Home Search

Search results: SEBI

Learning new rules

As Akil Hirani of Majmudar & Co explains, private equity investors are bracing for regulatory changes

The promise of higher returns and opportunities for diversification drove up private equity (PE) activity in India over the...

Funds in flux

Regulatory obstacles and systemic turbulence disrupt the dealflow, yet India retains its allure to private equity investors

Alfred Romann reports

One of the many paradoxes of India is that widespread optimism about the country’s future growth...

Playing by which rules?

The imminent introduction of India’s new takeover code presents an opportunity for regulatory arbitrage

Cyril Shroff and Amita Choudary report

The acquisition of shares of a listed company in India is currently governed by the Securities...

New rules for securities payments

Following its board meeting on 7 January, the Securities & Exchange Board of India (SEBI) has announced changes to the rules governing the sale of securities and related-party transactions.

1. From 1 May, purchases of public...

Simpler guidelines needed

Dear Editor,

I am a corporate transactional lawyer based in New Delhi. These days I am getting a lot of queries and concerns from hedge fund investors abroad about the lack of specific laws or...

IPOs in the insurance sector: myriad factors at play

Initial public offerings or IPOs in the Indian insurance sector have garnered much interest over the last couple of years. The spark that ignited this interest can be traced to Reliance Life Insurance Company...

Firing up the markets

Coal India’s IPO was the largest in India to date. Vandana Chatlani examines the complex preparations that were required and reveals the secrets behind the listing’s success

Make a call to Coal India and while waiting...

Deals of the Year 2010

India Business Law Journal showcases 50 of the most significant transactions, court cases and IP enforcement actions of 2010 and reveals the law firms that guided them

George W Russell reports

The international financial crash that...

Circulars, notes and orders

Steps are finally being taken to simplify the process through which businesses are notified of regulatory changes

Rebecca Abraham reports

When the government recently tightened rules on foreign direct investment (FDI) in real estate – saying...

Securities regulator given green light to scrutinize chartered accountants

Can the securities market regulator – the Securities and Exchange Board of India (SEBI) – issue show cause notices to a chartered accountant in connection with audits the chartered accountant carried out of a...

Recoding takeovers: Examining the changes

Few pieces of legislation have made as immediate and wide-sweeping an impact as the Takeover Code did when it was first introduced in 1997. It was a milestone marking the beginning of India’s corporate...

Public shareholding requirements onerous

The Ministry of Finance has recently made two amendments to the Securities Contracts (Regulation) Rules, 1957, that introduce mandatory requirements for minimum public shareholding in listed companies. While the first amendment, dated 4 June,...

Consolidated FDI policy – introducing changes

On 31 March, the Department of Industrial Policy and Promotion (DIPP) issued circular 1 of 2010 to consolidate all policy on foreign direct investment (FDI). This includes policy contained in the Foreign Exchange Management...

Indian takeover regulations up for overhaul

The Takeover Regulations Advisory Committee (TRAC) constituted by the Securities and Exchange Board of India (SEBI) to review the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997, (Takeover Code) submitted its report to...

Foreign acquirers and the Takeover Code

The acquisition of an Indian listed company by a foreign company is regulated by the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 (Takeover Code).

Public announcement

Under regulation 10...

Supreme Court interprets ‘persons acting in concert’

Can a mere holding and subsidiary company relationship be considered to be one of “persons acting in concert” under the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997...

Issue of non-convertible debentures regulated

The Reserve Bank of India (RBI) has recognized the importance of corporate deposits for meeting the capital requirements of companies in need of finance.

In a circular dated 23 June, the RBI has prescribed directions...

RBI to regulate the issue of short-term NCDs

Non-convertible debentures (NCDs) – traditionally used by companies to meet their short-term funding requirements – need to have a validity of at least 90 days. This is part of new directions, put together by...

Impact of revised pricing guidelines

The Reserve Bank of India (RBI) recently amended the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations 2000 (FEMA Regulation) with respect to the issue price for...

Foreign investment through convertible securities

Foreign investors invest in Indian companies through equity shares or securities that are fully and mandatorily convertible into equity shares within a specified time period. These convertible securities include compulsorily convertible preference shares (CCPS)...

Sharing the spoils or spoiling the shares?

Heightened risk aversion and financial prudence on the part of investors may drive a revival of joint ventures. Vandana Chatlani investigates the risks and rewards of joint venturing

To many foreign investors, India’s proverbial legal...

