Home Search

Search results: reserve bank of India

Changes needed at state level to develop Indian MBS market

The securitization market in India has come a long way since the first issuances that can be traced from the early 1990s, when originators and arrangers such as ICICI and Citigroup took the lead...

‘Dual listing’ and how to make it happen

It seems inappropriate to describe the failed deal between Bharti Airtel and MTN Group as either a merger or an acquisition (especially given the pains taken by both parties to avoid any suggestion of...

Easing foreign exchange borrowings and lendings

In a move to liberalize foreign currency borrowing by Indian corporates, in June the Reserve Bank of India (RBI) introduced significant amendments to the Foreign Exchange Management (Borrowing or Lending in Foreign Exchange) Regulations,...

The lion and the tiger

Singapore is seeking to enhance its standing as India’s business hub for Asia. Yet as India’s legal and financial markets mature, its reliance on offshore expertise and capital may be falling

Vandana Chatlani reports

Welcome to Singapore...

Trading in interest rate futures permitted

In a circular dated 28 August, SEBI introduced trading in exchange-traded interest rate futures (IRFs), which are standardized derivative contracts. IRFs differ from other derivative products only in the underlying security, which is a...

SEBI proposes new securities guidelines

In a recent meeting SEBI proposed certain amendments to securities laws in India. The changes are intended to realign the takeover norms with market developments and to bring various pieces of legislation governing Indian...

Second chance for interest rate futures

The end of August saw the long-awaited re-launch of exchange-traded interest rate futures (IRFs), as part of ongoing financial sector reforms. This is the first major initiative in the derivatives market since the launch...

Guidance required for cyberspace security

Individuals and companies alike are becoming increasingly dependent upon the use of the internet for their daily activities. Cyberspace has become the standard means of communication and information transfer worldwide, with users ranging from...

Acquisition, delisting and minority squeeze-out

There are certain considerations an overseas company (the acquirer) should take into account when structuring the acquisition of an Indian listed company (the target), followed by delisting and a potential minority squeeze-out. This discussion...

Racing for a place in the sun

With offshore jurisdictions increasingly eager to secure India-related business, law firms from the English Channel to the Caribbean are ramping up their India practices

George W Russell reports from Grand Cayman

Once technically extinct, the blue...

Keeping a tight grip

Private equity and venture capital investors have returned to India in cautious mood

Alfred Romann reports

After more than a year on the sidelines, venture capital and private equity investors are getting back to business. Funds...

FCEBs: A new way to borrow overseas

Indian corporations can raise foreign currency debt either by commercial loans from non-resident lenders through the external commercial borrowings (ECBs) route, or by issuing foreign currency convertible bonds (FCCBs), convertible into equity shares of...

Nurturing green shoots

Taurus has launched India’s first actively managed Islamic mutual fund. While the company considers the initiative a success, regulatory hurdles and a lack of domestic legal expertise continue to stunt the growth of Shariah-compliant finance. George...

New IDR rules to boost capital raising

On 22 July the Reserve Bank of India (RBI) further liberalized the norms for foreign companies to raise capital from the Indian market through the Indian depository receipts (IDR) route.

The concept of IDRs was...

Liberalization of external commercial borrowings

External commercial borrowing (ECB) can take several forms: bank loans; buyers’ credit; suppliers’ credit; securitized instruments; credit from official export credit agencies and international capital markets; and commercial borrowings from multilateral financial institutions, such...

India Business Law Journal’s 2009 Directory of Indian Law Firms

After surviving months of economic turbulence, Indian lawyers are priming themselves for the legal market’s resurgence and the chance to lead distressed clients to safety. Vandana Chatlani reports

The Indian legal market is buzzing with talk...

Rising from the flames

Peter Brudenall explains how ‘Mahindra Satyam’ was born and identifies key lessons the transaction holds for dealmakers, legal advisers and regulators

On 7 January Ramalinga Raju, the chairman of Satyam Computer Services, stunned markets when...

Building on common values

Canadian lawyers are witnessing a surge in India-related work as the two countries make good on a shared legal heritage and a partnership in natural resources. Ben Frumin reports

Glenn Faass, the director of Macleod Dixon’s...

Forging international partnerships

In India, partnership firms are a common vehicle for undertaking business activities on a small or medium scale. However, the existing legal framework for partnership firms is not as sophisticated as it is for...

Pledge disclosures: a rule or an exception?

