Home Search

Search results: goods and services tax

A guide to doing business in the Czech Republic

The Czech Republic is a full-fledged parliamentary democracy and among the emerging democracies in central and eastern Europe, it has one of the most developed industrialized economies. The Czech koruna (CZK) is a fully...

India Business Law Directory 2012

India Business Law Journal presents its annual legal market report and directory of Indian law firms

Legal market report by Rebecca Abraham

Sitting at the Gurgaon office of the 240-lawyer, five-office law firm that he has...

Prosper or perish?

The US is fertile ground for Indian companies hungry to sow new seeds of investment. But without adequate knowledge, preparation and legal guidance, they could rake in more regrets than rewards

Aliyah Shahid reports from...

The world’s finest

Top India-focused Law Firms 2007

Top India-focused Law Firms 2008

Top India-focused Law Firms 2009

Top India-focused Law Firms 2010

Top India-focused Law Firms 2011

Top India-focused Law Firms 2013

Top India-focused Law Firms 2014

Top India-focused Law Firms 2015

Top India-focused...

Recovering from a stall

Piecemeal policy making has played havoc with the health of India’s airlines. What can propel the industry back to greater heights?

Rebecca Abraham reports

As the Indian economy stumbles many eyes are on the airline industry,...

Running out of steam

India must persevere with sectoral reforms to revive India’s battered economy, argues Chandrajit Banerjee

India saw its economy shrink last year after slow-moving reforms coupled with persistently high levels of inflation – primarily due to...

Negative list approach to taxing services introduced

The Union Budget 2012-13 has proposed a paradigm shift in the way in which services are taxed, by moving from a “positive list” to a “negative list” approach. Currently, only notified services attract service...

Transfer pricing extended to some domestic dealings

The Union Budget 2012-13 saw major proposals to plug the adverse practices used by taxpayers to reduce their tax burden. Among the various general and specific anti-abuse proposals, a conspicuous proposition included extending the...

Union Budget proposals unsettle foreign investors

The 2012-13 Union Budget presented by India’s finance minister, Pranab Mukherjee, was eagerly anticipated by the global investment community as an opportunity for the government to shake off negative perceptions of policy paralysis by...

In the pipeline

Of 97 bills that are languishing before India’s parliament, 10 would have a significant impact on business and investment, if passed. Chakshu Roy offers a foretaste of the key changes that can be expected

As...

Reverse charge for services held valid by high court

The Allahabad High Court, in Glyph International Ltd v Union of India and Ors, recently upheld the constitutional validity of the provisions dealing with the “reverse charge mechanism” for services, contained in the Indian...

Exploring new pastures

Indian companies hunt for opportunities among Africa’s diverse economies and regulatory regimes

Vandana Chatlani reports

The tapestry that tells Africa’s story shares many of the same threads used to weave India’s story. Free from their colonial...

Indian Law Firm Awards 2011

Indian Law Firm Awards 2023

Indian Law Firm Awards 2022

Indian Law Firm Awards 2021

Indian Law Firm Awards 2020

Indian Law Firm Awards 2019

Indian Law Firm Awards 2018

Indian Law Firm Awards 2017

Indian Law Firm Awards 2016

Indian Law...

Seeing cost sharing from a service tax perspective

The Finance Act, 1994, which provides for the levy of service tax in India, began its journey modestly with three taxable services. Now more than 118 taxable services fall within its ambit. Despite this,...

Deals of the Year 2011

India Business Law Journal celebrates 50 of the most significant transactions and cases of 2011 and reveals the law firms that guided them to fruition

Nandini Lakshman reports from Mumbai

The global financial crisis may have...

India in 2012

Business and legal professionals share their forecasts for the coming year

Capital markets

Sandip Bhagat, partner, S&R Associates: The Indian capital markets experienced declining activity in 2011. The trends that impacted the Indian market include the...

Resolving dichotomy in transfer pricing and customs

Ideally, the commercial arrangements between the parties to a transaction should determine the value of the supplies. This principle should also hold true in transactions between related parties. However, under tax laws, there is...

Changes in taxation: the order of the day?

The Indian tax and regulatory regime governing cross-border transactions has recently undergone several changes. While amendments to the foreign direct investment policy initially restricted exit rights (in the nature of options) for investments into...

