Mauritius Inc on page 20.)

While the established FDI sources remain pre-eminent, it is new investment proposals from China, the Middle East and Southeast Asia that are grabbing the headlines. The “new Europe” is pitching in too, with investments from Scandinavia, and there is a resurgence of interest and funds from “old Europe” stalwarts France, Italy and Spain.

New investors emerge in Asia

Japanese investment into India stalled in tandem with its own economic difficulties and the jury is still out on whether it can regain a leading position. In the meantime, South Korean manufacturers have stolen some of their Japanese competitors’ thunder, most notably the likes of Daewoo Electronics and LG Electronics in consumer durables and machinery. Sidley Austin is advising Posco, a Korean steelmaker, in connection with its proposed US$12 billion investment in Orissa.

“Chinese investment is increasing, but not significantly, perhaps due to some political wariness on the part of Indians,” says Marcia A Wiss, a partner at Hogan & Hartson in Washington who was recently in Mumbai.

A growing interest in India has yet to translate into major billings for Chinese law firms but some have started to gain access to Indian clients – albeit indirectly – through international tie-ups. King & Wood, a prominent Beijing-based firm, for example, managed the link through affiliations with Hong Kong-based Arculli, Fong & Ng and Australia’s Gilbert & Tobin.

Other Chinese firms are adopting a wait-and-see attitude. “We do see a great increase in Chinese companies’ interest in investment in India,” says Irene Yang, a partner at the Guangdong Guangda Law Firm in Guangzhou. The only Indian law firm to establish a Chinese office is intellectual property major Remfry & Sagar, which opened a Beijing branch in 2006 headed by Nitin Sen.

International firms have had more success with China-India deals.

Lovells advised a Chinese contractor on its interests in a major India infrastructure project, said Crispin Rapinet, the firm’s regional managing partner. Some Chinese companies are using Singapore law firms as intermediaries in dealing with Indian counterparts but Nish Shetty, head of the India practice at WongPartnership in Singapore, said the opposite is more often true: Indian companies using Singapore as a bridgehead to China. “There is some vice-versa interest, though not as much,” he told India Business Law Journal.

If, or perhaps when, bilateral China-India trade and investment blossom, one focus of attention for PRC investors is expected to be raw materials, previously – and to some extent still – an area of strategic sensitivity on India’s such as the March 2007 green light from India’s National Development and Reforms Commission for the purchase by Qingtongxia Aluminium of a 50% stake in the Ashapura Minechem aluminium project in Gujarat, for which it paid US$651 million.

Roars of the “Lion State”

Roars of the “Lion State”

Both Singapore and Malaysia – facilitated partly by their significant populations of persons of Indian origin – have developed strong investment ties with India. One pioneer was Rajah and Tann in Singapore, whose head of the South Asia practice Leena Pinsler is seeing “a tangible ballooning of interest in 2007.”

Property and infrastructure are the major attractions for Singaporean investors in India. During 2007, Tan Peng Chin advised Ascendas India Development Fund Management in setting up a US$500 million India development fund. Rodyk & Davidson acted for Tiger Global Four Holdings, a hedge fund, in its US$60 million investment into Athena Projects, a holding company for hydroelectric and thermal power plants in India.

“Real estate is one area where interest is acute,” says Nish Shetty of WongPartnership, adding that fund activity is also high. His firm is working on the first Singapore real estate investment trust geared to Indian assets. GIC Real Estate, the property-investment arm of the state-owned Government of Singapore Investment Corporation, has been active in major India projects since 2006.

“Since the opening up of the Indian economy in 1991, the liberalization process has been an ongoing exercise,” said Colin Ng of Colin Ng & Partners in Singapore. His firm acted for Kubera Cross-Border Fund in its investment of US$20 million in Kejriwal Stationery Holdings.

International law firms are also using Singapore as a base from which to target India. For example, India has been cited as a key factor in Berwin Leighton Paisner’s decision to open a Singapore office. The firm reports strong Asian growth, particularly from the Indian subcontinent.

The Singapore connection is assisted by government initiatives such as the India-Singapore Comprehensive Economic Cooperation Agreement (CECA), signed in 2005. CECA has helped clear legal obstacles and provides some benefits for companies doing business in the other jurisdiction.

Malaysia and its ASEAN cousins gear up

Malaysia’s interests in the Indian economy have been confined mainly to the private sector, particularly oil and gas.

Jeff Leong, a senior partner with Deacons in Kuala Lumpur, said his firm is undertaking work on behalf of Malaysian firms related to the acquisition of an Indian pipe-coating company, a substantial stake in an Indian public listed pipe manufacturer and a joint venture with an Indian pipe maker. Malaysian companies are also interested in property and in the plantations of southern India.