Aloan against shares (especially shares of listed companies) is a mechanism routinely adopted by lenders to provide financing. However, the adverse market conditions and falling stock prices that have prevailed since early 2008 have...

Beating the odds

Xchanging’s successful takeover of Cambridge Solutions was complicated by the interplay between Indian takeover laws and UK market practice. Laurence Levy and Sean Skiffington explain

On 9 April, Xchanging completed its acquisition of 75% of the...

Singh swings it

But what does the election result really mean for the business of law and the law of business in India? Alfred Romann reports

Compared with previous outcomes, India’s national election in mid-May was a landslide. The...

Congress given a second chance

India’s Congress party celebrated a landslide election victory after winning 206 seats in the month-long voting process in May. Teaming up with two regional parties, the Bahujan Samaj Party and the Samajwadi Party, the...

New roadmap for foreign banks in India?

Recent turmoil in the global financial market may force the Reserve Bank of India (RBI) to rethink its roadmap for foreign banks, announced on 28 February 2005. The roadmap proposed a two-pronged approach to...

Lack of protection for whistleblowers in India

India’s lack of protection for whistleblowers leaves it vulnerable to large-scale corporate fraud. Ben Frumin reports

Start a discussion about whistle blowing in India and it won’t be long before Satyendra Dubey’s name comes up.

Dubey was...

Rebuilding corporate India

Law firms retool as their clients restructure and refinance their operations. Alfred Romann reports

Some India-focused lawyers are twiddling their thumbs these days. It’s a far cry from the same time last year, when they were...

Survival of the fittest

George W Russell investigates how Indian law firms are faring in the economic downturn

India is bracing itself for a tough year. For the past few months, both the government and private sector had expected...

Prepare for a new era

Emerging from the downturn is just the beginning. Corporates and their legal advisers will need to raise their game or flounder. But how?

With the end of the era of “easy growth” comes renewed focus...

NBFCs: Can banks still benefit from regulatory arbitrage?

Until recently, non-banking financial companies (NBFCs) were less-stringently regulated than banks by the Reserve Bank of India (RBI), and were thus considered an arbitrage boon in disguise by the financial services sector. NBFCs became...

Bargain hunting in Europe

France’s acquirer-friendly insolvency laws make it an attractive destination for Indian corporates in search of acquisitions. François Montrelay, Ulrike Heidegger and Stéphane Béraud explain

As the world’s sixth largest economy, France is an important destination for...

Private equity returns

Following a battering in the financial storm, private equity is once again showing signs of life. A new emphasis on risk mitigation means lawyers will play a key role in its recovery. Chris Crowe reports...

Going the distance

Foreign law firms face new hurdles in the race to build India practices. Do they have the stamina to stay the course? George W Russell reports from Bangalore

With international financing severely crimped and billions of...

High court upholds legality of derivatives

In one of the first cases of its kind in India, it was recently held by the Madras High Court in Rajshree Sugars and Chemicals Limited v AXIS Bank Limited that derivative contracts could...

Banks await final judgment on loan portfolio trading

While banks are still reeling from the the recent collapse of the financial system, a recent decision from the Gujarat High Court serves an additional blow that has the potential of creating far-reaching implications...

Stimulating Indian infrastructure growth

With the international liquidity crunch making its impact felt in India, the government and the Reserve Bank of India (RBI) have taken a series of measures, since the middle of 2008, to bolster the...

Rising stars, unsung heroes

Rising Stars 2017

Rising Stars 2018

Rising Stars 2019

A survey of India’s lesser-known law firms unveils a rich universe of high-quality legal solutions. Until now, clients may have been unaware of the depth and diversity of services on offer. Alfred Romann...

Deal or no deal?

The financial crisis has left dozens of India-related business deals in limbo. Alfred Romann assesses the state of play and asks whether there’s light at the end of the tunnel

The December/January issue of India Business...

Tax ruling hits foreign companies with liaison staff

In a significant ruling by the Authority for Advance Rulings (AAR) titled Singapore Tourism Board v Director of Income Tax-II (International Taxation) Delhi, it was clarified that a foreign company cannot escape its tax...

Supreme Court to reconsider controversial ban on debt trading

The Supreme Court of India, through its order in the case of ICICI Bank Limited v Official Liquidators of M/s APS Star Industries Limited & Others, has temporarily allowed banks to trade in debts...

Once-lucrative FCCBs are a bitter pill to swallow

Riding on the buoyant stock markets over the last few years, Indian corporates embraced foreign currency convertible bonds (FCCBs) as a preferred financing option. Most FCCB issuers bet on equities continuing the bullish run...

