Nigeria has recently reviewed and amended two principal laws regulating investments in the country: The Companies and Allied Matters Act 2020, which primarily regulates corporate entities, and the Finance Act 2021, which governs applicable taxes.

Partner

Tel: +234 1 462 6841

Email: afolasadeolowe@jacksonettiandedu.com

A foreigner, individual or corporate, can invest into and operate an enterprise in Nigeria, either by direct or portfolio investment, in all sectors except limited areas such as production of arms, narcotic drugs, psychotropic substances, and military and paramilitary uniforms and accoutrements.

For direct investment, a foreigner, alone or with Nigerians, is required to incorporate a company with the Corporate Affairs Commission (CAC) before commencing any business activity. The CAC now carries out e-registration of companies on its portal. However, foreign companies carrying out the following activities can be exempt from registering a company:

. A project on behalf of the Nigerian government;

. Executing an individual loan project on behalf of a donor country or international organisation;

. Foreign government-owned companies engaged solely in export promotion activities; and

. Engineering consultants and technical experts under a federal government-approved contract with a state government.

Before or after incorporation, the company may require licences and approvals from appropriate regulatory bodies to commence operation, particularly in the banking, securities, oil and gas, aviation, insurance, telecommunications, food and beverage, manufacturing, sport betting, engineering and hospitality sectors.

Foreigners are also allowed to own 100% share in a company registered in Nigeria, except for the sectors that require compulsory participation or control by Nigerians, such as oil and gas, shipping, broadcasting, advertising, engineering, sports betting, aviation and pharmaceutical.

Tax Incentives

There are key tax incentives applicable to certain sectors to encourage investment in the country. Pioneer companies investing in specified industrial activities may be granted a tax holiday for the initial three years, which may be extended for up to two years. A new company that engages in the mining of solid minerals is granted a tax exemption for the first three years of its operation.

Companies engaged in primary agricultural production enjoy a tax-free period of four years and can be extended for an additional three years on satisfactory performance. Hotels enjoy a tax exemption on 25% of the income derived from tourism, where the income is put in a reserve fund to be utilised within five years for expansion or construction of new hotels and other facilities for tourism development.

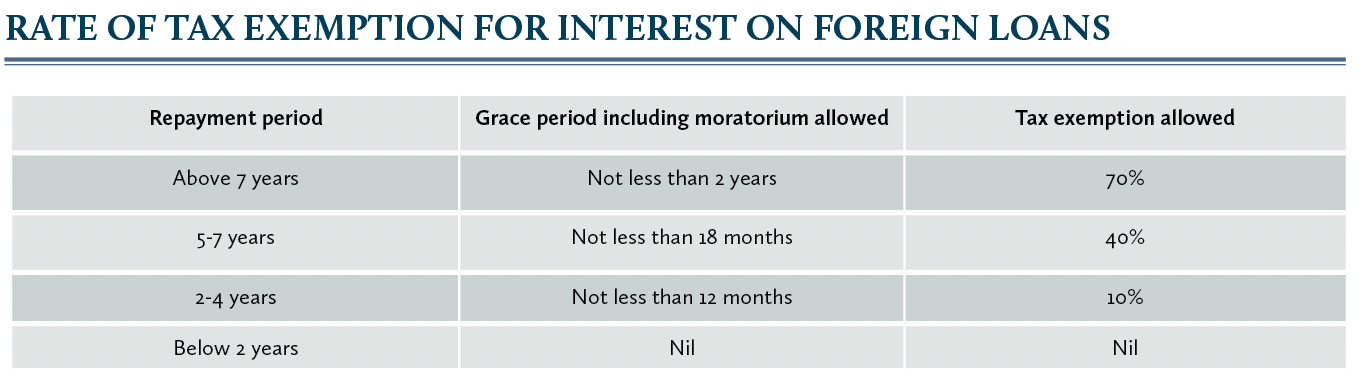

Additionally, the rate of tax exemption on the interest of foreign loans has been reduced (see chart).

Senior Associate

Tel: +234 1 462 6841

Email: yeyenwidaa@

jacksonettiandedu.com

IP protection

The protection of intellectual property (IP) rights is crucial for the security of foreign investment. The question is whether Nigeria has the appropriate framework to guarantee the returns on investment for foreign investors. This question must be examined in light of the existing IP framework to protect capital inflows, monetise assets, and repatriate profits back to the investor’s country.

The country IP framework protecting copyright in literary, artistic and musical works lasts for 70 years from the date of the author’s death. Patents for novel inventions can last for 20 years from the date of filing, subject to annuity payment. The design certificate issued by the Patents and Designs Registry is effective for five years from the date of the application, and can be renewed for two further consecutive periods of five years. The trademarks registration certificate issued by the Trademarks Registry can last for the initial period of seven years, and can be renewed for further periods of 14 years.