Other Association of Southeast Asian Nations (ASEAN) member states adopt a relatively more cautious approach, although the Kolkata office of S Jalan & Co is advising Indonesia’s Salim Group in its township project in West Bengal.

Australia has been slower than most to get in on the India act. Indian Commerce and Industry Minister Kamal Nath noted recently that cumulative Australian investment in India between 1990 and 2005 was “an abysmal A$200 million,” about US$160 million at current rates. Even today it stands at less than US$2 billion.

Change may, however, be on the horizon. Kent Grey, a partner at Minter Ellison in Perth, noted in a recent analysis that India is “investing in Australian oil and gas ventures, as well as in traditional hard rock mining, which in turn is creating exciting reciprocal opportunities for Australian companies.”

Israeli, UAE, Saudi investments grow

After the ASEAN area, the Middle East is the most dynamic new investor in India.

Israel and several Arab countries – notably Saudi Arabia and the United Arab Emirates (UAE) – are forging into Indian markets. Many lawyers see India as plugging a vital gap to create a continuous line of operations from the Arab world to China.

“The opening of our new Dubai office on 1 May 2007 will provide an additional nexus for Lovells along what has been called ‘the new silk road’ of China, India and the Middle East,” says Rapinet.

Alec Emmerson, a partner at Clyde & Co in Dubai, reports that a UAE client is investing in Indian special economic zones. Part of the impetus to invest in India, say lawyers, is restrictions and limitations of size in some Arab home markets. “There is an increasing recognition that you have to have offshore investment,” says Vince Gordon, managing partner of Reed Smith Richards Butler in Abu Dhabi.

The UAE’s Nakheel and India’s DLF have inked a deal to build two townships in India, with an initial investment of US$5 billion each in the next three years.

Meanwhile, S Jalan & Co is advising the UAE giant Emaar Properties in relation to two projects in Kolkata. RJ Gagrat is leading a Gagrats team advising Emirates Building Systems (EBS) in setting up steel production projects in India in a venture with SKS Ispat & Power. Martin Harman of Pinsent Masons advised Delhi International Airport on its US$1.5 billion redevelopment through lawyers based at its Dubai joint venture office, Masons Galadari.

In Kuwait, Bryan Cave, led by David Pfeiffer, represented Noor Financial Investment Company in connection with an initial public offering of its Indian subsidiary, the Kuwait India Holding Company.

Bilateral trade between India and Saudi Arabia surged 28% from US$2.63 billion in 2005 to over US$3.44 billion last year. Henry Cort, a partner of Trowers & Hamlins in Dubai, says both he and the head of the firm’s Riyadh affiliate, Feras Al Shawaf at Feras Al Shawaf Lawyers & Legal Advisers, see more adventurous investment decisions being made by their Saudi clients. “There’s much more Saudi Arabian capital investment into India now,” says Cort.

Saudi Telecom’s US$3 billion deal in June to acquire a 25% stake in Maxis Communications, Malaysia’s biggest mobile operator, is widely seen as a way to gain greater access to India. Saudi Telecom and Maxis plan to spend US$900 million on expanding the operations of Aircel, a Maxis-owned Indian mobile provider with six million customers.

Dubai corporate partner Bruce Embley headed the Freshfields Bruckhaus Deringer team acting for Saudi Telecom, while Clifford Chance’s Singapore managing partner Philip Rapp led a team advising Maxis.

Israel is also becoming a major investor, especially in IT and telecommunications.

“We are seeing Israeli investment into India picking up, albeit small in relative terms,” says Raja at Narasappa, Doraswamy & Raja. Bird & Bird recently advised Plaza Centers, a Dutch subsidiary of Israel’s Elbit Medical Imaging that develops shopping malls in India, in respect of its US$1 billion-plus IPO. Indian lawyers reporting new Israeli clients include Khaitan & Co partner Rabindra Jhunjhunwala and Bhasin & Co managing partner Lalit Bhasin.

The new “old Europe”

Khaitan & Co’s Rajiv Khaitan recently advised Bangalore icon MTR Foods on its acquisition by Orkla, a diversified Norwegian conglomerate, for about US$100 million.

European engineering companies continue to invest heavily in manufacturing. “The sector undergoing the maximum activity [from Europe] is the electrical machinery and machinery components sector,” says Niranjana Unnikrishnan, a partner at Economic Laws Practice in Mumbai.

“Investments from Germany and Finland, specifically, have been noted.”

