The reform of state-owned enterprises (SOEs) that rolls out nationwide is driving more and more SOEs to take part in the restructurings of listed companies. Examples include material asset restructurings between SOEs and listed companies under their control or between listed companies under common control of SOE conglomerates, as well as transactions whereby SOEs seek to acquire equity in outperforming listed companies as counterparties in their restructurings.

DU LILI

国枫律师事务所合伙人

Partner

Grandway Law Offices

Pursuant to the Measures for the Administration of Material Asset Restructurings of Listed Companies (amended in 2016), the Guidelines on the Contents and Formats of Information Disclosure by Companies Publicly Offering Securities No.26 – Material Asset Restructurings of Listed Companies (amended in 2017) and other applicable regulations, material asset restructurings of listed companies must undergo necessary, lawful and valid approval or authorization procedures. The procedures for listed companies’ material asset restructurings that involve SOEs are no doubt top concerns of reviewers.

This article looks at approval procedures for two usual scenarios where SOEs are involved in restructurings of listed companies, the first relating to participation by SOEs that results in change of their equity in the listed companies, and the second relating to acquisition of shares as new shareholders by financial SOEs through the participation. In the first part of the article we look at the first scenario.

According to the Circular on Issues concerning the Regulation of Asset Restructurings between Listed Companies and State-owned Shareholders, asset restructuring between a listed company and its state-owned shareholder (which may be a company), to which the Circular applies, means a transaction whereby an existing or potential state-owned shareholder injects any asset into, or purchases any asset from, or exchanges any asset with a listed company, thereby resulting in change of the state-owned shareholder’s equity in the listed company. The Circular will not apply if the equity is acquired with cash.

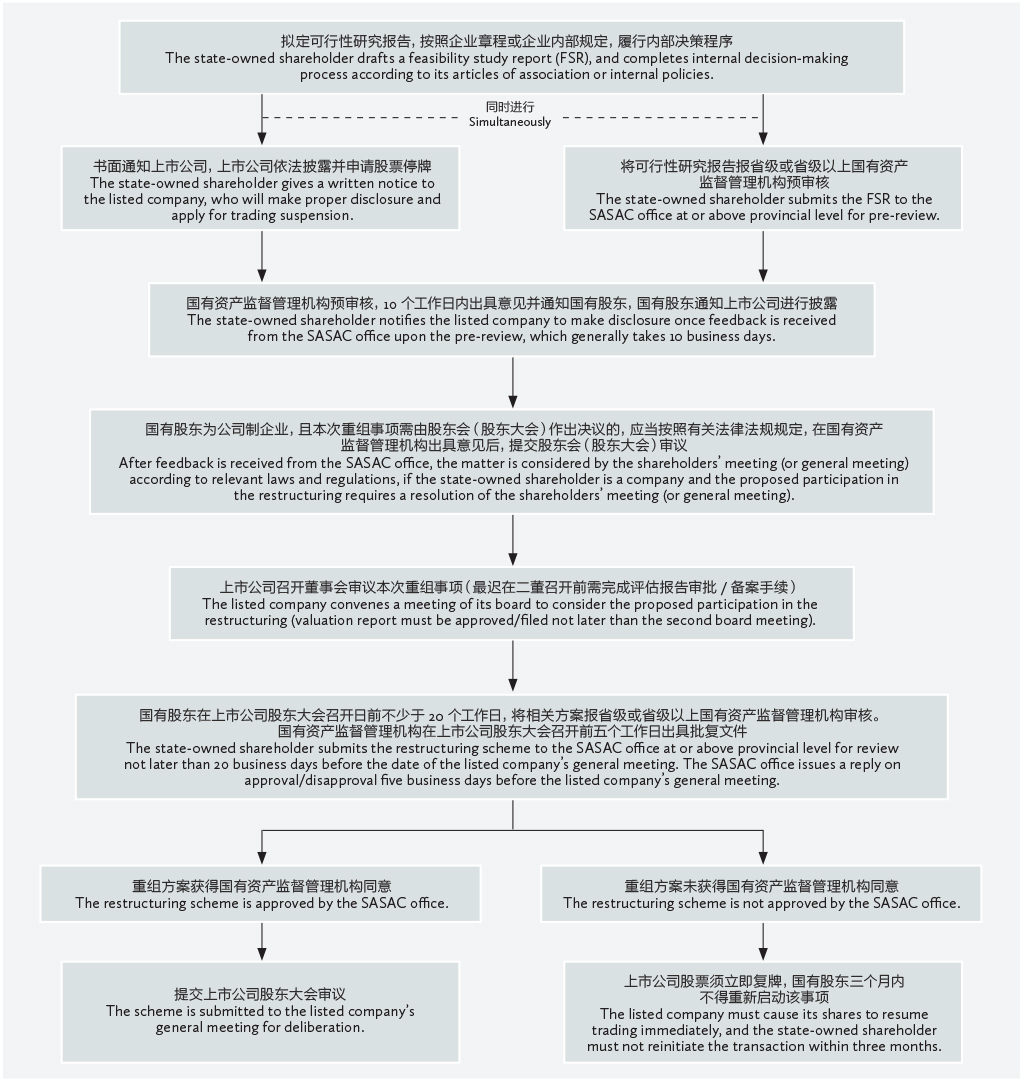

The flowchart in this column explains the key steps of the approval procedures, as required by the Circular, for cases where asset restructurings between state-owned shareholders and listed companies result in change of equity held by the state-owned shareholders.

It should be noted that in order to participate in a listed company’s restructuring, the SOE does not only have to undergo approval procedures for its own account, but also ensure that its controlling shareholder or actual controller (e.g., a central enterprise) completes internal decision-making or authorization process, if any. If the restructuring involves different underlying assets (e.g., a combination of equity and non-equity assets), approval procedures need to be undergone respectively pursuant to regulations governing the underlying assets, which may include but not be limited to the Law on State-Owned Assets of Enterprises, the Interim Measures for the Supervision and Administration of State-Owned Assets of Enterprises, and the Measures for the Supervision and Administration over Transactions in State-Owned Assets of Enterprises.

Du Lili is a partner and Zhao Yuanyuan is a trainee at Grandway Law Offices

北京市东城区建国门内大街26号新闻大厦7层 邮编:100005

7/F, Beijing News Plaza

No. 26 Jianguomennei Dajie

Beijing 100005, China

电话 Tel: +86 10 8800 4488 / 6609 0088

传真 Fax: +86 10 6609 0016

电子信箱 E-mail:

dulili@grandwaylaw.com

zhaoyuanyuan@grandwaylaw.com