Nigeria has enough IP framework to protect the interests of foreign investors. By ensuring IP protection, it will prevent copiers from diluting and infringing elements of the brand. For investors to earn from IP assets, there are various ways to monetise IP rights. Some of them include:

Licensing. Copyright, patents, trademarks and designs can be licensed to other parties for exploitation. There are different licences that can be employed for different purposes, e.g., exclusive, non-exclusive, cross and territorial licences. Licensees should also be registered with the different government agencies for proper documentation and enforcement of rights. Where it involves a transfer of technology into Nigeria, the

agreement must be registered with the National Office for Technology Acquisition and Promotion. Key considerations in licensing include partnership opportunities, royalties, duration of licence, dispute resolution, regulatory compliance, etc.

Franchising. Franchises are commonly used for trademarks and trade secrets. Franchisors’ IP rights should be protected under relevant laws and agreements. Key considerations in franchise agreements include the grant clause, royalties, franchisor support, protection of proprietary information, non-competition clauses, quality control requirements, dispute resolution, etc.

Assignment. Where an IP asset is becoming redundant, or potentially more profitable if sold, an assignment of the ownership rights to another party should be considered in exchange. All types of IP rights can be assigned. Key considerations in assignment agreements include territory of assignment, representation and warranties, confidentiality, indemnification, further assurance, and power of attorney.

Where IP rights are infringed, redress can be obtained in the Federal High Court through civil and criminal remedies. Remedies often include damages and injunctions against the infringer. Alternative dispute resolution methods may also be explored to resolve the dispute before litigation.

Senior Associate

Tel: +234 1 462 6841

Email: toluolaloye@jacksonettiandedu.com

Employment of foreigners

The Nigeria immigration terrain is regulated by the Immigration Act of 2015 and Immigration Regulations of 2017, which make provisions relating to the obligations expected of a company with foreign ownership to carry on business in the country. Any company registered in Nigeria that needs to employ foreigners has strict obligations under the law.

Expatriate quota approval. A company desiring to employ expatriates must apply for the grant of an expatriate quota (EQ). The EQ is issued by the Federal Ministry of Interior on merit. For example, the foreign employees possess certain skills not available in Nigeria. In this case, the foreign employees will transfer their knowledge and skills to the Nigerian designated to work directly with them.

Long-term work permit. When the EQ approval is issued, a company can offer employment to any foreigner who possesses the desired skills. On acceptance of the offer, the foreigner will in turn be able to apply for the STR (subject to regularisation) visa to enter the country and take up employment. Once in Nigeria, the foreigner must regularise his/her immigration status within 90 days of arrival by applying for a long-term work permit, which confers residency and the right to work for at least 12 months. The long-term permit is referred to as the CERPAC (combined expatriate residence permit and aliens card) or green card, which is subject to yearly renewal.

Short-term work permit. As the name implies, the short-term work permit is a single-entry visa issued to a skilled employee invited by corporate entities to perform short or temporary assignments. This permit is issued in the form of a temporary work permit, and typically granted for a period of not more than 60 days in the first instance. The visa may be extended in-country if the assignment will exceed the validity period.

Business visa or visa-on-arrival. This category of visa is available for foreign travellers who wish to visit for business meetings, conferences, seminars, training or other brief activities. The business visa is normally obtained from the Nigerian missions abroad. However, it can be obtained on arrival in Nigeria (visa-on-arrival) for urgent cases. On arrival at the port of entry, travellers proceed to the desk marked visa-on-arrival for biometric enrolment and issuance of the visa. It must be noted that this visa does not permit the holder to take up employment in Nigeria.

Conclusion

The avenues to do business in Nigeria are limitless, and foreign investors can actively partake in practically any profitable business venture, directly or indirectly. Where the mode of entry is a portfolio investment, many of the above-mentioned business registration requirements are done away with, except for IP registrations.

Moreover, the Nigerian government is constantly inaugurating executive policies to promote the ease of doing business in the country. It is expected that any investor that desires an entry into the Nigerian market contacts a local lawyer for specific legal advice.

Afolasade Olowe

Partner

Tel: +234 1 462 6841

Email: afolasadeolowe@jacksonettiandedu.com

Yeye Nwidaa

Senior Associate

Tel: +234 1 462 6841

Email: yeyenwidaa@

jacksonettiandedu.com

Tolu Olaloye

Senior Associate

Tel: +234 1 462 6841

Email: toluolaloye@jacksonettiandedu.com

Jackson Etti & Edu

3-5 Sinari Daranijo Street,

Victoria Island, Lagos, Nigeria

Tel: +234 1 462 6841/3; +234 1 280 6989

Email: jacksonettiedu@jacksonettiandedu.com

www.jacksonettiandedu.com