Big bang or big gamble?

India’s new securities rules may trigger a boom in share offerings, but have sparked fears over the liquidity of the market. They have also prompted mixed reactions from listed companies and their legal advisers

George W...

Reserve Bank amends pricing of shares

The pricing guidelines with respect to the issue and transfer of shares from a resident to a non-resident and vice-versa has been revised by the Reserve Bank of India (RBI) through a notification issued...

The regulators proxy battle continues

The tussle between the two regulators which we discussed in this column in March is now turning into a full blown legal battle. This is not just a turf war - rather it is...

Mutual funds as responsible investors

Globally, there exists a long list of fund houses which are so called “activist investors”. The “activism” is often a reference to either the changes in the management and operations of a company, which...

Draft guidelines on short-term NCDs: key issues

With a view to regulating short-term debentures, the Reserve Bank of India (RBI) placed on its website on 3 November 2009 draft guidelines on issuing non-convertible debentures (NCDs) of maturity less than one year....

Rebuilding value

Last year the Indian real estate market saw one of its worst plunges in recent history. The sector is now rebounding, with postponed and cancelled projects back on track

George W Russell reports

One sure sign of...

Consolidated FDI policy: A welcome move

On 31 March the Department of Industrial Policy and Promotion (DIPP) of the Ministry of Commerce and Industry issued a consolidated foreign direct investment (FDI) policy circular. It became effective on 1 April and...

Are changes in FCCB pricing norms a boon?

With the gradual liberalization of exchange control regulations in India during the 1990s, Indian corporates have had the ability to raise funds from global markets. A popular instrument, especially in the past few years,...

Rhodia to Subhkam: What indeed is control?

The Securities Appellate Tribunal (SAT) has recently ruled, in the matter of Subhkam Ventures Pvt Ltd v SEBI, that control as defined under the takeover regulations does not include negative control.

The ruling, which is...

Unit-linked insurance plans: deviating from insurance?

There are regulatory arbitrages and then there are arbitrages between regulators. Regulatory arbitrages are not uncommon. What may be uncommon is a regulator mediating to ensure a level playing field for its constituents!

Deeply concerned...

Veto rights do not constitute ‘control’

The Securities Appellate Tribunal (SAT) recently passed an order in favour of Subhkam Ventures India, clarifying that veto rights do not constitute “control” under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997...

Another false dawn for securities lending?

The latest amendment to the securities lending and borrowing (SLB) framework, through a notification dated 6 January demonstrates a renewed effort by the Securities and Exchange Board of India (SEBI) in kick-starting what is...

Connection lost

Bharti Airtel’s failed attempts to merge with MTN highlight the political and regulatory hurdles that plague international M&A deals

Alfred Romann reports

After almost two years, two attempts, half a dozen deadline extensions, regulatory reviews, political...

Newspaper giant raises US$82m

Skadden recently represented Citigroup Global Markets, Kotak Mahindra and Enam Securities in an US$82 million rule 144A/regulation S initial public offering by DB Corp.

DB Corp is the largest Hindi language newspaper group and one...

Investing in India through convertible instruments

There are certain issues an overseas investor should take into account when structuring an investment in an unlisted Indian company through instruments that are compulsorily convertible into equity shares of the company.

Foreign direct investment...

Sting in the tail

A recent interpretation of the takeover code threatens to rewrite the rules for M&A and add millions of dollars to the cost of Daiichi’s acquisition of Ranbaxy

Raghavendra Verma reports from New Delhi

The Daiichi-Ranbaxy deal is a...

Deals of the Year 2009

India Business Law Journal celebrates the top transactions and cases of 2009 and reveals the law firms that guided them to fruition

Chris Crowe reports from London

India Business Law Journal’s third annual Deals of the...

Civil court jurisdiction barred in company matters

In HB Stockholdings Ltd v DCM Shriram Industries Ltd & Others Delhi High Court recently interpreted the scope and ambit of provisions in sections 397, 398 and 402 of the Companies Act, 1956. The...

Barclays banned from ODI trade

The Securities and Exchange Board of India (SEBI) has suspended UK bank Barclays from dealing in products that allow foreign investors to buy Indian stocks. SEBI has issued Barclays an order not to issue,...

Changes needed at state level to develop Indian MBS market

The securitization market in India has come a long way since the first issuances that can be traced from the early 1990s, when originators and arrangers such as ICICI and Citigroup took the lead...