RBI derivatives regulation: 20/20 in hindsight?

The evolution of the derivatives market in India has not been smooth. With the benefit of hindsight, let us examine regulatory decisions and what can still be done differently.

Giving legal certainty to over-the-counter (OTC)...

The desperate search for liquidity

India is implementing regulatory changes to tackle the credit crunch. How will the moves help cash-strapped corporations restructure their debt portfolios and access new sources of funding? Karan Singh and Ameya Khandge report

India escaped the...

RBI permits FCCB buybacks

Until early this year, foreign currency convertible bonds (FCCBs) were regarded as one of the “most preferred” options for raising corporate finance.

Suddenly, FCCBs have become millstones around the necks of issuing companies, with dismal...

New stimulus package allows more overseas borrowing

The Indian government announced in early January that it would ease restrictions on overseas borrowing and temporarily lift the interest rate ceiling on money from overseas. The relaxations follow the government’s earlier efforts to...

A different perspective on liberalization

Dear Madam,

We refer to the article Opening the vault in the December 2008/January 2009 issue of India Business Law Journal. We would like to share a different perspective on some of the issues raised:

1....

One-sided coverage

Dear Madam,

I refer to the rather interesting article on foreign law firms in your December/January issue (Verdict due on foreign law firms). I firmly believe that foreign legal practitioners (FLPs) should be allowed into...

FCCBs affected by liquidity management measures in India

The bull run witnessed by the Indian stock markets over the last few years saw several companies tapping finance by issuing foreign currency convertible bonds (FCCBs). News reports estimate such issuances at almost US$20...

Making microfinance commercially viable

The Reserve Bank of India (RBI) through various policy measures has sought to promote small-ticket lending (primarily through priority sector lending stipulations). Some of these measures overlap with what is now known as microfinance.

The...

Verdict due on foreign law firms

The future direction of India’s legal market may be influenced by a little-known case that has languished in the country’s courts for 13 years. Alfred Romann reports

For over a decade Lawyers Collective v Bar Council of India...

Opening the vault

India’s banking sector is on the verge of a second wave of liberalization. Coming amid a global financial crisis, how will domestic and international banks – and their legal advisers – respond to the challenge? Barney...

Deals of the Year 2008

At the end of a tumultuous year, India Business Law Journal celebrates the top transactional achievements of 2008 and the law firms that made them happen. Chris Crowe reports from London

India’s transactional clout was drastically reined...

Standing shoulder to shoulder

Mumbaikars have once again demonstrated their immense resilience. India and the world should follow their lead

Defiance amid unity is framing the rightful response of the Indian people. See the following pages for such messages from...

Credit crisis prompts further ECB relaxation

In the July/August edition of India Business Law Journal, we outlined the series of recent relaxations introduced by the Reserve Bank of India (RBI) to the exchange control policy governing external commercial borrowings (ECBs)...

FCEBs – Understanding a new debt instrument

The finance minister, in his 2007-2008 Budget speech, promised a mechanism for Indian companies to unlock a part of their holding in group companies to meet financing needs by issuing exchangeable bonds. This led...

Coming full circle: Novel financing structures needed

Historically there have been restrictions on financing by banks. Presently, the Reserve Bank of India (RBI) has capped banks’ credit exposure limits at 15% of their capital funds, in the case of a single...

Gearing up for restructuring

As the tide of financial crisis sweeps the good times away, areas of law that were unglamorous just a few months ago are undergoing a renaissance

Alfred Romann reports

What started out as a financial crisis is developing...

Weathering the storm

How will the global financial flux affect India-focused businesses and law firms? Ben Frumin discovers that a mood of cautious optimism prevails among most experts

What began last year as a US slump sparked by...

Anatomy of a crisis

The complex aftershocks of the West’s financial emergency may be both blessing and curse for India. Proceed with caution

This issue of India Business Law Journal maintains our focus on how law firms and their...

Currency futures arrive

All the speculation regarding the introduction of currency futures in India ended on 6 August, with the Reserve Bank of India (RBI) publishing directions on them. Much interest has been spawned in relation to...

Raising finances against receivables

One of the means of raising finances is by the absolute assignment of receivables (along with underlying securities) from an obligor to an assignor or originator, that are structured as bankruptcy remote from the...

Indian depository receipts: An attractive proposition?