Computing value of tech transfer into India

The recent liberalization of India’s technology transfer and collaboration regulations was carried out with the objective of making Indian industries competitive in the global market. It has been effective in attracting the latest technology...

State and corporate initiatives to curb corruption

The regulations that guide businesses are stringent, numerous and complex. Many companies have seen their reputations wane when regulatory authorities impose fines on them. In some cases executives have been sent to prison. Multiple...

Legal Market Report & Directory of Indian Law Firms – 2011

To accompany this year’s directory of Indian law firms, India Business Law Journal consulted widely with the country’s legal practitioners to reveal the current state of play in the legal market

Vandana Chatlani reports

Ashopkeeper in...

Transfer pricing: trade and investment in Canada

Optimizing the opportunities for Indian companies in Canada should include planning to minimize income tax, customs duties, and value added taxes.

How does one maximize “after tax/ duty” income? And how do Indian companies defend...

Indian Law Firm Awards 2010

Indian Law Firm Awards 2023

Indian Law Firm Awards 2022

Indian Law Firm Awards 2021

Indian Law Firm Awards 2020

Indian Law Firm Awards 2019

Indian Law Firm Awards 2018

Indian Law Firm Awards 2017

Indian Law Firm Awards 2016

Indian Law...

India has one of the lowest income tax rates in the world

Proposals for the introduction of a goods and services tax lack clarity and are riddled with inconsistencies

Shivam Mehta and Kapil Kumar Sharma explain

India’s broad based tax regime aims to cover as many people and...

Service tax applies to leasing services

Does parliament have the power to levy a service tax on equipment leasing and hire-purchase services or is such power vested only in the states (under entry 54 of list II of the constitution)?

Answering...

Consolidating change

2010 will be remembered for its dizzying highs and terrifying lows

But more importantly, it marks the culmination of a decade in which poverty has come to be seen as a “removable condition”. This is...

Transfer of right to use: analysis in a federal structure

The 46th amendment to the constitution of India, carried out in February 1983, was effected to overcome judgments that had disallowed the levy of sales tax by states on transactions which did not conform...

Trading places

As pharmaceuticals, technology and outsourcing revive Indian exports, the government must devise trade policies that manage the challenges of a more open economy

During the recent visit to India by President Barack Obama, the US...

Latin America, country by country

Markets in the region range from emerging economic powers to small, resource-rich nations that can be surprisingly business-friendly or present major obstacles to investors

Argentina

While Argentina has natural resources and a well-educated workforce it often...

Taxation of software: ambiguities unresolved

In India, the taxation of software has been the subject of constant dispute and legislative review. One such issue is the unresolved overlap between value added tax (VAT) levied by the state governments on...

Legal Market Report & Directory of Indian Law Firms 2010

Indian law firms are grappling with a flood of new legislation as they attempt to capitalize on the resurgent economy

By Vandana Chatlani

In recent weeks resurgent monsoon rains have brought chaos to India’s capital city...

New taxes hit key services

On 1 July, several new categories of services became subject to service tax following the implementation of the Finance Act, 2010, at the end of May.

Healthcare services such as nursing homes and clinics are...

Confusion persists over taxing of works contracts

The distribution of powers between the centre and the states has created complexities around taxing of works contracts involving both goods and services. The recent decision of the larger bench of the Customs Excise...

Tax credit mechanism and evolving jurisprudence

In India, the CENVAT Credit Rules, 2004 provide for the manner of availability of tax credit on “inputs”, “input services” and “capital goods” at the federal level by a service provider or a manufacturer.

The...

Trouble overseas

India may be better known as a perpetrator than a victim of intellectual property abuses. But the growing international reach of its companies has resulted in many of them falling victim to piracy in...

Seize the opportunity!

UK-based businesses must raise their game in India, argues Toby Greenbury of the UK India Business Council

As India returns to annual growth rates of 8-9%, the immediate future for the West looks, by contrast, pretty gloomy.

In...

Dutch company taxed for Indian office purchase

In the March case of M/s AramCo Overseas Company, BV the Authority for Advance Rulings (AAR) held that a non-resident engaged in procurement support services for its group entities through an Indian office would...

