An overseas merger and acquisition (M&A) transaction does not only involve two or more countries or regions, but also parties that may differ notably in terms of strategy plan, expertise, financial strength and human resources. In recent years, not a few overseas M&A proposals offered by Chinese companies suffered setbacks as a direct result of severely asymmetric information in the possession of the parties and a lack of effective risk control measures of the Chinese acquirers. In this article, we look into the possible issues and risks that legal due diligence (LDD) may address.

LIN ZHONG

瑛明律师事务所

合伙人

Partner

EY Chen & Co. Law Firm

Purpose and effect. By confirming legal status of significant issues (e.g., legal capacity, business and assets of the seller), identifying potential risks and determining their nature and extent, as well as their impact and implications on the proposed transaction, the LDD of an overseas M&A transaction aims to provide a basis for pertinent arrangements under the transaction agreement so that legal risks are brought under control. Valuation, design of transaction structure, negotiation of terms and conditions, and development of an integration programme are based on findings of the LDD. The accuracy and completeness of an LDD report, and its quality of relevant analysis, may have a direct impact on the outcome of an M&A offer.

Preparations. How is thorough and intensive LDD conducted on an overseas target in a given time frame? Since an overseas M&A transaction involves at least two jurisdictions, dividing collaborative work between experienced, reliable PRC and local lawyers is crucial for the efficiency and quality of an LDD.

Before conducting the LDD, the team should inform themselves about purpose and background of the transaction, business plan, proposed structure, progress requirements and key concerns, determine subjects and scope of the LDD, search for basic particulars and industry background, and analyze laws and regulations applicable to the industry of the target. On top of this, they should proceed to design and provide an all-inclusive and feasible list of LDD that covers general issues, reflects industry features and contains a finalized timetable or agenda that is compact and efficient.

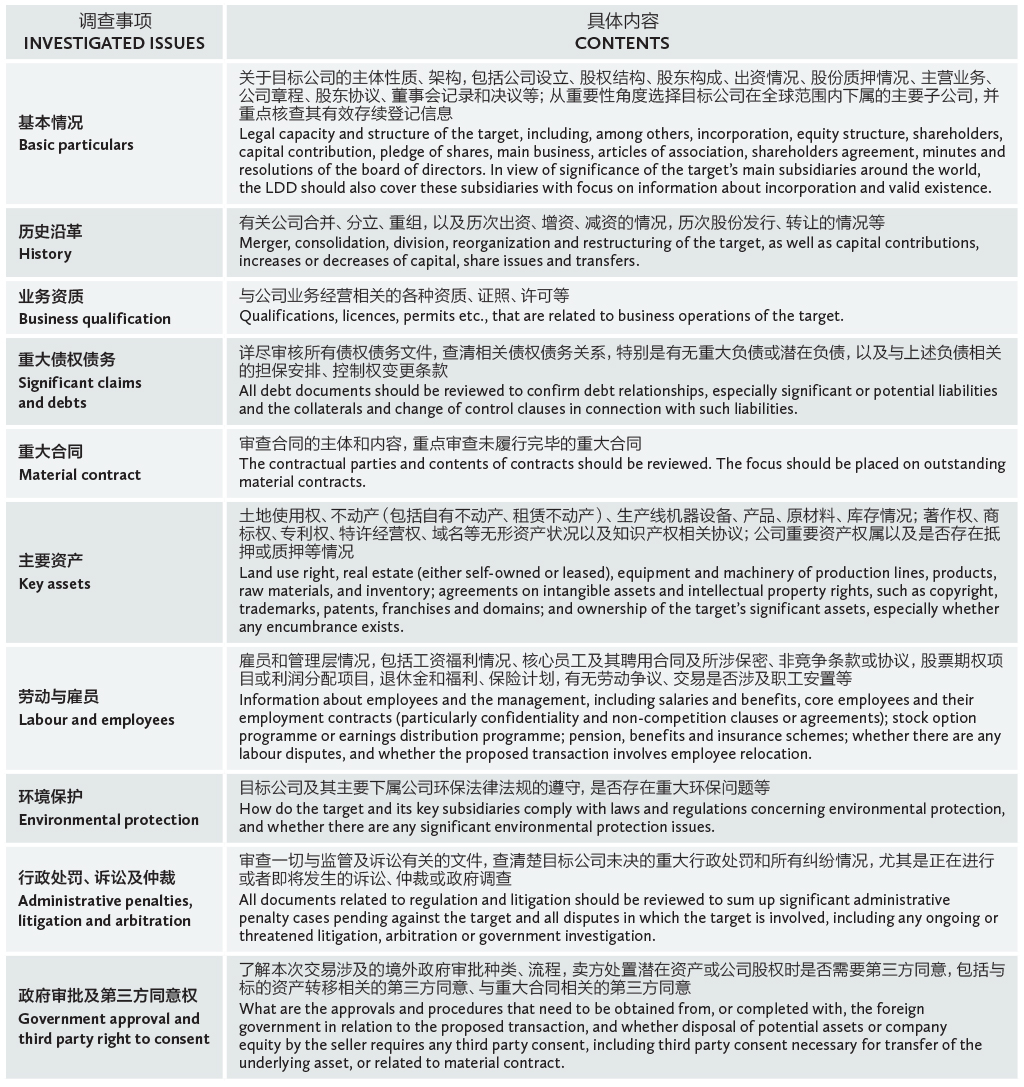

Contents of the LDD. The LDD of an overseas M&A transaction addresses issues described in the table. In practice, the scope of LDD conducted by a potential Chinese buyer is often restricted by the seller or target, who tends to disclose favourable information or has reservations about disclosure out of consideration for transaction strategy. Therefore, instead of relying completely on information received from the target, the LDD team should make best efforts to conduct an all-round investigations.

Other considerations. Upon collection and rationalization of due diligence data, lawyers should analyze any issues identified. Although the LDD should be treated carefully to prevent omissions, rigid interpretation of facts and laws should be avoided so that there is no exaggeration. More importantly, a lawful and effective solution to the problems should be developed. Besides, communication between the LDD team and the financial and tax due diligence teams should be strengthened.

Lin Zhong is a partner at EY Chen & Co. Law Firm

中国上海市浦东新区世纪大道100号

上海环球金融中心51楼 邮编:200120

51/F, Shanghai World Financial Center

100 Century Avenue, Pudong New District

Shanghai 200120, China

电话 Tel: +86 21 6881 5499

传真 Fax: +86 21 6881 7393

电子信箱 E-mail:

zlin@eychenandco.com