Depository receipts and the takeover code

Further to the announcement made at its board meeting of 22 September, the Securities and Exchange Board of India (SEBI) through a notification on 6 November amended various aspects of the SEBI (Substantial Acquisition...

Trading in interest rate futures permitted

In a circular dated 28 August, SEBI introduced trading in exchange-traded interest rate futures (IRFs), which are standardized derivative contracts. IRFs differ from other derivative products only in the underlying security, which is a...

Tribunal reaffirms relevant date for open offer price calculation

A recent order passed by the Securities Appellate Tribunal (SAT) in the matter of Goldstone Exports has reaffirmed the manner of calculation of open offer price under the takeover code in the event of...

‘Promoter’ does not imply acquisition of control

In a recent adjudication order the Securities and Exchange Board of India (SEBI) held that the disclosure of acquirers as “promoters” in terms of regulation 8(2) of the SEBI (Substantial Acquisition of Shares and...

The insurance sector needs further assurance

Following the introduction of the Insurance Laws (Amendment) Bill, 2008, the Insurance Regulatory and Development Authority (the IRDA) has issued a set of corporate governance guidelines for insurance companies.

As insurers in India are yet...

Acquisition, delisting and minority squeeze-out

There are certain considerations an overseas company (the acquirer) should take into account when structuring the acquisition of an Indian listed company (the target), followed by delisting and a potential minority squeeze-out. This discussion...

Is India ready for principle-based regulation?

The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 (the takeover code), was notified by SEBI in order to prevent actions that are detrimental to the interests of minority shareholders of companies. The...

QIBs: a need for rebalanced regulations

The area of private equity (PE) investment has seen some interesting crests and troughs in the last few months, primarily due to activity by qualified institutional buyers (QIBs). QIBs currently form a huge part...

Racing for a place in the sun

With offshore jurisdictions increasingly eager to secure India-related business, law firms from the English Channel to the Caribbean are ramping up their India practices

George W Russell reports from Grand Cayman

Once technically extinct, the blue...

Keeping a tight grip

Private equity and venture capital investors have returned to India in cautious mood

Alfred Romann reports

After more than a year on the sidelines, venture capital and private equity investors are getting back to business. Funds...

Investment climate requires clarity on ‘superior rights’

The Indian securities market regulator, the Securities and Exchange Board of India (SEBI), issued a circular on 21 July which introduced the new clause 28A to the listing agreement. The provision states: “The company...

Nurturing green shoots

Taurus has launched India’s first actively managed Islamic mutual fund. While the company considers the initiative a success, regulatory hurdles and a lack of domestic legal expertise continue to stunt the growth of Shariah-compliant finance. George...

Secur Industries acquirers exempt from open offer

In an order dated 30 June the Securities and Exchange Board of India (SEBI) granted the promoters of Secur Industries an exemption from the mandatory open offer requirement under section 11(1) of the SEBI...

New IDR rules to boost capital raising

On 22 July the Reserve Bank of India (RBI) further liberalized the norms for foreign companies to raise capital from the Indian market through the Indian depository receipts (IDR) route.

The concept of IDRs was...

New regulations for delisting equity shares

Just when things were looking good for promoter shareholders wanting to delist company equity shares, the Securities and Exchange Board of India (SEBI) notified new regulations for doing so. These took effect from 10...

In fits and starts and in bits and pieces

The Competition Act (2002), amended in 2007 (the act), targets anti-competitive agreements or arrangements, abuse of dominance, and combinations. After many years in limbo, the reconstituted Competition Commission of India (CCI) was finally empowered...

Rising from the flames

Peter Brudenall explains how ‘Mahindra Satyam’ was born and identifies key lessons the transaction holds for dealmakers, legal advisers and regulators

On 7 January Ramalinga Raju, the chairman of Satyam Computer Services, stunned markets when...

‘Anchor investors’ to boost capital markets

In its board meeting on 18 June, the Indian capital market regulator, SEBI provided a further boost to the Indian capital market by introducing a series of proposals.

The concept of an “anchor investor” was...

New delisting rules promote transparency

The Securities Contracts (Regulation) Act, 1956, was amended in 2005 to lay out a path for the creation of a delisting framework. On 15 June the government of India notified the Delisting Rules, which...

Process delayed is process denied

The coming years should see India achieve a successful moon landing. But what of long-standing problems back home?

As India Business Law Journal embarks on its third year, it finds itself revisiting the Achilles’ heel...

Pledge disclosures: a rule or an exception?