Budget boosts sentiment, but tax fears persist

On 26 February Indian finance minister Pranab Mukherjee presented the country’s Union Budget for 2010-2011. Mukherjee focused on controlling the fiscal deficit. He also expressed confidence that a new direct tax code (DTC), as...

The taxation of software in India

In India, multiple indirect taxes are levied on software transactions, including excise, customs, value added tax (VAT) and service tax. Excise is charged on the event of manufacture, customs on the import of goods...

Indian Law Firm Awards 2009

Indian Law Firm Awards 2023

Indian Law Firm Awards 2022

Indian Law Firm Awards 2021

Indian Law Firm Awards 2020

Indian Law Firm Awards 2019

Indian Law Firm Awards 2018

Indian Law Firm Awards 2017

Indian Law Firm Awards 2016

Indian Law...

Ruling unsettles definition of the export of services

The export of services from India, which is exempt from service tax, is governed by the Export of Services Rules, 2005, first introduced in March of that year. There has since been a series...

Competition law and the war of exchanges

Globalization, and relaxation in India’s foreign investment policy, have resulted in strong competition for the local market, which in turn has mandated higher standards of practice among market participants. With this desirable outcome in...

Cracking the new tax code

India’s complex tax system is set for wholesale reform. Alfred Romann investigates the proposed changes and assesses how they will affect domestic and international businesses

An Indian diplomat tells India Business Law Journal that he uses his personal...

Harmonizing customs law and transfer pricing provisions

The chase for profits often leads multinational enterprises (MNEs) to make cross-border transactions. According to the 1995 United Nations Conference on Trade and Development World Investment Report, intra-MNE transactions account for as much as...

India Business Law Journal’s 2009 Directory of Indian Law Firms

After surviving months of economic turbulence, Indian lawyers are priming themselves for the legal market’s resurgence and the chance to lead distressed clients to safety. Vandana Chatlani reports

The Indian legal market is buzzing with talk...

Mukherjee’s mixed bag

Tax reforms set out in the 2009 budget have been widely welcomed, but an unexpected rise in minimum alternate tax has alarmed investors. Rohan Shah and Anay Banhatti report

India’s complex and opaque tax system may...

Payments for offshore contracts not taxable

In the case of Hyosung Corporation (the applicant), which involved off-shore and on-shore contracts among three entities, the Authority for Advance Ruling (AAR) held that amounts paid to non-residents for off-shore contracts taking place...

Finance minister unveils 2009 budget

On 6 July Indian finance minister Pranab Mukherjee presented the union budget for the financial year 2009-2010. Mukherjee outlined plans to speed up infrastructure development and increase spending to help farmers and the poor.

The...

Process delayed is process denied

The coming years should see India achieve a successful moon landing. But what of long-standing problems back home?

As India Business Law Journal embarks on its third year, it finds itself revisiting the Achilles’ heel...

Singh swings it

But what does the election result really mean for the business of law and the law of business in India? Alfred Romann reports

Compared with previous outcomes, India’s national election in mid-May was a landslide. The...

Service providers must pay tax on SIM cards

In Commissioner of Central Excise & Customs, Cochin v Idea Mobile Communication Ltd, decided by Kerala High Court, the issue of service tax demands on the value of SIM cards sold by the assessee...

Competition Commission faces multiple tasks

From curbing monopolies to promoting competition, India has evolved from a gendarme policing big businesses into a dynamic regulator of competition. The object of the Monopolies and Restrictive Trade Practices Act, 1969 (MRTP), was...

US stimulus plan presents immediate opportunities

On 17 February, US President Barack Obama signed into law the American Recovery and Reinvestment Act (ARRA) of 2009. The stimulus legislation is set to have a profound impact on all aspects of the...

Protecting hidden value

With company budgets under pressure, IP owners are rethinking their protection strategies. Cutting costs in this vital domain may prove not merely a false economy but a fatal miscalculation. Vandana Chatlani reports

With corporate budgets slashed,...

Service tax net may catch manufacturers outside India

Indian companies and multinational corporations (MNCs) operating in India in order to derive the benefits offered by globalization have started to get their goods manufactured outside India through contract manufacturing.

A popular business model

Contract manufacturing...