Indian depository receipts (IDRs) are similar to American depository receipts (ADRs) and Global depository receipts (GDRs) with the exception that IDRs are issued by companies incorporated outside India and listed and traded on Indian...

A passage to India: Tourism boosted by FDI

Economic liberalization has given new impetus to the hospitality industry with the Government of India permitting 100% foreign direct investment (FDI) in hotels and the tourism sector under the automatic route.

FDI and technical collaboration...

RBI relaxes regulations for ECB collateral

External commercial borrowings (ECBs) refer to commercial loans (in the form of bank loans, buyers credit, suppliers credit and bonds) from offshore lenders to a resident Indian.

The norms relating to ECBs are set out...

Outsourcing comes of age

An industry that revolutionized global business is distancing itself from its humble beginnings. Alfred Romann investigates the transformation of India’s outsourcing sector from cheap labour provider to strategic knowledge partner

It is ancient history by...

Legislative and regulatory update – September 2008

Taxation

The Income Tax Appellate Tribunal (Mumbai Bench) recently announced a significant development in the law relating to transfer pricing regulations. The tribunal stated that a default by non-residents relating to Indian transfer pricing regulations...

Staying liquid

India’s once-vibrant capital markets have dried up. With the help of local and international lawyers, private equity is stepping into this financial desert to quench the corporate thirst for funds

George W Russell reports from...

Prescription for success?

The Daiichi-Ranbaxy deal has the bucked the trend of Indian buyers snapping up foreign targets. Raghavendra Verma investigates the intricacies of the transaction and examines the legal hurdles that faced both companies and their lawyers

Following...

ECBs relaxed to enhance revenue routes

Over the last few months, the Reserve Bank of India (RBI) has introduced key relaxations to the exchange control policy governing external commercial borrowings (ECBs) raised by Indian entities. ECBs have emerged as an...

Wait and watch

Dear Editor,

The saga of uncertainty over the revision of India’s tax treaties with Mauritius and Cyprus continues with the result that investors have resorted to a “wait and watch” policy. Although adoption of this...

Legislative and regulatory update – June 2008

Real estate

In a move to offer retail investors greater opportunities to profit from the increase in Indian property prices, the Securities and Exchange Board of India (SEBI) amended its mutual funds regulations on 16...

The dawn of Islamic finance

Simple regulatory changes could transform India into a regional hub for shariah-compliant finance and clear the way for a much-needed wave of investment into its infrastructure, explains Ben Frumin

India need only look across the...

Flies in the ointment

Faced with opposition to liberalizing China’s economy 30 years ago, Deng Xiaoping is said to have retorted: “When you open the window, some flies come in”

This first anniversary issue of India Business Law Journal...

Derivatives fiasco: Companies blame misinformation

Open any financial daily from the past few months and chances are you will see a news report or editorial on litigation concerning foreign exchange and currency linked derivative contracts between banks and companies.

While...

Money laundering laws in a spin

Widely welcomed measures to tackle the clandestine transfer of funds have been undermined by infighting over the allocation of adjudicating powers. Raghavendra Verma reports from New Delhi

In January 2007 a raid on Pune-based businessman...

The changing face of M&A

The international liquidity crisis and the growing financial muscle of Indian corporations have changed the nature of mergers and acquisitions

Alfred Romann explains

Holcim purchased a controlling stake in Gujarat Ambuja Cement. Hindalco Industries, part of...

Good times ahead

Dear Sir,

I must compliment India Business Law Journal on its coverage of the Indian real estate sector (April 2008). Indeed, India’s real estate market is currently a cynosure to all foreign investors and will...

Legislative and regulatory update – May 2008

Telecoms

The Department of Telecom-munications accepted a recommendation on 1 April from the Telecom Regulatory Authority of India, which will allow telecoms service providers and infrastructure providers to share active infrastructure such as antennas, cables,...

Setting up shop

Despite a restrictive regulatory regime and deep political sensitivities, now is the time for foreign retailers to establish a foothold in India

Ben Frumin in New Delhi explains

Against the colossal backdrop of a Bollywood film...

Sovereign wealth funds: Will India join the club?

Sovereign wealth funds (SWFs), or state-owned investment vehicles, are coming under increasing discussion and scrutiny. SWFs are estimated to hold over US$3,000 billion in assets. Merrill Lynch has projected that SWFs will reach US$7,900...

Financing gambling operations not easy

Foreign direct investment (FDI) has been recognized as an important instrument for advancing India’s foreign exchange resources, its technological base and for globalizing the Indian economy. Gambling (gaming), lottery business and betting are not...