Newly empowered private investors in Italy and Spain have also scored some major deals: Gagrats is Indian counsel to Generacion Eolica International, a Spanish wind power generator, while Vineet Aneja led a FoxMandal Little team advising Holla & Holla Associates, owners of Manipal Press, on its June 2007 acquisition by Leguprint of Italy. OP Khaitan & Co is assisting a large Italian property company, Beni Stabili, on setting up a wholly-owned subsidiary in India.

Fellow EU members Italy and France are also active. In March 2007, Lavazza, Italy’s largest coffee company, signed an agreement to acquire a 100% stake in India’s Barista Coffee, a chain of coffee shops, from Sterling Infotech for US$130 million.

Italian fashion and luxury goods companies are also moving in.

Clotilde Iaia, a partner at Khasawneh & Associates in Dubai, says India is one of the largest markets in the world for haute couture. Delhi-based Titus & Co and Milan-based Studio Legale Padovan have forged an alliance that has already seen 20 Italian companies invest in India since 2005.

Amarchand & Mangaldas & Suresh A Shroff & Co, meanwhile, advised BNP Paribas as it acquired an equity stake in Geojit Financials for around US$50 million. FoxMandal Little advised Geojit.

Both local firms work closely with Gide Loyrette Nouel – the expansionary French firm with a burgeoning Asian client roster – on a number of India-related deals. Paris-based partner Christophe Eck said from Chennai that French car manufacturers are particularly interested in making India investments.

“We also have inquiries from banks, distributors and infrastructure clients,” says Eck.

“India will be a much greater part of our business.”

UK legal advisers are also reporting growth. Herbert Smith and Linklaters are major forces in mergers and acquisitions, while Allen & Overy and Fladgate Fielder are major international transaction counsel on share placements. Arnold & Porter is another key legal name among investors in India.

North American firms more active

The US remains the largest investor in India (when investments routed via Mauritius are taken into account). US investment continues to increase, especially in the manufacturing and outsourcing sectors, partly due to the non-resident Indian factor.

“Indian-American businessmen are increasingly investing in India,” says Wiss of Hogan & Hartson, who adds that American private equity investment has risen sharply.

US venture capital investments are projected to rise to US$1 billion this year, up from US$508 million in 2006 and US$224 million in 2005, according to a recent report by the US-India Venture Capital Association.

The Silicon Valley offices of law firms such as Akin Gump Strauss Hauer & Feld, Fenwick & West and Wilson Sonsini Goodrich & Rosati have done much to facilitate such investment.

However, an Indian government proposal in February 2007 to impose a 35% tax on stock options could hinder future progress.

“US companies are just looking at the infrastructure sector again after the reluctance some attribute to the Dabhol matter,” says Wiss.

The Dabhol power plant in Maharashtra, a US$2.8 billion project began in 1992 but was cancelled in 1996 after a dispute over pricing between Enron International, the managers of the plant and the governments of Maharashtra state and India.

Shearman & Sterling, Davis Polk & Wardwell, White & Case and Kelley Drye & Warren all have important capital markets practices involved in India, while Chadbourne & Parke works on key energy and infrastructure projects.

Paul, Hastings, Janofsky & Walker recently advised Citigroup Property Investors, the real estate investment business of Citigroup, on the formation of a US$1.29 billion fund to invest in real estate and related assets, primarily in India.

Canada is also emerging as a significant investment partner, especially in the natural resources sector, although, in the words of Sunny Handa, a partner at Blake, Cassels & Graydon in Montreal.

“India has just come on line in the past two years,” he said.

“India itself is finally hustling for business,” Handa adds. He cites Indian IT and software companies as likely targets of Canadian investors, especially those engaged in digital graphics animation.

All in all, for “new” money or “old”, India is open for business.

Mauritius Inc

India’s tax system rewards careful planning

Nominally, India’s top foreign investment source is Mauritius, but this is in essence a quirk of the Indian tax system.

Mauritius, an offshore tax haven, has a double tax avoidance treaty with India.

A number of Mauritian law firms such as Erriah & Uteem Chambers, based in the capital of Port Louis, have created a business out of this sometimes-controversial loophole – one which Indian finance minister, P Chidambaram, has publicly considered closing.

The Indian Ocean island state is the primary route for most US venture capital and much European investment.

Critics have long argued that the agreement allows Indian companies to avoid paying capital gains tax, while Mauritius has also been accused of being a conduit for laundered money and an avenue for Indian companies to “round-trip” domestic investment to take advantage of benefits afforded to true foreign investors.

Roars of the “Lion State”

Roars of the “Lion State”