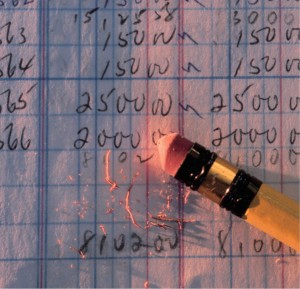

Allowing an appeal in Price Waterhouse Coopers Pvt Ltd v Commissioner of Income Tax, Kolkata-I & Anr, the Supreme Court set aside an order of Calcutta High Court upholding a decision by the tax authorities to impose a penalty on Price Waterhouse Coopers (PWC) following what the apex court held was an “an inadvertent and bona fide error”.

Satisfying itself that PWC “had not intended to or attempted to either conceal its income or furnish inaccurate particulars”, the court held that the order to penalize PWC, under section 271(1)(c) of the Income Tax Act, 1961, was not justified.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

The update of court judgments is compiled by Bhasin & Co, Advocates, a corporate law firm based in New Delhi. The authors can be contacted at lbhasin@bhasinco.in or lbhasin@gmail.com. Readers should not act on the basis of this information without seeking professional legal advice.