Derivatives spark legal struggle

Banks in India are set for a long and bloody battle with their clients over the legality of the derivatives market.

Hundreds of Indian companies bought into cross-currency options and structured products to protect themselves...

Fighting for funds

Market turbulence has forced many Indian corporates to re-evaluate their domestic and international capital-raising strategies. But in spite of the difficulties, there is no shortage of investors willing to gamble on India, Chris Crowe reports...

New foreign currency bonds to be exchangeable for equity

The finance minister, during his budget speech of 2007-08, promised to introduce a new financing option for corporate India – the foreign currency exchangeable bond (FCEB).

The FCEB was conceived as an innovative structured finance...

FDI cleared to climb to new heights

The latest reforms to India’s foreign investment regulations are significant because they tackle sensitive sectors that the government has previously been reluctant to liberalize. But concerns persist over the scope of the changes and...

ICICI fined for ‘demeaning’ the legal profession

ICICI Bank has been fined for allegedly refusing to provide a lawyer with a credit card on the grounds that her profession has a “negative profile”.

Demanding that the bank refrain from “defaming and demeaning”...

Building the future

Foreign investors are flocking back to India’s once-pariah infrastructure sector. They must tread carefully, but this time the opportunities are real, Ben Frumin reports from New Delhi

One minute. That’s all it took on 15 January...

Relaxed regulations boost overseas acquisitions

Over the past decade or so, India has become accustomed to measuring the success and pace of its liberalization measures with the quantum of foreign investment pouring into India.

More recently, there has been a...

Converging accounting standards challenge issuers

The International Accounting Standards Board (IASB) recently reported the announcement by the Council of the Institute of Chartered Accountants of India (ICAI) at its July 2007 meeting that Indian accounting standards will achieve full...

Non-banking financial companies consolidate

The non-banking financial companies (NBFC) sector, which grew rapidly in the early 1990s but later witnessed a turbulent period, has been in a phase of consolidation during the last two years.

The main reasons for...

Amarchand Mangaldas advises on location for IIFCL subsidiary

Amarchand & Mangaldas & Suresh A Shroff & Co has been advising on the best location for the establishment of the overseas subsidiary of India Infrastructure Finance Co Ltd (IIFCL), a government-owned special purpose...

A busy year ahead

Dear Sir,

Most investors already include India in their plans, not only as an investment destination but in their search for business partners.

As the Reserve Bank of India continues to liberalize its regulations, the country...

Age no bar for Delhi lawyers

Age will no longer be a bar against practising the law in Delhi after a senior citizen who is also a qualified lawyer took the Delhi Bar Council to court and won.

The bar council...

The rupee bull: Late Diwali or early Christmas?

Diwali marks the holiday shopping season in India, much like the Christmas holiday in the United States.

This year, however, Diwali has come late (or Christmas has come early) as the ever strengthening rupee presents...

Domestic hurdles curtail leveraged buy-outs

Private equity firms make most of their investments in leveraged buy-outs (LBO) that involve significant use of debt to finance the acquisition of a company.

LBOs are important instruments of merger and acquisition financing as...

A stimulating time

Dear Sir,

As the Reserve Bank of India continues to liberalize its regulations, the country is entering an exciting phase in terms of Indian companies investing abroad. For lawyers, this is an intellectually stimulating time.

In...

Level playing field needed for domestic acquisitions

Merger and acquisition activity in India is thriving at the moment. However, it is not as vibrant as in the US and Europe on account of a lack of acquisition financing options, particularly in...

India in 2008

Shardul Thacker previews the regulatory changes that foreign and domestic businesses may witness during the coming year

India’s fast-moving economy hinges, to a large degree, on timely legislative reform and regulatory development. Authorities must stay...

India’s agonizing decision

Corporate law firms and their clients in India and overseas may soon witness the beginning of a new era in legal services

There is growing momentum behind moves to open India’s legal market to foreign...

Lowering the bar

India Business Law Journal investigates recent moves to open the legal market to foreign firms and hears reactions from a wide range of stakeholders, Ben Frumin reports from New Delhi

As autumn began in India with...

The new financial architects

Lawyers are playing a vital role in the introduction of securitization, structured finance and other high-end financial techniques into India. Ben Frumin talks to some of the deal-makers and explores how legal and regulatory...

Continuing liberalization increases India’s appeal

In recognition of the important role of foreign direct investment (FDI) in driving economic growth, the Government of India initiated numerous economic and financial reforms in 1991, transforming the nature of the Indian economy...