Aloan against shares (especially shares of listed companies) is a mechanism routinely adopted by lenders to provide financing. However, the adverse market conditions and falling stock prices that have prevailed since early 2008 have...

Beating the odds

Xchanging’s successful takeover of Cambridge Solutions was complicated by the interplay between Indian takeover laws and UK market practice. Laurence Levy and Sean Skiffington explain

On 9 April, Xchanging completed its acquisition of 75% of the...

Corporate governance: A paradigm shift needed

A great deal has been written about corporate governance in India since the turn of the millennium, when the nation’s economy was gaining prominence on the world stage. It became a buzzword in boardrooms...

Lack of protection for whistleblowers in India

India’s lack of protection for whistleblowers leaves it vulnerable to large-scale corporate fraud. Ben Frumin reports

Start a discussion about whistle blowing in India and it won’t be long before Satyendra Dubey’s name comes up.

Dubey was...

New measures to stimulate capital markets

On 24 February, the Securities and Exchange Board of India (SEBI) amended the SEBI (Disclosure and Investor Protection) Guidelines, 2000 (DIP guidelines), which govern initial public offerings and preferential allotments by Indian companies. While...

The awful truth

A billion-dollar lie at a major outsourcing company has sent shockwaves through corporate India. By Vandana Chatlani

Having witnessed the panic and furore that followed one of India’s most high-profile cases of fraud, one cannot help...

Creeping acquisition limits raised

Pursuant to its notification dated 30 October, the Securities and Exchange Board of India (SEBI) has made amendments to the creeping acquisition limits available to the promoters of listed companies. Until recently a person...

Deals of the Year 2008

At the end of a tumultuous year, India Business Law Journal celebrates the top transactional achievements of 2008 and the law firms that made them happen. Chris Crowe reports from London

India’s transactional clout was drastically reined...

Short selling: Regulator apprehension unfounded?

Short selling (the sale of a security that the seller does not own) is a long-standing market practice, yet one which has often been the subject of considerable debate in securities markets worldwide. Indian regulators...

Hostile takeover secures Zandu for Emami

In one of the most significant hostile takeovers in Indian corporate history, Emami, a leading personal healthcare company in Kolkata, acquired 27.5% of the shares in 100-year-old Zandu Pharmaceutical Works from co-promoters, the Vaidya...

FCEBs – Understanding a new debt instrument

The finance minister, in his 2007-2008 Budget speech, promised a mechanism for Indian companies to unlock a part of their holding in group companies to meet financing needs by issuing exchangeable bonds. This led...

Restrictions on ODIs removed

SEBI has taken important measures in favour of FIIs as well as unregistered foreign investors, who intend to invest in the Indian securities market.

As a result of the lacklustre performance in the capital markets...

Relaxation of FII investment norms in debt instruments

Through its circular dated 16 October, SEBI notified three important relaxations in the foreign institutional investor (FII) norms for investments in Indian securities: 1) The cumulative debt investment limit for FII investments in corporate debt have...

Financial crisis lands Ranbaxy-Daiichi with US$200m tax bill

The global credit crunch is already having an impact on deals, with one stark example found in the sale of Ranbaxy shares to Japanese drug firm Daiichi Sankyo.

In October, the Securities and Exchange Board...

Currency futures arrive

All the speculation regarding the introduction of currency futures in India ended on 6 August, with the Reserve Bank of India (RBI) publishing directions on them. Much interest has been spawned in relation to...

The changing regulatory mechanics of M&A

Mergers and Amalgamations (M&A) are regulated through the provisions of the Companies Act, 1956, the Foreign Exchange Management Act, 1999, and the Income Tax Act, (ITA) 1961. Regulations have also been issued by the...

Raising finances against receivables

One of the means of raising finances is by the absolute assignment of receivables (along with underlying securities) from an obligor to an assignor or originator, that are structured as bankruptcy remote from the...

New payment system for share applications

India’s capital markets regulator, the Securities and Exchange Board of India (SEBI) has prescribed a new method of payment for public issues through the book building process. The new method, called Applications Supported by...

New pricing norms for QIPs, ADRs and GDRs

In a press release dated 13 August, the Securities and Exchange Board of India (SEBI) introduced new pricing norms for qualified institutional placements (QIPs).

Prior to the amendment, the price of securities listed through QIPs...

Tussle continues in Zandu battle

The long running battle over the future of Zandu Pharmaceutical Works has been tossed back and forth between India’s Company Law Board (CLB) and Bombay High Court over the past two months.

