Jitters, uncertainty can move stock prices

A superstar footballer moves two Coke bottles out of the spotlight during a press conference and replaces them with water, reportedly prompting a USD4 billion drop in Coca-Cola’s market value. Was this a display of the tremendous power celebrities wield, or merely that the incident in question happened to coincide with the company’s stock price having hit a ceiling?

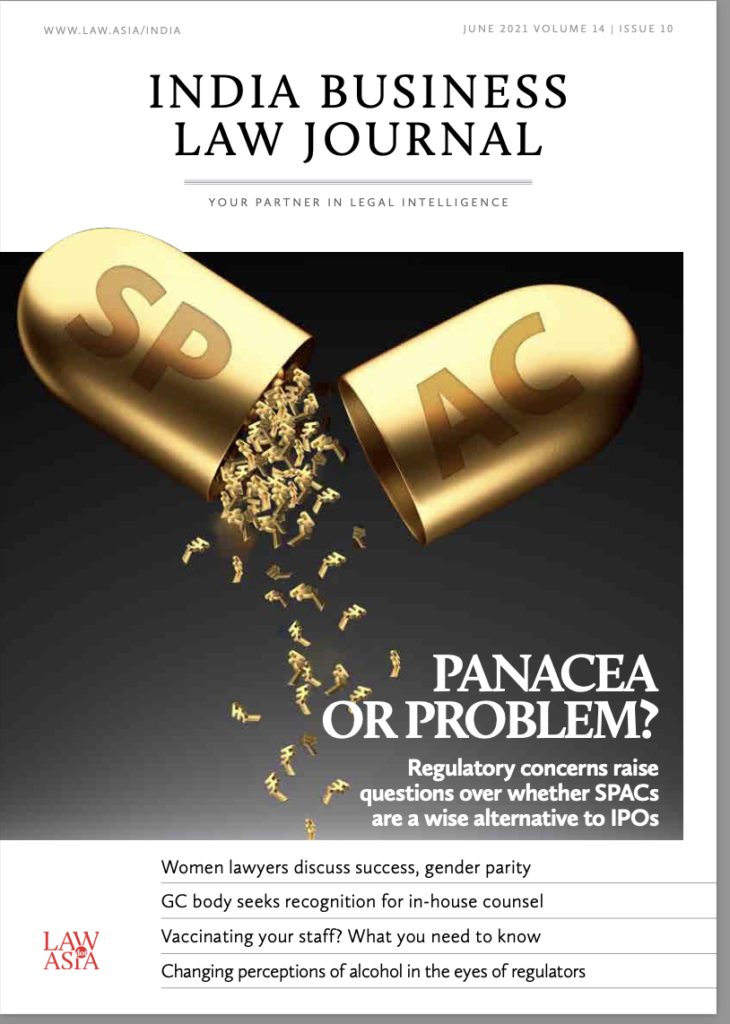

This month’s Cover story delves into the re-emergence of the special purpose acquisition company (SPAC) as an investment tool and alternative to IPOs. Are they a panacea for reviving capital markets in the covid era? A large number of Indian companies are vying to tap capital markets, and with more than 400 of these so-called blank cheque companies listed on US bourses, a merger with a SPAC can be a very viable option. “At least it can survive, raise funds and be listed at the same time,” observes one expert.

With SPAC listings not possible in India, the money is on SPAC transactions where the majority of shareholders of the Indian target reside overseas. There are about 20 to 30 such companies with overseas parents or international shareholding and they are attractive targets, as no regulatory approvals are necessary. This can also result in local players moving out, a fear that is pushing the authorities to actively review whether blank cheque companies can be listed in the country.

As we detail, the domestic capital market watchdog and its counterpart for Gujarat’s GIFT City, the International Financial Services Centres Authority (IFSCA), are reviewing plans to launch SPACs in India. How soon they will become a reality remains to be seen.

As India grapples with vaccinating its population, the government recently issued a guidance note on vaccination at workplaces. This month’s What’s the deal explains how to go about setting up a vaccination facility for company employees. Our coverage details everything from whether employers can import covid-19 vaccines to whether family members of employees can be included. While corporate vaccination camps cannot solve the pandemic, they are contributing to the nationwide effort.

In Gender in Justice we turn the spotlight on eight successful women lawyers across Asia whose individual journeys have made the legal profession more inclusive.

Among them are: Rebecca Mammen John, the first woman to be designated as a senior counsel on the criminal side by Delhi High Court, and who has represented the accused in many landmark cases; Preeti Balwani, GC of Hindustan Coca-Cola Beverages in Mumbai; and Wolora Rasna, managing partner of Wolora Ashfaque & Associates in Dhaka.

As Rasna, who is also the founder and president of Women in IP in Bangladesh, says: “Being women makes us different, and we must embrace it … we all must remain dedicated and break the fear of fear”. Powerful sentiments that every woman lawyer would recognise.

Writing in Vantage Point Akhil Prasad and Sanjeev Gemawat, founding members of the General Counsels’ Association of India, put forward a persuasive case for GCs receiving recognition for the services they provide. The existing framework does not include advocates who don’t appear in court and those who are full-time salaried employees.

As the authors point out: “The prohibition on salaried employment for lawyers has no place in the regulatory regime for lawyers in any modern society.” With companies requiring more in-house legal advisers, they argue it is time for the role of the GC to receive its due recognition and be backed by a regulatory body.

This month’s Intelligence report provides valuable insights from a former policymaker and regulator currently striving to bring about much-needed change to policy. After working with various ministries, departments and regulatory bodies, Anand Vijay Jha joined United Breweries as its head of public policy where he was tasked, among other things, with changing the negative social perception of alcohol among policymakers and convincing them to tax beer at a lower rate than hard liquor.

This was a daunting prospect given that each of India’s 28 states has its own set of regulations and needs to raise revenue through excise without being seen as promoting liquor. Add to this the taboos around liquor that prove challenging to manufacturers, policymakers and customers alike. Yet Jha says he has already seen a transformation in the mindset of some state governments. According to him, one of the biggest issues in developing policy predictability is building trust between the government, the market players and the consumers.