ECB policy linked to exchange rate concerns

Last month, this column discussed the recent modifications by the Reserve Bank of India (RBI) to the External Commercial Borrowings (ECB) policy.

To summarize, the RBI on 7 Augustnov 2007 revised the policy restricting ECB...

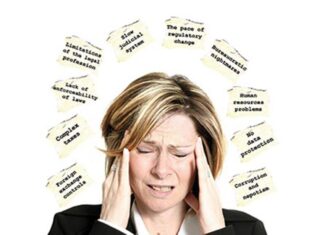

A cure for legal headaches

India Business Law Journal diagnosed the top 10 legal problems facing corporate counsel and challenged Indian lawyers to prescribe remedies Alfred Romann reports

Doing business in India can be daunting. Not only is the market...

Battle strategies

Commercial disputes in India are slow, costly and all too likely to end in stalemate. Meticulous planning and the careful selection of advisers are crucial factors in achieving a successful outcome By Ben Frumin...

RBI regulations restrict availability of debt funding

External commercial borrowings (ECB) are commercial loans with minimum average maturity (MAM) of three years, obtained from non-resident lenders.

ECB has been an important source of finance for Indian corporates, allowing them to supplement domestically...

Permanent establishment costly despite shutdown

Foreign companies operating in India should carefully structure their operations with an eye on the tax collector. Shutting down a permanent establishement (PE) does not necessarily allow companies to avoid taxes in India if their...

Nerves of steel

The largest takeover ever attempted by an Indian corporation has helped forge new laws in two countries Raghavendra Verma reports from New Delhi

Competing schemes, an accelerated auction, offer prices distorted by time considerations and...

Legislative and regulatory update – October 2007

Banking

Banks have to provide borrowers with a copy of any loan agreement, the Reserve Bank of India (RBI) said on 22 August. According to the RBI, some banks were violating the Guidelines on Fair...

Public offer and listing of securitized debt instruments

Pursuant to the amendment of the Securities Contract (Regulation) Act, 1956 (SCRA) to include pass through certificates (PTCs), the Securities Exchange Board of India (SEBI) has released a draft of the SEBI (Public Offer...

ECB: Looking back or looking forward?

The Government of India, Ministry of Finance and the Reserve Bank of India, the country’s central bank, have been confronted by the challenge of surging capital inflows over the past five years.

Until early 2007...

How safe is your data?

Inadequate privacy laws are putting client information at risk and jeopardizing the future of India’s outsourcing industry Rodney Ryder and Salman Waris explain

Outsourcing IT-enabled services (ITES) to India is an attractive proposition. It allows...

Legislative and regulatory update – September 2007

Intellectual property

In a landmark decision on 6 August the Chennai High Court rejected Swiss firm Novartis AG’s challenge of a key provision of the 2005 patent law. Dismissing Novartis’ petition, the bench observed...

Preference shares: No longer preferable

The Companies Act, 1956 allows an Indian company to issue either equity or preferential shares. The latter get preferential treatment over equity shares.

Preference shareholders are entitled to a fixed rate of dividend to be...

FCCBs: Popular tools for investors

The bull run witnessed by the Indian stock markets has seen a number of issuers raise funds through Foreign Currency Convertible Bonds (FCCBs).

The term FCCBs has been defined in the FCCB Scheme to mean...

RBI relaxes the rules

The Reserve Bank of India (RBI) announced in August that Indian companies seeking to buy international brands, trademarks and franchises no longer have to seek the bank’s prior approval.

The move should make it easier...

Cyber laws in need of upgrade

India should introduce a single e-commerce bill that covers transactions, computer misuse and fraud

By Sumanjeet Singh

Phishing, a common computer scam, involves a mass e-mail promising a reward in exchange for information. One of the...

Legislative and regulatory update – July/August 2007

Securities

An Airports Economic Regulatory Authority (AERA) could be created in the near future after the Union Cabinet approved in May the passing of the AERA Bill, 2007. Under the bill, the authority would review...

India goes shopping

India Inc has embarked on a global shopping spree, but is it equipped to tackle the legal and regulatory hurdles it will face?

Ed Lane reports from New Delhi

Between 2002 and the first half of...

Foreign VC funds may wish to register with SEBI

The Indian media are flooded daily with explosive figures earned by venture capital investors. Increasingly, new domestic and offshore funds are being formed with a specific India and industry focus. One avenue open to...