The dispute centred...

Indian depository receipts: An attractive proposition?

Indian depository receipts (IDRs) are similar to American depository receipts (ADRs) and Global depository receipts (GDRs) with the exception that IDRs are issued by companies incorporated outside India and listed and traded on Indian...

Investors seek improved corporate governance

In an emerging market like India, investors require the assurance that the companies in which they are investing are managing their human, physical and financial resources aptly, while also employing appropriate corporate governance. Corporate...

The cost of behaving badly

Accusations of corporate irresponsibility can be extremely damaging. What steps can businesses take to ensure good corporate citizenship in India and what are the legal and financial consequences if they fail?

Ben Frumin reports

Coca-Cola’s...

Prescription for success?

The Daiichi-Ranbaxy deal has the bucked the trend of Indian buyers snapping up foreign targets. Raghavendra Verma investigates the intricacies of the transaction and examines the legal hurdles that faced both companies and their lawyers

Following...

Regulatory developments

Provident funds

On 5 June, the Central Board of Trustees of the Employees’ Provident Fund Organisation (EPFO) approved the lowering of the threshold limit for the applicability of establishments covered under the Employees Provident Fund...

Towards affirmative boardrooms

Accountability, fairness, transparency and independence are the cardinal principles of corporate governance, which has become the buzzword because of the inflow of foreign investments into India.

To alleviate the concerns of foreign investors about efficient...

Legislative and regulatory update – June 2008

Real estate

In a move to offer retail investors greater opportunities to profit from the increase in Indian property prices, the Securities and Exchange Board of India (SEBI) amended its mutual funds regulations on 16...

Money laundering laws in a spin

Widely welcomed measures to tackle the clandestine transfer of funds have been undermined by infighting over the allocation of adjudicating powers. Raghavendra Verma reports from New Delhi

In January 2007 a raid on Pune-based businessman...

The changing face of M&A

The international liquidity crisis and the growing financial muscle of Indian corporations have changed the nature of mergers and acquisitions

Alfred Romann explains

Holcim purchased a controlling stake in Gujarat Ambuja Cement. Hindalco Industries, part of...

Legislative and regulatory update – May 2008

Telecoms

The Department of Telecom-munications accepted a recommendation on 1 April from the Telecom Regulatory Authority of India, which will allow telecoms service providers and infrastructure providers to share active infrastructure such as antennas, cables,...

Question lingers over status of pre-IPOs

India has become a hub for several young and fast moving companies with tremendous potential to achieve exponential growth. However, most of them struggle during their infancy period.

Often, the main reason for the struggle...

The road to REITs and REMFs

Gautam Mehra of PricewaterhouseCoopers evaluates recent moves to introduce collective investment schemes into Indian real estate

Since April 2004, India’s real estate market has been open to investment by institutional investors and high net worth...

Defying the laws of economics

Despite the sub-prime crisis in the US and a restrictive regulatory regime at home, Indian real estate continues to boom. Can it last? Alfred Romann reports

Nandan Nelivigi, a New York-based partner at White & Case,...

Indian law firms rebranded

Delhi-based law firm Suman Khaitan & Co has taken on two equity partners and changed its name to Khaitan & Partners. The reorganization took effect on 1 April and the new partners are Shally...

Reform’s unstoppable march

As elections loom, a shaky coalition government going slow on reform is no surprise. But the fact that it is still trying bodes well for India

One conclusion that India-watchers may glean from this month’s...

Fighting for funds

Market turbulence has forced many Indian corporates to re-evaluate their domestic and international capital-raising strategies. But in spite of the difficulties, there is no shortage of investors willing to gamble on India, Chris Crowe reports...

Tax treatment could hurt domestic funds

Venture capital is a useful source of risk capital, especially for start-up ventures in the knowledge-intensive sectors. Since such funds enjoy a pass-through status, it is necessary for the government to limit the tax...

Capital injections could help pharmaceutical industry

India has made significant progress in terms of self-reliance in pharmaceutical products. Prices for indigenously manufactured drugs are the lowest in the world.

The success story of the pharmaceutical sector stems from its reliance on...

FDI route facilitates more real estate investment

India can be acknowledged as one of the fastest growing economies in the world and real estate has emerged as one of the most appealing investment areas for domestic as well as foreign investors.

This...

Legislative and regulatory update – March 2008

Foreign investment

In January, the government proposed the liberalization of foreign direct investment (FDI) in certain key economic sectors.

