Concerns from private equity (PE) investors on the recently launched National Equity Exchange Quotation, or the New Third Board, about their exit returns have been largely relieved as the board sets no threshold on applicants’ profits. The recovering securities market is also fuelling capital raising in start-ups. From a founder’s perspective, PE investors’ market valuation of the founder’s business is of the greatest importance. However, if the founder attaches importance only to valuation, but neglects the clauses of, e.g., liquidation and repurchasing, disputes may erupt unexpectedly at later stages.

Alternative to valuation

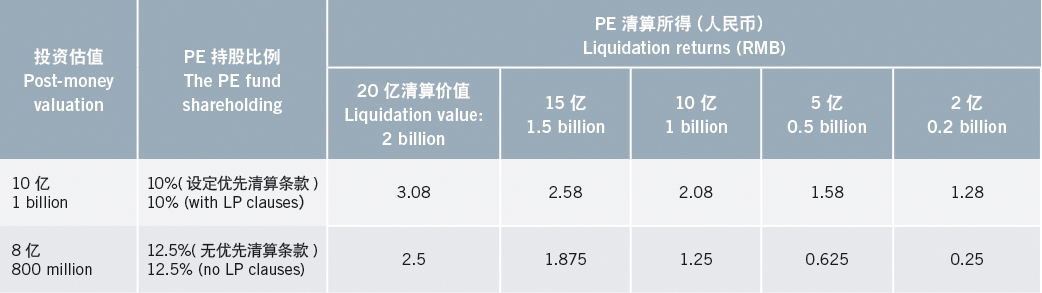

Company X will be used as an illustrative example. Company X completed its round A financing in April 2014. No liquidation preference clause (LP clause) was set in round A. The company raised RMB 100 million (US$16.1 million) in its round B financing in April 2015, and its post-money valuation was RMB 1 billion. The PE investor holds a 10% stake of the company.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Liu Yan is an arbitrator of Beijing Arbitration Commission and a professor of the Peking University School of Law. Lu Huaqiang is a PhD candidate of the Peking University School of Law