India to enact innovation law

The Ministry of Science & Technology plans to enact the National Innovation Act, 2008, the draft of which is now available at http://dst.gov.in/draftInnovationlaw.pdf for public review.

The draft act defines innovation as “a process for incremental...

Shipping and logistics crucial areas for India

The Indian peninsula is strategically located between cargo movements, to and from the European Middle East in the West and the Pacific Asia rim in the East. India has 7,517 kilometres of coastline studded...

Goods and services tax: A fiscal and political leap

Indirect tax reform in India, spanning two decades, is a spectacular achievement of Indian fiscal policy. In terms of its sweep, it is a testimony to the political will of the government, the tax...

India’s telecom network takes a paradigm stride

The Indian telecom network is the eighth largest in the world and the second largest among emerging economies. The sector has undergone a crucial metamorphosis with significant policy reforms.

Telecommunications is driving growth at a...

India’s telecom network makes a paradigm shift

The Indian telecom network is the eighth largest in the world and the second-largest among emerging economies.

The sector has undergone a crucial metamorphosis with significant policy reforms.

Telecommunications is driving growth at a feverish pace....

Free trade and warehousing zones offer myriad benefits

One of the prerequisites of providing total integrated logistics solutions is well equipped warehousing. The necessity to store perishable goods generates a need for convenient and ample warehousing.

The management of warehouses is crucial for...

Money laundering laws in a spin

Widely welcomed measures to tackle the clandestine transfer of funds have been undermined by infighting over the allocation of adjudicating powers. Raghavendra Verma reports from New Delhi

In January 2007 a raid on Pune-based businessman...

The changing face of M&A

The international liquidity crisis and the growing financial muscle of Indian corporations have changed the nature of mergers and acquisitions

Alfred Romann explains

Holcim purchased a controlling stake in Gujarat Ambuja Cement. Hindalco Industries, part of...

Legislative and regulatory update – April 2008

The budget

India’s latest budget, unveiled by Finance Minister P Chidambaram on 29 February, includes a number of tax provisions that impact businesses and individuals.

The budget had been expected to include significant changes to the...

Third party logistics gains momentum

Third party logistics (3PL), or logistics outsourcing, refers to outsourcing transportation, warehousing and other logistics related activities to a 3PL service provider that were originally performed in-house.

Logistics outsourcing is used for the logistics activities...

Taxing role for new solicitors general

Two new solicitors general are to be appointed to act in direct and indirect tax cases, the Finance Ministry announced in January.

“We are concerned about the quality of representation from the government side,” said...

Legislative and regulatory update – December 2007/January 2008

Telecoms

The significance of telecommunications licensing was underscored recently as mobile telecommunications operators moved to block the issuance of licences covering multiple technologies. The Cellular Operators Association of India (COAI), a lobby group representing GSM...

Taxing times in America

Indian investors in the US are encountering the same tax troubles that have long since frustrated American businesses in India.Great care must be taken to minimize exposure

Daniel M Davidson and Andrea A Ramezan-Jackson explain

Ajoint...

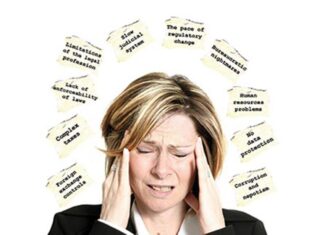

A cure for legal headaches

India Business Law Journal diagnosed the top 10 legal problems facing corporate counsel and challenged Indian lawyers to prescribe remedies Alfred Romann reports

Doing business in India can be daunting. Not only is the market...

Contractual anatomy of a wind power project

Gone are the days when wind power projects were done mainly for depreciation benefits. They have now become significant investment opportunities. However, contract documentation continues to be influenced by the early history of this...

Controversy as India zones in on economic growth

Special economic zones give industry a vehicle to achieve tax breaks and benefits unavailable elsewhere

Rohan Shah and Nishant Shah explain

Special economic zones (SEZs) could provide a welcome boost to investment in specific sectors. Some...

A round-up of legislative and regulatory developments

thForeign institutional investors, mutual funds, and other institutions may be allowed to short sell their stocks under a March proposal by the capital markets regulator, the Securities and Exchange Board of India (SEBI). Though...