The Legislative Affairs Office of the State Council promulgated on 30 August 2017 the Interim Regulations (Draft for Soliciting Opinions) on the Administration of Private Equity Investment Funds (the exposure draft) to make further provisions with respect to the managers, custodians, capital raising, operation, information disclosure, self-regulation, supervision and management of “private equity securities investment funds and private equity investment funds”. The exposure draft also has a chapter dedicated to venture capital funds. The draft, however, does not make any mention of “managers of private equity funds of other categories”. So under the new policy, what should managers of private equity funds of other categories do?

Founding Partner

Hengdu Law Firm

Creation of private equity funds of other categories. Private equity funds of other categories were created on 21 August 2014. Article 2 of the Interim Measures for the Supervision and Administration of Private Equity Investment Funds stipulates that “investments that may be made with the assets of private equity funds include stocks, equities, bonds, futures, options, fund units and other investments agreed upon in investment contracts”. Article 20 stipulates that, “For the formation of private equity funds of other categories, the rights and obligations of the parties and other relevant matters shall be expressly stipulated in the fund contract in the light of the provisions of Article 93 and Article 94 of the Securities Investment Fund Law.”

In 2014, the private equity fund registration system (commonly known as the “old system”) of the Asset Management Association of China (AMAC) added private equity investment funds of other categories, but the old system was confusing in terms of the classification of investments.

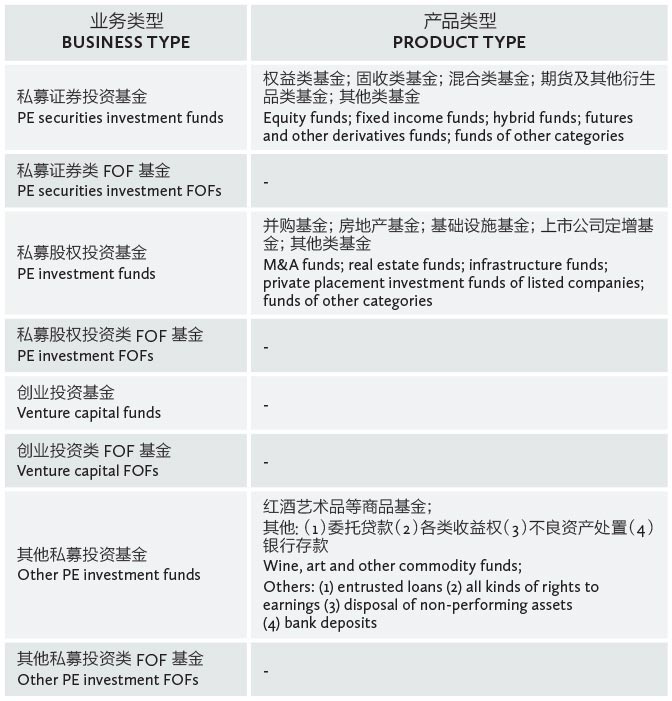

On 6 September 2016, the “integrated submission platform for asset management” (commonly known as the “first phase of the new system”) of AMAC was launched. The first phase of the new system reclassifies funds and products, but still retains private equity investment funds of other categories (see Table 1).

Capital Market Associate

Hengdu Law Firm

Status quo of private equity investment funds of other categories. After querying the private equity fund information disclosure system and the private equity fund manager integrated query system, the author found that from 25 March 2014 to 10 September 2017, a total of 743 funds of other categories had their managers successfully registered, including 151 funds in 2014, 411 in 2015, 114 in 2016 and 67 in 2017 (as of 10 September).

On 31 March 2017, AMAC issued Q&A (13), requiring the implementation of the specialized operation principle, under which the manager of a private equity fund can only select “manager of a private equity securities investment fund”, “manager of a private equity investment/venture capital fund” or “manager of a private equity investment fund of other categories” for the type of institution.

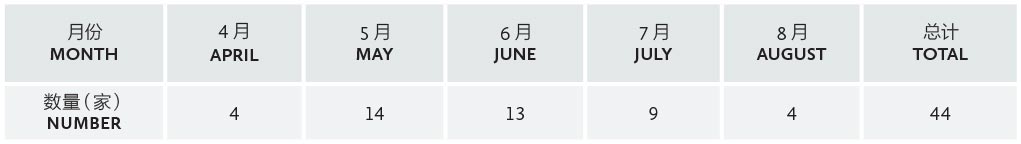

Based on this, I further summarized the registration of the managers of private equity funds of other categories since 1 April 2017 (see Table 2).

Future of private equity investment funds of other categories. Private equity investment funds of other categories are mainly targeted at non-standardized claimable assets. According to the Notice of the CBRC on Issues Concerning the Regulation of the Investment Operations of Commercial Banks’ Financial Management Business, non-standardized claimable assets include but are not limited to credit assets, trust loans, entrusted debt investments, acceptance drafts, letters of credit, accounts receivable, all kinds of beneficiary rights (rights to earnings) and equity financing with a buy-back clause.

The exposure draft comment period ended on 30 September 2017. Where do the managers of private equity funds of other categories and private equity investment fund products go? The answer will soon be revealed with the release of the official document.

Author: Jiang Fengtao is the founding partner and Zhang Jinjin is a capital market associate at Hengdu Law Firm

北京市朝阳区建国门外大街1号

国贸大厦3期B座50层 邮编:100004

50/F, Block B, China World Trade Center Tower 3

No.1 Jian Guo Men Wai Avenue

Chaoyang District, Beijing 100004, China

电话 Tel: +86 10 5985 2999

传真 Fax: +86 10 5760 0599

电子邮箱 E-mail: hengdulaw@hengdulaw.com

www.hengdulaw.com