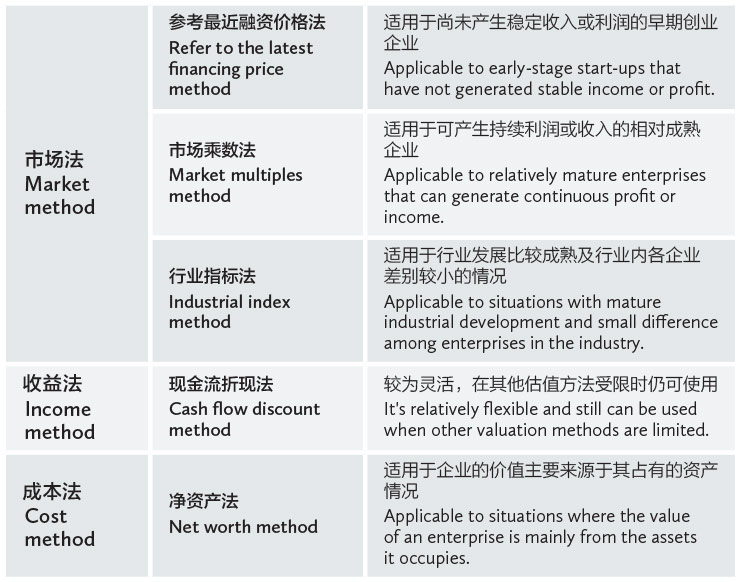

In order to guide the professional valuation of non-listed equity investments of privately offered funds, the Asset Management Association of China (AMAC) issued a Guideline for Valuation of Non-listed Equity Investment of Privately Offered Funds (Trial Implementation) on 30 March 2018. The guideline proposes five specific valuation methods, applicable scenarios and the guideline for investment in non-listed enterprises using privately offered funds.

Xiao Weixiao

邦信阳中建中汇律师事务所律师

Associate

Boss & Young

From the perspective of equity investment, the enterprise life cycle can be divided into the initial stage (angel investment stage), growth stage (VC investment stage), rapid/stable development stage (PE investment stage), expansion stage (pre-IPO stage) and mature stage (IPO listing stage). Different valuation methods are used for the enterprises in different developmental stages.

Initial stage/growth stage: refer to the latest financing price method. This refers to the equity valuation by reference to the latest financing price of the invested enterprise, and it is applicable to invested enterprises that are in the initial stage and growth stage, with no stable income, but with frequent financing activities. When adopting this method, judging the fairness of the latest financing price is required, for example, whether the latest transaction is an inconsistent transaction, whether the enterprise is forced to sell equity or it is a rescue investment for the invested enterprise in crisis. The longer the valuation date (measured from the time of financing completion), the weaker the reference to the significance of the latest financing price will be.

Rapid/stable development stage: cash flow discount method. This method discounts the future cash flow of the invested enterprises after the valuation date at an appropriate discount rate, and the discounts are aggregated to obtain a corresponding value.

When using the cash flow discount method, a deep analysis of the financial data and operation model of the invested enterprises is required, which is

beneficial to understanding the core driving factors.

Wang Yubi

邦信阳中建中汇律师事务所律师助理

Paralegal

Boss & Young

Pre-IPO stage: market multiples method. Under a condition where the invested enterprises are relatively mature with sustainable profits or incomes, market multiples such as P/E (price-to-earnings ratio), P/B (price-to-book ratio), P/S (price-to-sales ratio), EV/EBITDA (EV=enterprise value; EBITDA=earnings before interest, taxes, depreciation and amortization) and EV/EBIT (EBIT =earnings before interest and taxes) can be used for valuation.

When using market multiples, comparable companies are required to be selected, i.e., comparable listed companies or comparable transaction cases that have a similar enterprise scale, risk conditions and profit growth potential can be used to obtain comparable market multiples by analysis and calculation.

Common market multiples include P/E, which is the multiple of equity value to the enterprise net profit, P/B, which is the multiple of equity value to the enterprise net assets, and P/S, which is the multiple of equity value to the enterprise sales income etc. Different market multiples are suitable for different types of enterprises, for example, P/B is applicable to financial

enterprises with high asset liquidity because such enterprises have a net asset book value much closer to the market value. P/S is mainly applicable to income-driven enterprises with a stable ratio of sales to cost, such as public transportation enterprises, internet enterprises (typically e-commerce enterprises) and communication equipment manufacturing enterprises.

Net worth method. When the value of an enterprise is mainly from the assets it occupies, this method will apply. For example, heavy asset enterprises or investment holding enterprise, or invested enterprises that have bad operating conditions and may be liquidated. The net worth method is based on the enterprise’s balance sheet, with contents that can be evaluated such as current assets, machinery equipment, intangible assets, long-term unamortized expenses and liabilities. This method is known as the valuation method closest to the accounting method.

Verification and evaluation: industrial index method. In some industries with mature development and with little differences among enterprises, a specific industry index directly connected to the fair value can be used as the reference basis for valuation of fair value of the invested enterprises; however, the industrial index method is generally used to examine whether the valuation conclusions obtained from other valuation methods are relatively reasonable, and should not be separately used as a main valuation method.

The guideline was published in view of the fact that there is still a lack of valuation standards for non-listed equity investments of privately offered funds and the use different operational methods in valuation practice by administrators of privately offered funds. Because the guideline will be formally implemented from 1 July 2018, the administrator of a privately offered fund is obliged to examine the valuation conclusion regularly to prevent the likelihood of a major deviation in valuation, and must bear the ultimate liability for the valuation method and valuation parameters.

Xiao Weixiao is an associate and Wang Yubi is a paralegal at Boss & Young

中国上海市黄浦区中山南路100号

金外滩国际广场12-15楼 邮编:200010

12/F-15/F, 100 Bund Square

100 South Zhongshan Road

Huangpu District, Shanghai 200010, China

电话 Tel: +86 21 2316 9090

传真 Fax: +86 21 2316 9000

电子邮箱 E-mail:

liuhui@boss-young.com

wangyubi@boss-young.com