In 2004, China formally issued regulations on the outbound direct investment (ODI) of Chinese enterprises. A decade later, in 2014, China made overall adjustments to the ODI regulatory system, transforming from the approval system to the filing system (that is, filing is generally required for normal ODI projects, and approval is only required in special case”). In 2017, under the principle of the filing system, the relevant departments further established a supervision principle based on classification (encouragement, restriction and prohibition) based on the nature of the projects in practice. Since then, both from the perspective of overall regulatory principles or specific regulatory measures, China has established a complete ODI regulatory legal system.

Partner

Llinks Law Offices

Nevertheless, against a background of an increasingly well-placed situation for Chinese enterprises in investment and M&A transactions around the world, many of them still lack understanding of the application procedures of ODI projects and the requirements of “substantive review” and “case-by-case review”, and there are a large number of cases where the applications fail due to the improper implementation of ODI procedures or inadequate preparation.

Under the current regulatory system, once there are flaws in the ODI procedure, enterprises do not have the opportunity to “supplement” materials and “correct” mistakes afterwards. This may also affect enterprises that fail to properly implement ODI procedures in terms of compliance in operation, follow-up transactions of overseas investment projects (equity sale or introduction of new investors, and repatriation of funds), and even future listing of enterprises.

Partner

Llinks Law Offices

In order to better help enterprises understand the regulatory requirements and operational practices of ODI, this article analyzes and sort some of the most frequently encountered problems in ODI applications, including the following: (1) assessing whether the project needs to apply for ODI; (2) ODI application timing; (3) ODI applicant (how to deal with multiple applicants); (4) use of “route company”; (5) how to define “overseas reinvestment”; (6) simultaneous acquisition of multiple projects under the same control abroad; and (7) the impact of the JV party/counterparty’s overseas investment procedure on the ODI application.

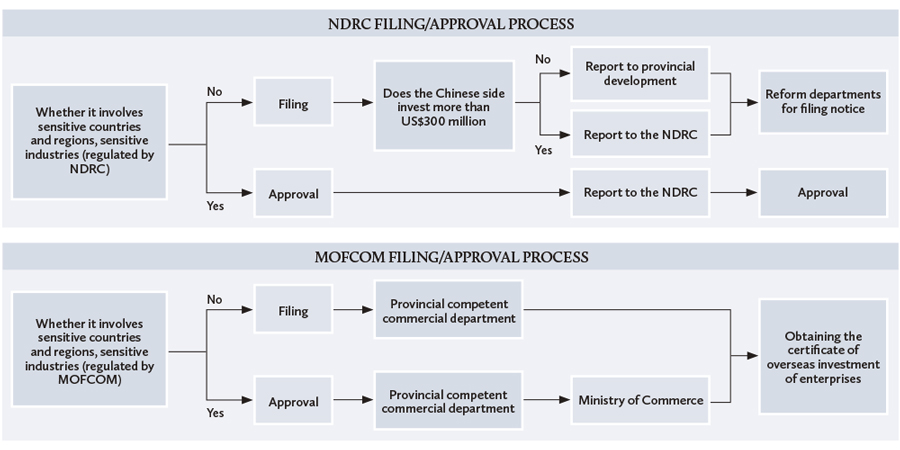

The current supervision system: three-way supervision and varied dimensions of review. Under the current legal system, the ODI projects carried out by Chinese enterprises are mainly supervised by the National Development and Reform Commission (NDRC), the Ministry of Commerce (MOFCOM) and the State Administration of Foreign Exchange (SAFE).The NDRC and the commissions of commerce are responsible for the review of ODI projects, while SAFE controls the remittance of funds.

In the ODI application process, enterprises need to obtain the approval of or file with the NDRC and MOFCOM, and then apply to banks for remittance of funds within the approved quota of foreign currency. The general enterprise ODI application procedure is shown in the figure below:

It should be noted that there are differences in the strictness of review, the understanding of laws and regulations, and the acceptance of complex and special projects among the local competent authorities. For example, some local authorities tend to hold a negative attitude towards the final remittance of funds from ODI projects to the domestic subsidiaries of overseas companies, while some will not pay special attention to it. It is suggested that enterprises should understand the differences and prepare before applying by communicating with the competent authorities or consulting professional advisers.

The competent authorities will not only intervene and implement supervision at the stage of filing/approval. Enterprises also have the obligation to report to ODI authorities in advance (before the implementation of the project) and afterwards (after the completion of the investment) for ODI projects, and the supervision of the competent authorities actually covers the whole process of overseas investment activities. Enterprises’ failure to fully fulfil the relevant reporting obligations may also lead to defective records of ODI projects with the competent authorities.

Selena She and Kenneth Kong are partners at Llinks Law Offices.

Llinks Law Offices

16F / 19F, ONE LUJIAZUI, 68 Yin Cheng Road Middle

Shanghai 200120, China

Tel: +86 21 3135 8666

Fax: +86 21 3135 8600

E-mail:

selena.she@llinkslaw.com

kenneth.kong@llinkslaw.com

www.llinkslaw.com