The ceiling on foreign investment in public sector petroleum refining has been raised from 26% to 49%...

Redrawing the corporate framework

Proposed amendments to India’s companies law would do away with much bureaucracy and bring India a step closer to modern international practices. By Bijesh Thakker in Mumbai

Since the Indian Companies Act was passed in 1956,...

Legislative and regulatory update – February 2008

Real estate

The State of Maharashtra has repealed its Urban Land (Ceiling and Regulation) Act, 1976, which limited landholdings by a single person to 0.5 hectares in Mumbai and one to two hectares in other...

Legislative and regulatory update – December 2007/January 2008

Telecoms

The significance of telecommunications licensing was underscored recently as mobile telecommunications operators moved to block the issuance of licences covering multiple technologies. The Cellular Operators Association of India (COAI), a lobby group representing GSM...

The Deals of the Year

Following a record year for Indian M&A and capital markets transactions, India Business law Journal is proud to reveal its 2007 Deals of the Year and the lawyers who guided them to fruition

Chris Crowe...

The new financial architects

Lawyers are playing a vital role in the introduction of securitization, structured finance and other high-end financial techniques into India. Ben Frumin talks to some of the deal-makers and explores how legal and regulatory...

Legislative and regulatory update – November 2007

Aviation

A proposal in the draft Civil Aviation Policy, to waive five years of domestic flying as a pre-condition for private airlines to operate overseas, is under the Delhi High Court scanner. A writ petition...

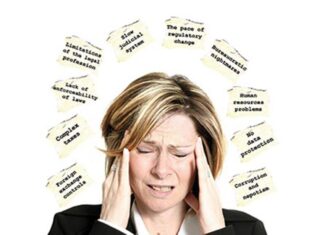

A cure for legal headaches

India Business Law Journal diagnosed the top 10 legal problems facing corporate counsel and challenged Indian lawyers to prescribe remedies Alfred Romann reports

Doing business in India can be daunting. Not only is the market...

Venture capital: Structuring a profitable exit

Innovative ideas are always warmly welcomed. New and innovative ventures in India have not been an exception and have managed to secure financial assistance in both domestic and global markets. Venture capital is one...

Public offerings in India: Some recent developments

India’s capital markets, and consequently its capital markets regulator (that is the Securities and Exchange Board of India or “SEBI”) and its regulations, have developed at a frenetic pace in the last few years.

The...

Legislative and regulatory update – October 2007

Banking

Banks have to provide borrowers with a copy of any loan agreement, the Reserve Bank of India (RBI) said on 22 August. According to the RBI, some banks were violating the Guidelines on Fair...

Public offer and listing of securitized debt instruments

Pursuant to the amendment of the Securities Contract (Regulation) Act, 1956 (SCRA) to include pass through certificates (PTCs), the Securities Exchange Board of India (SEBI) has released a draft of the SEBI (Public Offer...

Legislative and regulatory update – September 2007

Intellectual property

In a landmark decision on 6 August the Chennai High Court rejected Swiss firm Novartis AG’s challenge of a key provision of the 2005 patent law. Dismissing Novartis’ petition, the bench observed...

Legislative and regulatory update – July/August 2007

Securities

An Airports Economic Regulatory Authority (AERA) could be created in the near future after the Union Cabinet approved in May the passing of the AERA Bill, 2007. Under the bill, the authority would review...

Debating employee stock options

A lawsuit involving two former board members of Larsen & Toubro (L&T) was settled out of court after they agreed to return their employee stock option shares (Esops). The case in June before the...

A new era of securitization

The securitization market in India began evolving from the mid-1990s when originators such as ICICI and Citigroup took the lead in developing it at an institutional level.

The issuance of securitization saw exponential growth from...

New trends herald India’s equity boom

The 2006-07 financial year was expected to be a year of unprecedented activity in the Indian equity capital markets following the extraordinary stock market gains of the preceding three years.

The US$6 billion raised through...

A round-up of legislative and regulatory developments

thForeign institutional investors, mutual funds, and other institutions may be allowed to short sell their stocks under a March proposal by the capital markets regulator, the Securities and Exchange Board of India (SEBI). Though...

Kesar Dass hires top regulator

RS Loona, former general counsel at the Securities and Exchange Board of India (SEBI), has joined law firm Kesar Dass B & Associates

to head its capital markets and infrastructure practice in Mumbai. Loona...