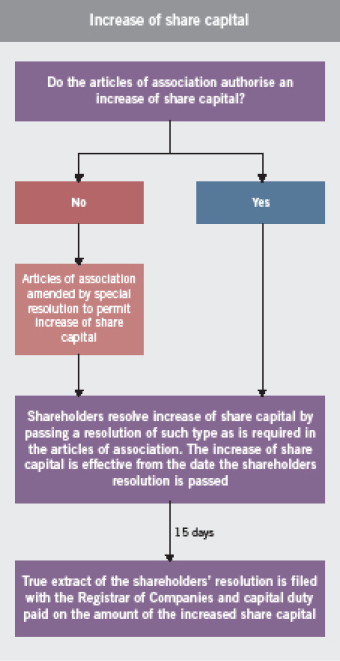

An increase of authorised share capital comprises one of five capital operations listed in section 60 of the Companies Law, which may be exercised by a company limited by shares “if so authorised by its articles”. Where the articles of association of such a company do not expressly contain an authority to increase share capital, they would need to be amended by special resolution to facilitate such authority for the increase to be effected. An increase of capital requires the approval of the company’s shareholders and is effective from the date such shareholder resolution is passed. In the absence of an express requirement in the Companies Law, the type of shareholder resolution required – ordinary or special – is a matter of the construction of the articles of association of each company.

L. Papaphilippou & Co

Advocate

L. Papaphilippou & Co

Cyprus

Pursuant to section 62(1) of the Companies Law, the shareholders’ resolution authorising the increase of capital would need to be filed with the Registrar of Companies within 15 days from the date the resolution is passed. In practice, the company secretary submits a certified true extract of the shareholders’ resolution authorising the increase of capital to the Registrar of Companies, along with Form HE14, which sets out numerically the increase of share capital for the purposes of calculation of the capital duty due. Capital duty is calculated at a rate of 0.6% on the amount of the share capital increase or €20 (US$27), whichever amount is greater, and is payable at the time all filings pertinent to the increase of share capital are submitted to the Registrar of Companies.

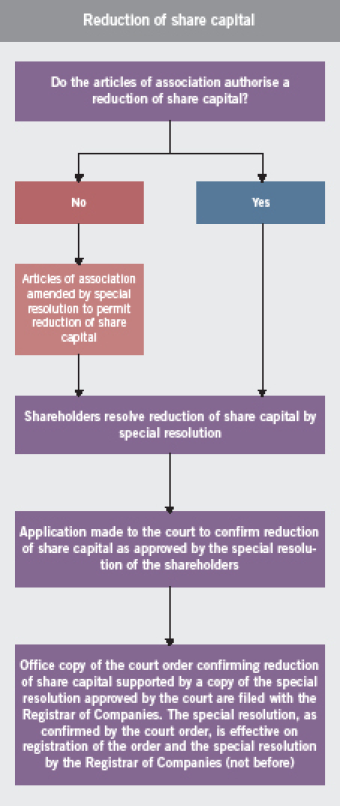

The court application for the confirmation of the share capital reduction is done by petition instituted in the matter of the company and in the matter of the Companies Law after the passing of the shareholders’ special resolution approving the share capital reduction.

Apart from the boilerplate particulars customarily included in company court applications – incorporation, registered office, operative objects of the memorandum of association, share capital – the petition must clearly point out the operative provision in the articles of association of the company permitting the reduction, the relevant special resolution approved by the shareholders as well as the reasons the reduction of share capital is sought.

Confirmation of the share capital reduction by the court is discretionary and may be conditional on such terms and conditions as the court thinks fit. An office copy of the court order confirming the reduction and of the special resolution approved by the court must be submitted to the Registrar of Companies for registration. Upon registration of the order and the special resolution, and not before, the special resolution for reducing share capital as confirmed by the registered court order will take effect. The certificate by the Registrar of Companies shall be conclusive evidence that all requirements of the Companies Law with respect to reduction of share capital have been complied with and that the share capital of the company is as stated in the relevant special resolution.

Nick Tsilimidos is an advocate at L Papaphilippou & Co in Cyprus

17 Ifigenias street

2007 Strovolos, P.O. Box 28541

2080 Nicosia, Cyprus

电话 Tel:+357 22 27 10 00

传真 Fax:+357 22 27 11 11

电子邮件 E-mail:nt@papaphilippou.eu

www.papaphilippou.eu